JCPenney 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 17

Management’s Discussion and Analysis of Financial Condition and Results of Operations

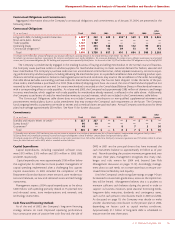

Debt Percent to Total Capital

The Company manages its capital structure to ensure financial

flexibility and access to capital, at a competitive cost, necessary to

accomplish its business strategies. Management considers all on-

and off-balance sheet debt in evaluating the Company’s overall

liquidity position and capital structure. Off-balance sheet debt

consists of the present value of operating leases (PVOL), which

are a fundamental part of the Company’s store operations.

While the debt percent to total capital, including off-balance

sheet debt, is not intended to be a substitute for the comparable

GAAP measure, management believes that this approach is a

more comprehensive and realistic view of financial leverage. Debt

investors and the credit rating agencies also consider off-balance

sheet debt when evaluating financial leverage.

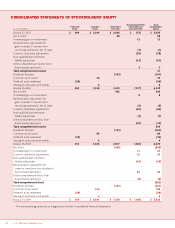

Debt Percent to Total Capital

($ in millions) 2003 2002 2001

Short-term investments(1) $(2,986) $(2,468) $ (2,834)

Short-term debt 18 13 15

Long-term debt(2) 5,356 5,173 6,060

Net debt 2,388 2,718 3,241

PVOL(3) 657 659 794

Tot al debt , including

PVOL 3,045 3,377 4,035

Consolidated equity 5,425 6,370 6,129

Tot al capital(4) $8,470 $9,747 $ 10,164

Debt percent to total capital 30.6% 29.9% 34.6%

Debt percent to total capital,

including PVOL 36.0% 34.6% 39.7%

(1) Includes restricted balances of $87 million, $86 million and $114 million in 2003,

2002 and 2001, respectively.

(2) Includes current maturities, capital leases and other.

(3) PVOL is the estimated present value of operating leases.

(4) Eckerd PVOL of $3.3 billion, $2.9 billion and $2.8 billion for 2003, 2002 and 2001,

respectively, and securitization of receivables of approximately $200 million each year,

have been excluded for all periods presented due to being reported as a discontinued

operation.

The Company’s capital structure in 2003 was positively impact-

ed by improved earnings, which contributed to the approximate-

ly $379 million of positive free cash flow generated from continu-

ing operations. Overall, however, the 2003 debt percent to total

capital increased slightly due to the reduction to equity of $1.3 bil-

lion to reflect Eckerd at fair value and the related tax effect of a

potential sale transaction, as discussed in Note 2.

As the Company proceeds with the divestiture of its drugstore

operations, proceeds from such a transaction will be used to fur-

ther strengthen the Company’s financial position and capital

structure. Through an appropriate mix of both common stock

repurchases and long-term debt retirements, management will

seek to deliver value to the Company’s shareholders and support

the long-term objective of improving the Company’s bond cred-

it ratings. Going forward, the Company’s financing strategy will

remain focused on preserving both strong liquidity and financial

flexibility as management works to improve the performance of

both Department Stores and the Catalog/Internet operation.

See discussion of financing transactions on page 14.

RISK MANAGEMENT

Management recognizes its responsibility to proactively man-

age risks effectively in order to maximize enterprise value (defined

as the combined market value of the Company’s debt and equity)

to investors. A certain degree of risk is inherent in operating a

three-channel retailing organization. The Company has an

enterprise-wide risk management framework in place to identify,

measure and manage risks. The Company’s organizational struc-

ture, both at the Board and Company management levels, plays

a critical role in maintaining an effective overall risk management

process, as highlighted by the following risk management and

monitoring processes:

Independent Oversight — There are various committees at

the Board of Directors’ level that oversee the risk governance

activities of the senior management committees. The Audit

Committee of the Board of Directors is responsible for discussion

of guidelines and policies to govern the process by which risk

assessment and management is undertaken. In addition, the

Audit Committee reviews with management the system of inter-

nal controls and financial reporting that is relied upon to provide

reasonable assurance of compliance with the Company’s opera-

tional risk management processes. The Finance Committee of

the Board of Directors reviews the Company’s overall financing

plan and dividend policy, as well as the liquidity position of the

Company, discussed below. The Human Resources and

Compensation Committee of the Board of Directors oversees

senior management committees responsible for retirement and

welfare plans, equity and other compensation plans.

Executive Management Committee — Sets the overall

strategic direction and financial targets for the Company, defines

the enterprise-wide risk tolerance levels consistent with overall

business strategies, recommends capital and operating budgets

to the Board of Directors, and is responsible for managing the

portfolio of risks throughout the enterprise.

•The Finance Liquidity Team, under the oversight of the

Executive Committee, monitors the Company’s liquidity

and cash flows as they relate to operating performance,

inventory and working capital requirements, capital

expenditures, financing and compliance with debt and bank

covenants.

Capital Appropriations Committee — Reviews and approves

individual capital and systems projects and ensures proper capital

allocation consistent with the overall capital expenditure plan.

Disclosure and Controls Review Committee (DCRC) and

Sarbanes-Oxley (SOX) Steering Committee — The DCRC is

made up of senior executives of the Company, including the

CEO. The DCRC ensures that the Company’s established disclo-

sure controls and certification process are adhered to. The SOX

Steering Committee oversees the implementation of the

corporate control procedures of Section 404 of the Sarbanes-

Oxley Act (Section 404) to ensure that the Company has proper