JCPenney 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.16

Management’s Discussion and Analysis of Financial Condition and Results of Operations

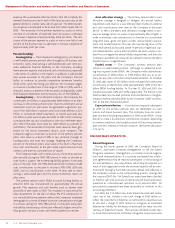

To minimize the impact from unforeseen events, management

has developed various contingency plans to provide alternative

courses of action under several scenarios, including deteriorating

economic conditions, potential shortfalls in profits or cash flow

and limited access to the capital markets. Such actions include

adjustments to capital expenditure and working capital levels, as

necessary, to maintain liquidity and financial flexibility within the

parameters of the Company’s long-term financing strategy.

For 2004, free cash flow is expected to be negative by approx-

imately $150 million. This reflects capital expenditures of approx-

imately $500 million, higher working capital needs related to

inventory, the reversal of 2003’s accounts payable and accrued

expense benefits associated with the 53rd week, and dividend

payments, which are subject to approval by the Company’s

Board of Directors.

In accordance with its long-term financing strategy, the

Company manages its financial position on a multi-year basis and

may access the capital markets opportunistically. As a result of its

strong liquidity position, the Company does not anticipate that

additional external financing will be required in 2004 to fund its

operating or strategic initiatives. Additionally, the Company does

not expect to borrow under the $1.5 billion credit facility except

to support ongoing letters of credit.

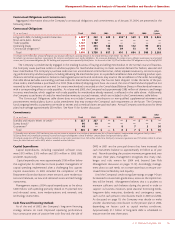

Dividend Policy

JCPenney paid quarterly dividends of $0.125 per share in 2003.

The Company’s Board of Directors reviews the dividend policy

and rate on a quarterly basis, taking into consideration the over-

all financial and strategic outlook for the Company, earnings, liq-

uidity and cash flow projections, as well as competitive factors.

Operating Leases and Guarantees

Management takes operating leases into consideration in eval-

uating the Company’s capital structure and overall liquidity. See

discussions on pages 15-17 and Note 14.

In December 2003, as part of the previously discussed cost sav-

ings initiative, JCP notified the third-party service providers of the

six outsourced SSCs of its intent to terminate their services during

the first half of 2004. On January 30, 2004, JCP purchased the

equipment of four outsourced SSCs for $34 million. In accordance

with the related service contracts, JCP will assume financial respon-

sibility for the building and remaining equipment leases upon ter-

mination. As of January 31, 2004, JCP’s potential obligation related

to these leases was $120 million.

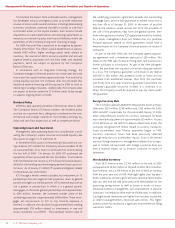

JCP, through a wholly owned subsidiary, has investments in 15

partnerships that own regional mall properties, seven as general

partner and eight as a limited partner. JCP’s potential exposure to

risk is greater in partnerships in which it is a general partner.

Mortgages on the seven general partnerships total approximate-

ly $345 million; however, the estimated market value of the

underlying properties is approximately $600 million. These mort-

gages are non-recourse to JCP, so any financial exposure is

minimal. In addition, the subsidiary has guaranteed loans totaling

approximately $18 million related to investments in one real

estate investment trust (REIT). The estimated market value of

the underlying properties significantly exceeds the outstanding

mortgage loans, and the loan guarantee to market value ratio is

less than 6% as of January 31, 2004. In the event of possible

default, the creditors would recover first from the proceeds of

the sale of the properties, next from the general partner, then

from other guarantors before JCP’s guarantee would be invoked.

As a result, management does not believe that any potential

financial exposure related to these guarantees would have a

material impact on the Company’s financial position or results of

operations.

As part of the 2001 DMS sale, the Company signed a guaran-

tee agreement with a maximum exposure of $20 million. This

relates to the 1994 sale of a block of long-term care business by a

former subsidiary to a third party. As part of the 1994 sale agree-

ment, the purchaser was required to maintain adequate reserves

in a trust. The Company’s guarantee is the lesser of any reserve

shortfall or $20 million. Any potential claims or losses are first

recovered from established reserves, then from the purchaser

and finally from any state insurance guarantee fund before the

Company’s guarantee would be invoked. It is uncertain if, or

when, the Company would be required to pay any claims under

this guarantee.

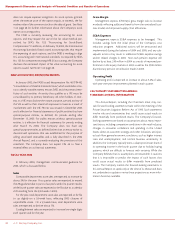

Foreign Currency Risk

The Company operates 58 Renner Department Stores in Brazil.

Sales were $273 million, $249 million and $252 million for 2003,

2002 and 2001, respectively. For the year ended January 31, 2004,

other comprehensive income on currency translation for Brazil

was a favorable adjustment of approximately $25 million. As part

of the 2003 loss on the sale of its Mexico department stores, the

Company recognized $25 million related to currency translation

losses accumulated since Mexico operations began in 1995.

Currency translation losses had been previously reflected

through reductions to stockholders’ equity. Due to the limited

nature of foreign operations, management believes that its expo-

sure to market risk associated with foreign currencies does not

have a material impact on its financial condition or results of

operations.

Merchandise Inventory

Total LIFO inventory was $3,156 million at the end of 2003

compared with $2,970 million at the end of 2002. FIFO merchan-

dise inventory was $3,199 million at the end of 2003, an increase

from the prior year end of 6.0%. Although higher than last year’s

levels, inventories contain significantly less clearance merchandise

than last year and are well positioned with merchandise for the

upcoming spring season as well as better in-stocks of basics.

Enhanced inventory management, with improvement in seasonal

transitions, has helped to drive more profitable sales. In addition,

Catalog/Internet inventories are higher than last year, as planned,

to reflect Catalog/Internet’s improved sales trends. This higher

inventory level has resulted in a significant improvement in filling

customers’ orders.