JCPenney 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 35

Notes to the Consolidated Financial Statements

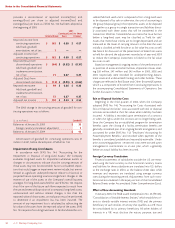

12 ACCUMULATED OTHER COMPREHENSIVE

(LOSS)/INCOME

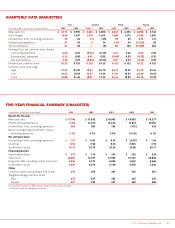

($ in millions) 2003 2002 2001

Foreign currency translation

adjustments(1) $(115) $(140) $ (86)

Non-qualified plan

minimum liability

adjustment(2) (82) (58) (51)

Net unrealized gains

on investments(3) 60 19 14

Other comprehensive

(loss) from

discontinued operations (1)(4) (24) (14)

Accumulated other

comprehensive (loss) $(138) $(203) $ (137)

(1) A deferred tax asset has not been established due to the historical reinvestment of

earnings in the Company’s Brazilian subsidiary.

(2) Shown net of a deferred tax asset of $52 million, $39 million and $33 million for

2003, 2002 and 2001, respectively.

(3) Shown net of a deferred tax liability of $32 million, $10 million and $8 million for

2003, 2002 and 2001, respectively.

(4) Shown net of a deferred tax asset of $1 million for 2003.

13 STOCK-BASED COMPENSATION

In May 2001, the Company’s stockholders approved a new

2001 Equity Compensation Plan (2001 Plan), which initially

reserved 16 million shares of common stock for issuance, plus 1.2

million shares reserved but not subject to awards under the

Company’s 1997 and 2000 equity plans. The 2001 Plan provides

for grants to associates of options to purchase the Company’s

common stock, stock awards or stock appreciation rights. No

future grants will be made under the 1997 and 2000 plans. At

January 31, 2004, 8.7 million shares of stock were available for

future grants. Stock options and awards typically vest over per-

formance periods ranging from one to five years. The number of

option shares is fixed at the grant date, and the exercise price of

stock options is generally set at the market price on the date of

the grant. The 2001 Plan does not permit stock options below

grant date market value. Options have a maximum term of 10

years. Over the past several years, the Company’s net stock

option grants (stock options granted during the year, less any for-

feitures or terminations) have averaged about 1.5% of total out-

standing stock.

Stock Options

At January 31, 2004, options to purchase 24.5 million shares of common stock were outstanding. If all options were exercised, common

shares outstanding (including common equivalents of outstanding preferred stock) would increase by 8.6%. At the end of 2003, 17.6 million,

or 72% of the 24.5 million outstanding options, were exercisable. Of those, 56% were "in-the-money" or had an exercise price below the

closing price of $26.18 on January 31, 2004, as shown in the following schedule:

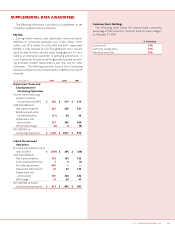

(shares in thousands, price is weighted average exercise price)

Exercisable Unexercisable Total

Shares % Price Shares % Price Shares % Price

In-the-money 9,930 56% $17.44 6,785 99% $18.80 16,715 68% $17.99

Out-of-the-money(1) 7,712 44% 45.27 50 1% 32.21 7,762 32% 45.16

Tot al options outstanding 17,642 100% $29.59 6,835 100% $18.93 24,477 100% $26.61

(1) Out-of-the-money options are those with an exercise price equal to or above the closing price of $26.18 at the end of 2003.

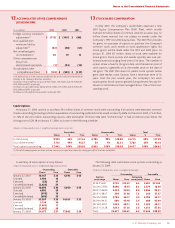

A summary of stock option activity follows:

(shares in thousands, price is weighted average exercise price)

