JCPenney 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 39

Notes to the Consolidated Financial Statements

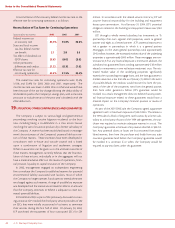

debt securities, illiquid assets such as real estate, the use of deriv-

atives, and Company securities are set forth in written guidelines

established for each investment manager and monitored by the

Company. Direct investments in JCPenney securities are not per-

mitted, even though ERISA rules allow such investments up to

10% of a plan’s assets. The plan’s asset allocation policy is

designed to meet the plan’s future pension benefit obligations.

The policy is periodically reviewed and re-balanced if necessary

to ensure that the mix continues to be appropriate relative to

established targets and ranges.

The Company has an internal Benefit Plan Investment

Committee, consisting of senior executives, who have established

and oversee risk management practices associated with the man-

agement of the plan’s assets. Key risk management practices

include having an established and broad decision-making frame-

work in place, focused on long-term plan objectives. This frame-

work consists of the Company, third-party investment managers,

a third-party investment consultant, a third-party actuary and a

third-party trustee/custodian. The funded status of the plan is

monitored with updated market and liability information at least

annually. Actual asset allocations are monitored monthly and

rebalancing actions are executed at least quarterly, if needed. To

manage the risk associated with an actively managed portfolio,

the Company reviews each manager’s portfolio on a quarterly

basis and has written manager guidelines in place, which are

adjusted as necessary to ensure appropriate diversification levels.

Also, annual audits of the investment managers are conducted by

independent auditors. Finally, to minimize operational risk, the

Company utilizes a master custodian for all plan assets, and each

investment manager reconciles its account with the custodian at

least quarterly, and annual audits of the plan’s financial state-

ments are conducted by the Company’s independent auditors.

Other Postretirement Benefits

The Company provides medical and dental benefits to retirees

based on age and years of service. Benefits under these plans are

paid through a voluntary employees beneficiary association

trust; however, this is not considered to be a pre-funding arrange-

ment under SFAS No. 106. The Company provides a defined dol-

lar commitment toward retiree medical premiums. In 2001, the

Company amended these plans to freeze eligibility for retiree

coverage and to further reduce and limit the Company’s contri-

butions toward premiums. These changes were accounted for as

a negative plan amendment in accordance with SFAS No. 106.

Accordingly, the effects of reducing eligibility and Company con-

tributions toward retiree premiums are being amortized over the

remaining years of service to eligibility of the active plan partici-

pants. The Company began recognizing the costs under the

amended plans in the third quarter of 2001. The decrease in the

other postretirement expense presented in the table below is due

to these plan changes.

Medicare Reform Act — The Company’s accumulated post

retirement benefit obligation (APBO) and net cost recognized for

other postretirement plans do not reflect the effects of the

Medicare Prescription Drug Improvement and Modernization

Act of 2003 (Act) passed in December 2003. The provisions of

the Act provide for a federal subsidy for plans that provide pre-

scription drug benefits and meet certain qualifications. Specific

authoritative guidance on the accounting for the federal subsidy

is pending and when that guidance is issued, it could require the

Company to change information related to its actuarially deter-

mined APBO and net cost for other postretirement benefit plans.

There is no impact on 2003 since the measurement date for the

Company’s other postretirement benefit plans was October 31,

2003, which was prior to the date the Act was passed.

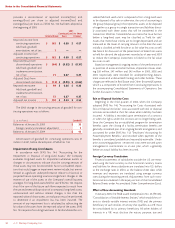

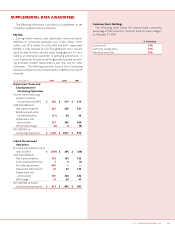

Postretirement (Income)/Expense

($ in millions) 2003 2002 2001

Service costs $3$3$4

Interest costs 13 16 24

Net amortization (20) (16) (9)

Net periodic postretirement

benefit (income)/expense $(4) $3$19

The discount rates used for the postretirement plan are the

same as those used for the defined benefit plans, as disclosed on

page 37, for all periods presented. Changes in the postretirement

benefit obligation are as follows:

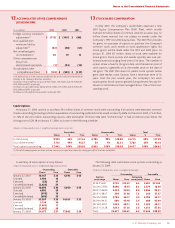

Postretirement Benefit Obligation

($ in millions) 2003 2002

Benefit obligation, beginning of year $186 $227

Service and interest cost 16 19

Participant contributions 37 27

Actuarial (gain) (27) (41)

Gross benefits paid (41) (46)

Net postretirement obligation $171 $186

The Company’s postretirement benefit plans were amended in

2001 to reduce the per capita dollar amount of the benefit costs

that would be paid by the Company. Thus, changes in the

assumed or actual health care cost trend rates do not materially

affect the APBO or the Company’s annual expense.

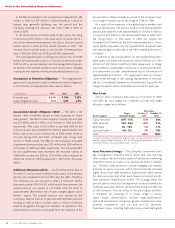

Cash Contributions

Although no additional funding was required under ERISA, the

Company made voluntary contributions of $300 million, or $190 mil-

lion after tax, to its pension plan in October of both 2003 and 2002.

For the qualified pension plan, the Company does not expect

to be required to make a contribution in 2004 under ERISA. It

may decide to make a discretionary contribution, however,

depending on market conditions and the resulting funded posi-

tion of the plan. The Company’s policy with respect to funding

the qualified plan is to fund at least the minimum required by

ERISA of 1974, as amended, and not more than the maximum