JCPenney 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.32

Notes to the Consolidated Financial Statements

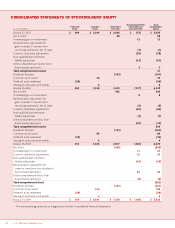

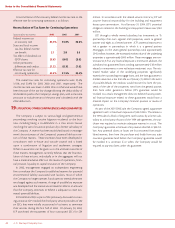

The assets and liabilities of discontinued operations were as follows:

2003 2002

($ in millions) Eckerd Eckerd Mexico Total

Cash and short-term

investments $7$8$6$14

Receivables 441 494 3 497

Merchandise inventory 1,986 1,963 12 1,975

Prepaid expenses 33 27 1 28

Tot al current assets 2,467 2,492 22 2,514

Property and

equipment, net 1,468 1,297 –– 1,297

Goodwill 2,269 2,269 –– 2,269

Intangible assets 443 494 –– 494

Other assets 157 172 3 175

Tot al A ssets $6,804 $6,724 $ 25 $ 6,749

Accounts payable and

accrued expenses $1,422 $1,439 $ — $ 1,439

Current deferred taxes 87 91 –– 91

Tot al current liabilities 1,509 1,530 –– 1,530

Long-term deferred taxes 218 232 –– 232

Other liabilities 259 254 –– 254

Tot al Liabilities $1,986 $2,016 $ — $ 2,016

JCPenney’s net investment $4,818 $4,708 $ 25 $ 4,733

Fair value adjustment (450)

Fair value of JCPenney’s

investment in Eckerd $4,368

As of January 31, 2004, Eckerd securitized managed care receiv-

ables totaled $218 million. This securitization program would be

terminated and the debt paid upon closing of a sale of Eckerd.

The unwinding of the securitization transaction was included in the

determination of the Eckerd fair value adjustment.

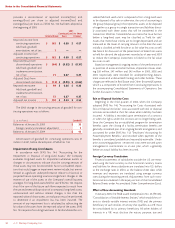

3EARNINGS PER SHARE

Income from continuing operations and shares used to com-

pute income per share from continuing operations, basic and

diluted, are reconciled below:

(in millions) 2003 2002 2001

Income from continuing

operations $364 $285 $ 182

Less: preferred stock dividends 25 27 29

Income from continuing

operations, basic $339 $258 $ 153

Adjustment for assumed

dilution: Interest of 5%

convertible debt, net of tax 22 22 ––

Income from continuing

operations, diluted $361 $280 $ 153

Shares:

Average common shares

outstanding (basic shares) 272 267 263

Adjustment for assumed dilution:

Stock options and

restricted stock units 234

Shares from convertible debt 23 23 ––

Average shares assuming

dilution (diluted shares) 297 293 267

The following average potential shares of common stock were

excluded from the diluted EPS calculations because their effect

would be anti-dilutive:

(shares in millions) 2003 2002 2001

Stock options(1) 899

$650 million notes

convertible at

$28.50 per share –– —7

Preferred stock 11 11 13

Tot al anti-dilutive

potential shares 19 20 29

(1) Exercise prices per share ranged from $20 to $71, $21 to $71 and $23 to $71 for

2003, 2002 and 2001, respectively.

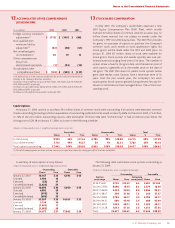

4SUPPLEMENTAL CASH FLOW INFORMATION

($ in millions) 2003 2002 2001

Income taxes paid $50$136 $ 225

Interest paid 420 422 420

Interest received 188 198 201

2003

•The Company issued 2.4 million shares of common stock to

fund the 2002 contribution of $47 million to the savings plan.

2002

•The Company issued 2.9 million shares of common stock to

fund the 2001 contribution of $58 million to the savings plan.

•The Company exchanged certain notes and debentures with

a carrying amount of $227 million for new notes recorded at

a fair value of $225 million.

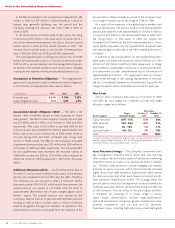

5OTHER ASSETS

($ in millions) 2003 2002

Real estate investments $169 $106

Leveraged lease investments 134 131

Capitalized software, net 97 94

Deferred catalog book costs 77 73

Debt issuance costs, net 52 46

Other 27 41

Tot al $556 $491