JCPenney 2003 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.20

Management’s Discussion and Analysis of Financial Condition and Results of Operations

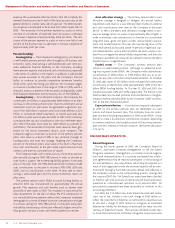

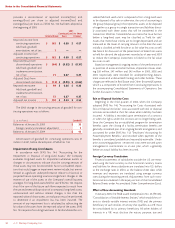

does not require expense recognition for stock options granted

when the exercise price of the option equals, or exceeds, the fair

market value of the common stock on the date of grant. See Note

1 on page 28 for further information about the Company’s stock

option accounting policy.

The FASB is currently reviewing the accounting for stock

options, and may require the use of the fair value method pre-

scribed by SFAS No. 123, “Accounting for Stock-Based

Compensation.” In addition, on February 19, 2004, the International

Accounting Standards Board issued accounting rules that require

the expensing of stock options, and the FASB is working to align

U.S. accounting with international standards. As required by SFAS

No. 123 for companies retaining APB 25 accounting, the Company

discloses the estimated impact of fair value accounting for stock

options issued. See Note 1 on page 28.

NEW ACCOUNTING PRONOUNCEMENTS

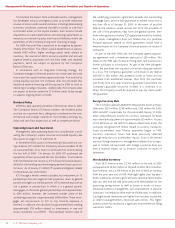

In January 2003, the FASB issued Interpretation No. 46 (FIN 46),

“Consolidation of Variable Interest Entities,” which establishes crite-

ria to identify variable interest entities (VIE) and the primary bene-

ficiary of such entities. An entity that qualifies as a VIE must be

consolidated by its primary beneficiary. All other holders of inter-

ests in a VIE must disclose the nature, purpose, size and activity of

the VIE as well as their maximum exposure to losses as a result of

involvement with the VIE. FIN 46 was revised in December 2003

and is effective for financial statements of public entities that have

special-purpose entities, as defined, for periods ending after

December 15, 2003. For public entities without special-purpose

entities, it is effective for financial statements for periods ending

after March 15, 2004. The Company does not have any

special-purpose entities, as defined (other than an entity within its

discontinued operations that was established for the purpose of

selling securitized receivables and is fully described in the 2002

Annual Report), and is currently evaluating the provisions of this

statement. The Company does not expect FIN 46 to have a

material effect on its financial statements.

FISCAL YEAR 2004

In February 2004, management communicated guidance for

2004, which is discussed below.

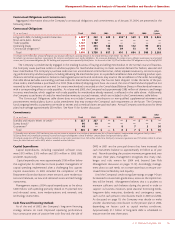

Sales

Comparable department store sales are expected to increase by

about 2% for the year. First quarter sales are expected to exceed

the 2% guidance due in part to last year’s weak first quarter results,

while fourth quarter sales are expected to be flat due to a calendar

shift resulting from the 53rd week in 2003.

For the year, total department store sales are expected to be flat

to up slightly on a 52-week basis, reflecting 2003 closures of

unprofitable stores. On a 53-week basis, total department store

sales are expected to decline about 1%.

Catalog/Internet sales are expected to increase low-single digits

each quarter and for the year.

Gross Margin

Management expects JCPenney’s gross margin ratio to increase

modestly, reflecting additional benefits from the centralized busi-

ness model, and improved supply chain efficiencies.

SG&A Expenses

Management expects SG&A expenses to be leveraged. This

includes savings from the initial phase of the Company’s cost

reduction program. Additional actions will be announced and

implemented during the balance of 2004 and 2005, and any sub-

sequent actions may result in additional SG&A expense savings

and/or related charges in 2004. Non-cash pension expense will

decline by at least $30 million in 2004 as a result of improved per-

formance in the equity markets in 2003 as well as the $300 million

discretionary pension contribution made in 2003.

Operating Profit

Operating profit is expected to increase to about 5.2% of sales,

with year-over-year improvement planned in each quarter.

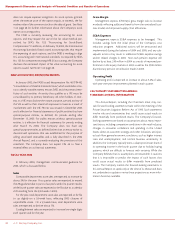

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This Annual Report, including the Chairman’s letter, may con-

tain forward-looking statements made within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

involve risks and uncertainties that could cause actual results to

differ materially from predicted results. The Company’s forward-

looking statements are based on assumptions about many impor-

tant factors, including competitive conditions in the retail industry;

changes in consumer confidence and spending in the United

States; direct-to-customer strategy and other initiatives; anticipat-

ed cash flow; general economic conditions, such as higher interest

rates and unemployment; and normal business uncertainty. In

addition, the Company typically earns a disproportionate share of

its operating income in the fourth quarter due to holiday buying

patterns, which are difficult to forecast with certainty. While the

Company believes that its assumptions are reasonable, it cautions

that it is impossible to predict the impact of such factors that

could cause actual results to differ materially from predicted

results. The Company intends the forward-looking statements in

this Annual Report to speak only at the time of its release and does

not undertake to update or revise these projections as more infor-

mation becomes available.