JCPenney 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.34

Notes to the Consolidated Financial Statements

ues of the remaining scheduled payments, discounted to the

redemption date on a semi-annual basis at the "treasury yield"

plus 50 basis points, together in either case with accrued interest

to the date of redemption.

Payments Related to Put Bonds and Sinking Fund Debt

In August 2003, bondholders exercised their option to redeem

approximately $117 million of the $119 million 6.9% Debentures

Due 2026. During the year, the Company retired $62 million of

its sinking fund debentures through mandatory payments total-

ing $25 million and available optional sinking fund payments

totaling $37 million. Also in 2003, the Company purchased

approximately $17 million of the 8.25% Sinking Fund Debentures

Due 2022 and will apply them to unspecified future mandatory

sinking fund payments.

Payment of Notes Due

In November 2003, the outstanding amount of the Company’s

6.125% Notes Due 2003, totaling $246 million, matured and was

paid in full.

Debt Covenants

The Company has indentures covering approximately $755 mil-

lion of long-term debt that contain a financial covenant requiring

the Company to have a minimum of 200% net tangible assets to

senior funded indebtedness (as defined in the indenture, which

includes Eckerd). These indentures permit the Company to issue

additional long-term debt if it is in compliance with the covenant.

At year-end 2003 the Company’s percentage of net tangible assets to

senior funded indebtedness was 245%.

Other

The $650 million of 5% Convertible Subordinated Notes Due

2008 are convertible at any time prior to maturity, unless previ-

ously redeemed, at the option of the holders into shares of the

Company’s common stock at a conversion price of $28.50 per

share, subject to certain adjustments. The notes are subordinated

to the Company’s senior indebtedness. The notes will not be sub-

ordinated to the Company’s trade payables or other general cred-

itors of the Company. The notes are structurally subordinated to

all indebtedness and other liabilities of the Company and its sub-

sidiaries. The Company may redeem the notes on or after

October 20, 2004.

The 7.4% Debentures Due 2037, principal amount of $400 mil-

lion, contain put options where the investor may elect to have

the debenture redeemed at par on April 1, 2005. Assuming these

debenture holders exercise their repayment options, required

principal payments on long-term debt over the next five years are

as follows:

($ in millions)

2004 2005 2006 2007 2008 2009-2097

$242 $629 $236 $559 $878 $2,845

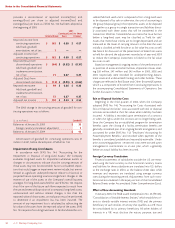

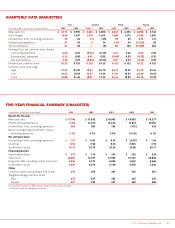

10 INTEREST EXPENSE, NET

($ in millions) 2003 2002 2001

Short-term debt $6$4$—

Long-term debt 429 403 426

Short-term investments (30) (41) (50)

Other, net 20 22 10

Less: Interest expense of

discontinued operations(1)(2) (164) (162) (155)

Tot al $261 $226 $ 231

(1) Includes interest expense from Mexico Department Stores of $1 million, $1 million

and $2 million in 2003, 2002 and 2001, respectively.

(2) See Note 2 for explanation of interest expense allocated to Eckerd.

11 CAPITAL STOCK

The Company had 46,524 stockholders of record as of January

31, 2004. On a combined basis, the Company’s savings plans,

including the Company’s employee stock ownership plan

(ESOP), held 44 million shares of common stock or 15.5% of the

Company’s common shares after giving effect to the conversion

of preferred stock.

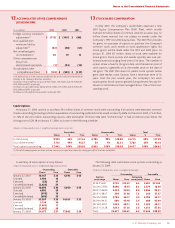

Preferred Stock

The Company has authorized 25 million shares of preferred

stock; 505,759 and 554,426 shares of Series B ESOP Convertible

Preferred Stock were issued and outstanding as of January 31,

2004 and January 25, 2003, respectively. Each share is convertible

into 20 shares of the Company’s common stock at a guaranteed

minimum price of $30 per common share. Dividends are cumu-

lative and are payable semi-annually at an annual rate of $2.37 per

common share equivalent, a yield of 7.9%. Shares may be

redeemed at the option of the Company or the ESOP under cer-

tain circumstances. The redemption price may be satisfied in

cash or common stock or a combination of both, at the

Company’s sole discretion.

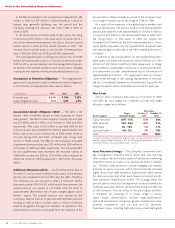

Preferred Stock Purchase Rights

In January 2002, in connection with the Holding Company for-

mation, the Board of Directors issued one preferred stock pur-

chase right on each outstanding and future share of common

stock. JCP’s then-existing rights plan, which was established in

March 1999 with terms substantially similar to those of the

Company’s 2002 plan, was simultaneously amended so that it

expired. The new rights entitle the holder to purchase, for each

right held, 1/1000 of a share of Series A Junior Participating

Preferred Stock at a price of $140. The rights are exercisable by the

holder upon the occurrence of certain events and are

redeemable by the Company under certain circumstances as

described by the rights agreement. The rights agreement con-

tains a three-year independent director evaluation (TIDE) provi-

sion. This TIDE feature provides that a committee of the

Company’s independent directors will review the rights agree-

ment at least every three years and, if they deem it appropriate,

may recommend to the Board a modification or termination of

the rights agreement.