JCPenney 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.36

Notes to the Consolidated Financial Statements

The Company follows the intrinsic value expense recognition

provisions of APB 25 as permitted by SFAS No. 123. As a result,

no compensation expense is recognized for stock options. As

required by SFAS No. 123, the Company estimates the pro forma

effect of recording the estimated Black-Scholes fair value of stock

options as expense over the vesting period. See Note 1.

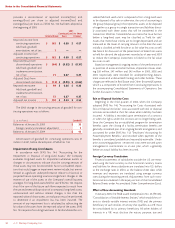

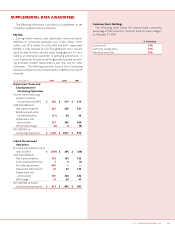

Stock Awards

The Company awarded approximately 364,000, 227,000 and

133,000 shares of stock to employees with weighted-average grant-

date fair values per share of $19.43, $20.09 and $15.94, respectively,

in 2003, 2002 and 2001, respectively. Total expense recorded for

stock-based employee compensation awards was $8.2 million, $5.1

million and $7.5 million in 2003, 2002 and 2001, respectively.

The 2001 Plan also provides for grants of restricted stock awards

and stock options to outside members of the Board of Directors.

Restricted stock awards acquired by such directors are not trans-

ferable until a director terminates service. The Company granted

shares of common stock totaling 36,682, 21,266 and 18,608 to out-

side members of the Board of Directors in 2003, 2002 and 2001,

respectively. Total expense recorded for these directors’ awards

was $0.7 million, $0.5 million and $0.4 million in 2003, 2002 and

2001, respectively.

14 LEASES

The Company conducts the major part of its operations from

leased premises that include retail stores, Catalog/Internet fulfill-

ment centers, warehouses, offices and other facilities. Almost all

leases will expire during the next 20 years; however, most leases

will be renewed or replaced by leases on other premises. Rent

expense for real property operating leases totaled $231 million in

2003, $252 million in 2002 and $266 million in 2001, including

contingent rent, based on sales, of $23 million, $24 million and

$24 million for the three years, respectively.

JCPenney also leases data processing equipment and other

personal property under operating leases of primarily three to

five years. Rent expense for personal property leases was $80 mil-

lion in 2003, $85 million in 2002 and $74 million in 2001.

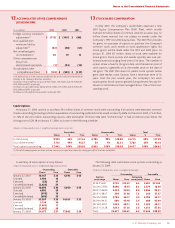

As of January 31, 2004, future minimum lease payments for

non-cancelable operating and capital leases were:

($ in millions) Operating Capital

2004 $213 $ 5

2005 186 5

2006 145 5

2007 112 5

2008 99 3

Thereafter 415 —

Tot al minimum lease payments $1,170 $ 23

Present value $657 $ 20

Weighted average interest rate 9.2% 5.9%

In December 2003, JCP notified the third party service

providers of the six outsourced SSCs of its intent to terminate

their services during the first half of 2004. In accordance with the

related service contracts, JCP will assume financial responsibility

for the building and equipment leases upon termination. The

future minimum lease payments under the current third-party

agreements for 2004, 2005, 2006, 2007, 2008 and after five years

are $16 million, $17 million, $22 million, $11 million, $11 million

and $43 million, respectively.

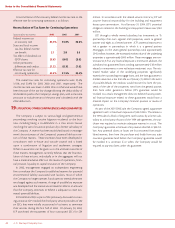

15 RETIREMENT BENEFIT PLANS

The Company provides retirement and other postretirement

benefits to substantially all employees (associates), except for

associates hired or rehired on or after January 1, 2002, who are

not eligible for retiree medical or dental coverage. These benefits

are an important part of the Company’s total compensation and

benefits program designed to attract and retain qualified and tal-

ented associates. The Company’s retirement benefit plans consist

of a non-contributory qualified pension plan (primary pension

plan), non-contributory supplemental retirement and deferred

compensation plans for certain management associates, a 1997

voluntary early retirement program, a contributory medical and

dental plan, and a 401(k) and employee stock ownership plan.

Tot al Com pany expense for all retirement-related benefit plans

was $207 million, $106 million and $33 million in 2003, 2002 and

2001, respectively. These plans are described in more detail below.

See Management’s Discussion and Analysis under Critical

Accounting Policies on pages 9-10 for additional discussion of

the Company’s defined benefit pension plan and Note 1 on

pages 27-28 for the Company’s accounting policies regarding

retirement-related benefits.

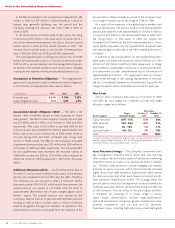

Defined Benefit Retirement Plans

Primary Pension Plan — Funded

The Company and certain of its subsidiaries provide a non-

contributory pension plan to associates who have completed at

least 1,000 hours of service generally in a 12 consecutive month

period and have attained age 21. The plan is funded by Company

contributions to a trust fund, which is held for the sole benefit of

participants and beneficiaries. Participants generally become

100% vested in the plan after five years of employment or at age

65. Pension benefits are calculated based on an associate’s aver-

age final pay, an average of the social security wage base, and the

associate’s credited service (up to 35 years), as defined in the plan

document.

Estimated Future Benefit Payments

($ in millions) Pension Benefits(1)

2004 $196

2005 204

2006 213

2007 222

2008 233

2009-2013 1,327

(1) Does not include plan expenses.

Supplemental Retirement Plans — Unfunded

The Company has unfunded supplemental retirement plans,

which provide retirement benefits to certain management asso-

ciates and other key employees. The Company pays ongoing

benefits from operating cash flow and cash investments. The pri-

mary plans are a Supplemental Retirement Plan, a Benefit

Restoration Plan and a Voluntary Early Retirement Plan. Benefits

for the Supplemental Retirement Plan and Benefits Restoration

Plan are based on length of service and final average compensa-

tion. The Benefit Restoration Plan is intended to make up bene-

fits that could not be paid by the qualified pension plan due to

governmental limits on the amount of benefits and the level of