JCPenney 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 33

Notes to the Consolidated Financial Statements

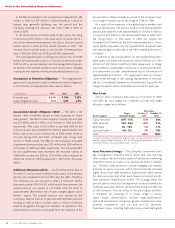

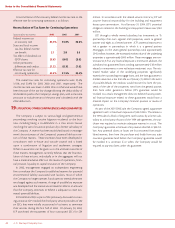

6ACCOUNTS PAYABLE AND ACCRUED EXPENSES

($ in millions) 2003 2002

Trade payables $1,167 $993

Accrued salaries, vacation and bonus 409 413

Customer gift cards/certificates 179 172

Interest payable 132 122

Taxes payable 119 98

Advertising payables 79 72

Workers’ compensation and

general liability insurance 63 63

Common dividends payable 35 34

Other(1) 368 307

Tot al $2,551 $2,274

(1) Other includes various components that are individually insignificant such as

general accrued expenses related to operations and fixed asset accruals.

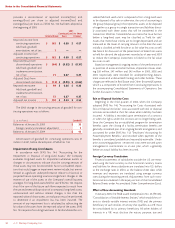

7FAIR VALUE OF FINANCIAL INSTRUMENTS

The following methods and assumptions were used in esti-

mating the fair values of financial instruments:

Cash and Short-Term Investments

The carrying amount approximates fair value because of the

short maturity of these instruments.

Short-Term and Long-Term Debt

Carrying value approximates fair value for short-term debt.

The fair value of long-term debt, excluding capital leases, is esti-

mated by obtaining quotes from brokers or is based on current

rates offered for similar debt. At January 31, 2004, total notes and

debentures had a carrying value of $5.3 billion and a fair value of

$5.9 billion. At January 25, 2003, total notes and debentures had

a carrying value of $5.2 billion and a fair value of $4.9 billion.

Concentrations of Credit Risk

The Company has no significant concentrations of credit risk.

8SHORT-TERM DEBT

The Company’s Brazilian subsidiary, Renner, had short-term

debt outstanding of $18 million at January 31, 2004 and $13 mil-

lion at January 25, 2003.

Credit Facility

In May 2002, the Company entered into a three-year, $1.5 bil-

lion revolving bank line of credit (credit facility) with a syndicate

of banks with JPMorgan Chase Bank as administrative agent. This

credit facility replaced a $1.5 billion facility that was scheduled to

expire in November 2002 and a $630 million letter of credit facil-

ity. The credit facility may be used for general corporate purpos-

es, including the issuance of letters of credit. No borrowings,

other than the issuance of trade and standby letters of credit,

which totaled $227 million as of the end of 2003, have been

made under this credit facility.

Under the credit facility, the Company must maintain an asset

coverage ratio, which is eligible inventory to total revolving cred-

it exposure, of at least 1.75 to 1.0. Given that there were no bor-

rowings other than the issuance of letters of credit, this ratio was

14.1 to 1.0 at year-end 2003, far exceeding the requirement.

Additionally, the credit facility includes a financial performance

covenant, which consists of a maximum ratio of total debt to

consolidated EBITDA (leverage ratio, as defined in the credit

agreement, which includes Eckerd) as measured on a trailing

four-quarters basis, calculated at each quarter end. As of year-

end 2003, the actual leverage ratio was 3.31 to 1.0, well within the

prescribed limit of 4.25 to 1.0.

Any indebtedness incurred by the Company under the credit

facility is collateralized by all eligible Department Stores and

Catalog/Internet domestic inventory, as defined in the credit

facility agreement. The security interest can be released as per-

formance improvements are achieved and credit ratings by the

rating agencies improve. Pricing is tiered based on the corporate

credit ratings for the Company by Moody’s and Standard &

Poor’s. Obligations under the credit facility are guaranteed by

J. C. Penney Company, Inc. and JCP Real Estate Holdings, Inc.,

which is a wholly owned subsidiary of the Company.

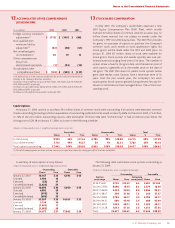

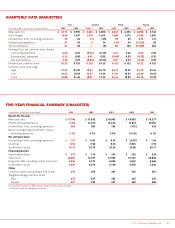

9LONG-TERM DEBT

($ in millions) 2003 2002

Issue

6.125% to 9.0% Notes, due 2003 to 2097 $2,165 $1,928

7.125% to 8.125% Debentures,

due 2016 to 2037 1,525 1,525

6.5% to 7.05% Medium-term notes,

due 2005 to 2015 493 493

5.0% Convertible subordinated

notes, due 2008 650 650

8.25% to 9.75% Sinking fund

debentures, due 2021 to 2022 313 392

6.0% Original issue discount

debentures, due 2006(1) 167 156

6.35% to 7.33% Equipment

financing notes, due 2007 21 25

Tot al note s and debentures 5,334 5,169

Capital lease obligations and other 22 4

Tot al long-term debt, including

current maturities 5,356 5,173

Less: current maturities (242) (276)

Tot al long-term debt $5,114 $4,897

(1) Face amount of these OID debentures is $200 million.

Issuance of $600 Million Debt

On February 28, 2003, the Company issued $600 million princi-

pal amount of 8.0% Notes Due 2010 (“Notes”). The Notes are

redeemable in whole or in part, at the Company’s option at any

time, at a redemption price equal to the greater of (a) 100% of the

principal amount of such Notes or (b) the sum of the present val-