JCPenney 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 15

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Capital Expenditures

Capital expenditures, including capitalized software costs,

were $373 million, $315 million and $315 million in 2003, 2002

and 2001, respectively.

Capital expenditures were approximately $100 million below

the original plan for 2003 due to more prudent management of

capital spending implemented after a challenging first quarter.

Capital investments in 2003 included the completion of the

Department Store distribution center network, store moderniza-

tions and renewals, six new and relocated stores and technology

investments.

Management expects 2004 capital expenditures to be about

$500 million, with spending primarily related to 15 planned new

and relocated stores, store modernizations and renewals, and

technology investments.

Cash Flow and Financing Outlook

As of the end of 2003, the Company’s long-term financing

strategy remains on track. Improved operating performance,

four consecutive years of positive free cash flow and the sale of

DMS in 2001 are the principal drivers that have increased the

cash investment balance to approximately $3 billion as of year

end. Notwithstanding the positive momentum generated over

the past three years, management recognizes that many chal-

lenges and risks remain for 2004 and beyond (see Risk

Management discussion on pages 17-19). Accordingly, manage-

ment plans its cash needs on a conservative basis to ensure con-

tinued financial flexibility and liquidity.

Until the Company’s credit ratings (see ratings on page 14) can

be restored to investment-grade status, access to the capital mar-

kets will be limited. Management believes that it is prudent to

maintain sufficient cash balances during this period in order to

support its business initiatives, peak seasonal borrowing needs,

long-term debt maturities, dividends and contingency items,

such as the cash pension contributions made in 2003 and 2002.

As discussed on page 10, the Company may decide to make

another discretionary contribution to the pension plan in 2004,

depending on factors such as capital market conditions.

Approximately $1.1 billion of long-term debt is scheduled to

mature over the next three years.

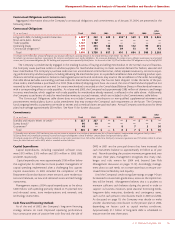

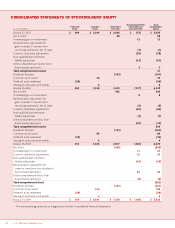

Contractual Obligations and Commitments

Aggregated information about the Company’s contractual obligations and commitments as of January 31, 2004, are presented in the

following tables.

Contractual Obligations

After

($ in millions) Total 2004 2005 2006 2007 2008 5 years

Long-term debt, including current maturities $5,389(1) $242 $ 629 $ 236(1) $559 $ 878 $ 2,845

Short-term debt - Renner 18 18—————

Trade payables 1,167 1,167—————

Operating leases 1,170 213 186 145 112 99 415

Contractual obligations(2) 226 88 42 29 13 11 43

Tot al $7,970 $1,728 $ 857 $ 410 $ 684 $ 988 $ 3,303

(1) Includes $200 million face amount of original issue discount debentures; carrying amount at the end of 2003 was $167 million. See Note 9.

(2) Includes (a) minimum purchase requirements for exclusive merchandise and royalty obligations; (b) minimum obligations for energy services, software maintenance and network

services; and (c) minimum obligations for SSC building and equipment leases operated by third parties. As discussed in Note 14, JCP will assume these SSC obligations in the first half of 2004.

The Company is predominantly engaged in the retailing business of buying and selling merchandise. In the normal course of business,

the Company issues purchase orders to vendors/suppliers for merchandise inventory to meet customer demand for fashion, seasonal and

basic merchandise. The Company’s purchase orders are not unconditional commitments but, rather, represent executory contracts requir-

ing performance by vendors/suppliers, including delivering the merchandise prior to a specified cancellation date and meeting product spec-

ifications and other requirements. Failure to meet agreed upon terms and conditions may result in the cancellation of the order. Accordingly,

the table above excludes outstanding purchase orders for merchandise inventory that has not been shipped. Under the terms of the pur-

chase orders, merchandise is purchased on a F.O.B. (Free on Board) shipping point basis. As a result, the cost of merchandise shipped but not

received by the Company as of year end (in-transit merchandise) is recorded on the Consolidated Balance Sheets in Merchandise Inventory

with a corresponding offset to trade payables. As of year-end 2003, the Company had approximately $382 million of domestic and foreign

in-transit merchandise, which together with trade payables for merchandise already received, is reflected in the table above. Additionally,

the Company issues letters of credit for merchandise inventory sourced overseas, which are included in the Commitments table below.

The Contractual Obligations table above does not include Company contributions to non-qualified supplemental retirement and

postretirement medical plans, due to a plan amendment that may increase the Company’s cash requirements in the future. The Company

funds ongoing benefits as payments are made to retirees and as medical claims are paid each year. Annual Company contributions for these

plans have average approximately $30 million. See Note 15 for further discussion.

Commitments

After

($ in millions) Total 2004 2005 2006 2007 2008 5 years

Standby and import letters of credit(1) $227 $ 227 $ — $—$—$—$—

Surety bonds(2) 90 90—————

Guarantees(3) 48—— 8 7 330

Tot al $365 $ 317 $ — $ 8 $ 7 $ 3 $ 30

(1) Standby letters of credit ($210 million at year-end) are issued as collateral to a third-party administrator for self-insured workers’ compensation and general liability claims.

(2) Surety bonds are primarily for previously incurred and expensed obligations related to workers’ compensation and general liability claims.

(3) Includes guarantees of $18 million on loans related to a real estate investment trust, $20 million related to a third-party reinsurance guarantee and $10 million related to certain

leases for stores that were sold in 2003, which is recorded in other liabilities.