JCPenney 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 45

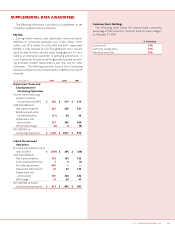

SUPPLEMENTAL DATA (UNAUDITED)

The following information is provided as a supplement to the

Company’s audited financial statements.

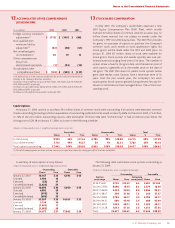

EBITDA

Earnings before interest, taxes, depreciation and amortization

(EBITDA) of continuing operations was $1,156 million, $1,071

million and $912 million for 2003, 2002 and 2001, respectively.

EBITDA is a key measure of cash flow generated and is focused

upon by debt investors and the credit rating agencies. It is pro-

vided as an alternative assessment of operating performance. It

is not intended to be a substitute for generally accepted account-

ing principles (GAAP) measurements and may vary for other

companies. The following reconciles Income from Continuing

Operations before Income Taxes (GAAP) to EBITDA (non-GAAP

measure).

($ in millions) 2003 2002 2001

Department Stores and

Catalog/Internet

Continuing Operations

Income from continuing

operations before

income taxes (GAAP) $546 $415 $ 274

Add back/(deduct):

Net interest expense 261 226 231

Real estate and other

(income)/expense (17) 59 48

Depreciation and

amortization 372 365 368

LIFO (credit)/charge (6) 6(9)

FIFO EBITDA of

continuing operations $1,156 $1,071 $ 912

Eckerd Discontinued

Operations

(Loss)/income before income

taxes (GAAP) $(369) $204 $ (64)

Add back/(deduct):

Net interest expense 163 161 153

Other expense/(income) 75(1)

Fair value adjustment 450 ——

Acquisition amortization 40 42 120

Depreciation and

amortization 301 253 226

LIFO charge 21 20 47

FIFO EBITDA of Eckerd

discontinued operations $613 $685 $ 481

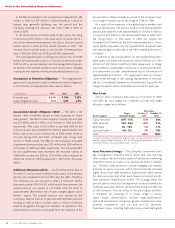

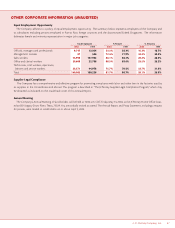

Common Stock Holdings

The following table shows the approximate ownership

percentage of the Company’s common stock by major category

as of January 31, 2004:

% Ownership

Institutional 74%

Company savings plans 16%

Individual and other 10%