JCPenney 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

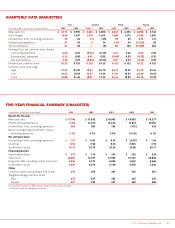

J. C. Penney Company, Inc.38

Notes to the Consolidated Financial Statements

In the PBO reconciliation, the actuarial loss increased from $89

million in 2002 to $379 million in 2003 primarily as a result of

interest rates generally declining over this period and the

Company lowering the discount rate from 7.10% in 2002 to

6.35% in 2003.

In the reconciliation of the fair value of plan assets, the swing

of more than $700 million in the actual return on assets, which is

net of plan administrative expenses, was due to the poor capital

market returns in 2002 and the market rebound in 2003. The

one-year return on plan assets at the October 31 measurement

date in 2003 and 2002 was 19.5% and (6.7)%, respectively.

The unrecognized losses, including prior service cost, of $1,099

million will be amortized, subject to a corridor as permitted under

SFAS No. 87, as pension expense over the average remaining serv-

ice period of the covered workforce. Such amortization, included

in total pension expense, will reduce the prepaid pension cost.

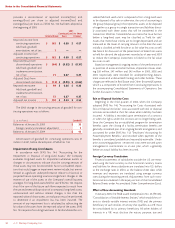

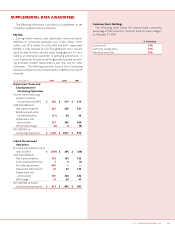

Assumptions to Determine Obligations —The weighted aver-

age actuarial assumptions used to determine benefit obligations

at the October 31 measurement dates were as follows:

Assumptions 2003 2002 2001

Discount rate 6.35% 7.10% 7.25%

Salary progression rate 4.0% 4.0% 4.0%

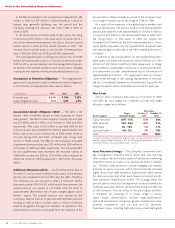

Accumulated Benefit Obligation (ABO) —The ABO is the

present value of benefits earned to date, assuming no future

salary growth. The ABO for the Company’s primary pension plan

was $3.0 billion and $2.6 billion as of October 31, 2003 and 2002,

respectively. Plan assets of $3.5 billion at year-end 2003 for the

primary pension plan exceeded the ABO by approximately $0.5

billion, due to total cash contributions of $600 million made to

the plan during 2003 and 2002, combined with strong asset

returns of 19.5% in 2003. The ABO for the Company’s unfunded

supplemental pension plans was $372 million and $318 million as

of October 31, 2003 and 2002, respectively. The unfunded ABO

for the supplemental plans exceeded the recorded liability of

$228 million at year-end 2003 by $134 million, which required an

additional minimum liability adjustment. See further discussion

below.

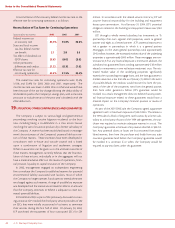

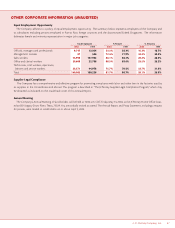

Additional Minimum Liability —At the measurement date of

October 31, the fair value of pension plan assets in the primary

pension plan exceeded both the PBO and the ABO. Therefore,

the Company was not required to reflect a minimum liability

adjustment under SFAS No. 87, which would have removed the

prepaid pension cost (asset) of $1.3 billion with the offset of

approximately $800 million, net of taxes, charged against stock-

holders’ equity. The prepaid pension cost carried on the

Company’s balance sheet as of year-end 2003 represents pension

funding as well as return on plan assets in excess of pension

expense recognized through the statement of operations. The

prepaid pension cost has accumulated from the inception of the

pension plan in 1966 principally as a result of the Company’s pol-

icy to target a funded ratio in the range of 110% to 130%.

As a result of the weakness in the global equity markets over

the past several years, the pension surplus of the defined benefit

pension plan declined from approximately $1.2 billion in 2000 to

a surplus of $45 million at the measurement date in 2002. With

the strong return on plan assets in 2003, this surplus has

increased to $219 million at the 2003 measurement date. A min-

imum liability adjustment for the supplemental retirement plan

was required again in 2003 due to the ABO exceeding the record-

ed liability.

In addition to the accrued liability for the supplemental retire-

ment plans, the additional minimum liability balance was $134

million and $97 million in 2003 and 2002, respectively. A charge

was recorded to stockholders’ equity, net of income tax benefits,

as a component of other comprehensive loss in the amount of

approximately $24 million. This adjustment does not impact

current year earnings or the funding requirements of the plan.

See the Consolidated Statements of Stockholders’ Equity for the

charge included in other comprehensive income for each year.

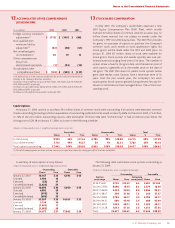

Plan Assets

The fair value of pension plan assets as of October 31, 2003

and 2002, by asset category as a percent to total, and target

allocation ranges are as follows:

Plan Assets

Target October 31, October 31,

Asset Category Allocation Ranges 2003 2002

Equity securities(1) 65% - 75% 62% 58%

Debt securities 15% - 25% 20% 21%

Real estate 5% - 15% 9% 11%

Cash and other(1) 0% - 5% 9% 10%

Tot al 100% 100%

(1) Cash investments exceeded the targeted range, and equity securities were less

than the targeted range temporarily, due to the timing of contributions relative to

investments made in equity and fixed income securities.

Asset Allocation Strategy —The Company’s investment strat-

egy is designed to provide a rate of return that, over the long

term, increases the ratio of plan assets to liabilities by maximizing

investment return on assets, at an appropriate level of volatility

risk. The plan’s asset portfolio is actively managed and invested

primarily in equity securities, which have historically provided

higher returns than debt portfolios, balanced with fixed income

(i.e, debt securities) and other asset classes to maintain an effi-

cient risk/return diversification profile. This strategy allows the

pension plan to serve as a funding vehicle to secure benefits for

Company associates, while at the same time being cost effective

to the Company. The risk of loss in the plan’s equity portfolio

is mitigated by investing in a broad range of equity

types. Equity diversification includes large-capitalization

and small-capitalization companies, growth-oriented and value-

oriented investments, and U.S. and non-U.S. securities.

Investment types, including high-yield versus investment-grade