Outstanding Exercisable

Shares Price Shares Price

January 27, 2001 18,167 $ 33 6,592 $ 48

Granted 3,402 16

Exercised (56) 17

Canceled/forfeited (2,823) 29

January 26, 2002 18,690 $ 30 5,840 $ 48

Granted 4,993 20

Exercised (610) 15

Canceled/forfeited (806) 38

January 25, 2003 22,267 $ 28 14,551 $ 33

Granted 5,136 20

Exercised (1,843) 17

Canceled/forfeited (1,083) 39

January 31, 2004 24,477 $ 27 17,642 $ 30

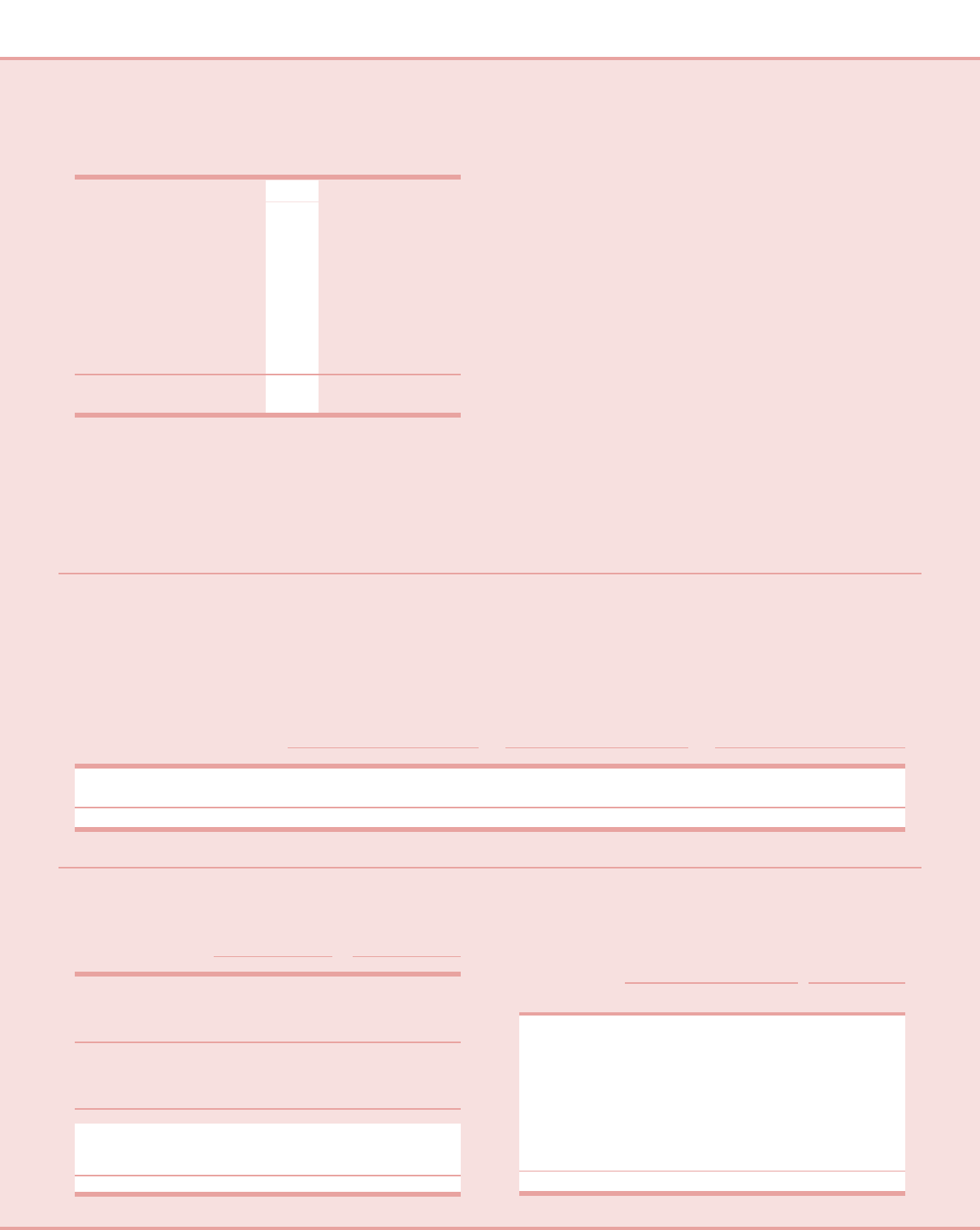

The following table summarizes stock options outstanding at

January 31, 2004:

(shares in thousands, price is weighted average)

Outstanding Exercisable

Exercise Remaining

price range Shares Price term (years) Shares Price

$9.32-$16.00 3,755 $15.01 6.4 3,681 $15.04

$16.06-$19.80 8,696 18.10 8.1 2,374 16.39

$20.01-$24.80 4,223 20.35 8.0 3,844 20.31

$25.31-$28.57 303 27.36 7.2 243 27.17

$32.05-$40.84 3,784 36.17 4.5 3,784 36.17

$43.00-$44.31 680 43.40 2.4 680 43.40

$47.69-$50.91 1,423 48.11 2.2 1,423 48.11

$55.31-$71.28 1,613 67.25 2.6 1,613 67.25

To t al 24,477 $26.61 6.4 17,642 $29.59