JCPenney 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stores

Catalog

Internet

J. C. PENNEY COMPANY, INC.

2003 ANNUAL REPORT

Table of contents

-

Page 1

J . C . P E N N E Y C O M PA N Y, I N C . 2003 ANNUAL REPORT Stores Catalog Internet -

Page 2

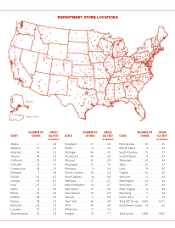

DEPARTMENT STORE LOCATIONS Alaska Puerto Rico STATE NUMBER OF STORES GROSS SQ. FEET (in millions) STATE NUMBER OF STORES GROSS SQ. FEET (in millions) STATE NUMBER OF STORES GROSS SQ. FEET (in millions) Alaska ...1 ...0.2 Alabama ...17 ...1.6 Arkansas ...16 ...1.2 Arizona ...18 ...1.6 ... -

Page 3

..., Catalog and Internet. Merchandise offerings consist of family apparel, jewelry, shoes, accessories and home furnishings. In addition, through its Department Stores, the Company offers services including full-service salons, optical, portrait photography and custom decorating. The Company operates... -

Page 4

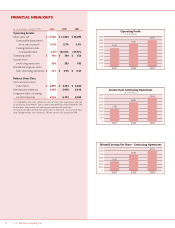

... department store sales increase(1) 0.9% Catalog/Internet sales increase/decrease 3.3%(2) Operating profit $ 790 Income from continuing operations 364 Diluted earnings per share from continuing operations $ 1.21 Balance Sheet Data: Cash and short-term investments Merchandise inventory Long-term debt... -

Page 5

... operating profit contributions to the Department Store and Catalog/Internet segment received an enormous boost from our Internet site, which recorded impressive sales growth of 50% versus the prior year. We expect our Internet business to continue to provide a competitive advantage for the Company... -

Page 6

... and financial flexibility as we work to improve the performance of our Department Store and Catalog/Internet business. THE FUTURE At any point in time, prognostication of future events and conditions can always include both good and bad. At JCPenney, we prefer to see the future in a positive light... -

Page 7

...customer segments. The financial goals are to attain at least 2% annual comparable store sales growth and achieve a 6% to 8% operating profit margin in fiscal 2005. To re-establish and solidify the customer franchise, management is focused on building clear reasons for the Company's target customers... -

Page 8

... financial goals, pension accounting and funding, stock option accounting, and forward-looking information related to operating results, cash flow and financing. This 2003 Annual Report continues the trend with the addition of an executive overview, discussion of corporate governance practices, risk... -

Page 9

... on financial condition or operating performance is material. While net retail sales are material, the Company's business is fairly straightforward. Customers purchase merchandise and services with credit or debit cards, cash or gift cards, and revenue is recognized at the point of sale when payment... -

Page 10

... of the year is calculated using merchandise cost data at the item level. Prior to 2002, this index was based on retail prices. See Merchandise Inventories in Note 1 on page 29 for more details on the change. Valuation of long-lived and intangible assets, including goodwill: Management evaluates the... -

Page 11

... asset/liability amounts in the consolidated financial statements. Market-related value of plan assets - In accounting for pension costs, the Company uses fair value, which is the market value of plan assets as of the annual measurement date, to calculate the expected return on assets and gain/loss... -

Page 12

... in the event of a decline in the market. In addition, a well-funded plan assures associates of the plan's and the Company's financial ability to continue to provide competitive retirement benefits, while at the same time being cost effective. The Company targets to maintain a funded ratio in... -

Page 13

... on certain store leases, inventory shrinkage and transaction costs. Direct Marketing Services In 2001, the Company closed on the sale of its J. C. Penney Direct Marketing Services, Inc. (DMS) assets, including its J. C. Penney Life Insurance subsidiaries and related businesses, to a U.S. subsidiary... -

Page 14

...and Analysis of Financial Condition and Results of Operations value pricing and certain marketing events, including free shipping. Sales reflected less reliance on Big Books and a focus on targeted specialty books and Internet. Total Internet sales, which are an integral part of the Company's three... -

Page 15

... expenses. The Company's financial goal is to generate operating profit of 6% to 8% of sales in 2005. The successful execution of the turnaround and progress toward improving profitability is impacted by customers' response to the Company's merchandise offerings, competitive conditions, the effects... -

Page 16

...These cash balances support the Company's liquidity needs during its turnaround, at a time when the Company has limited access to the capital markets due to its credit ratings. Credit Ratings As of March 16, 2004, ratings were as follows: Senior Implied Long-term Debt Moody's Investors Service, Inc... -

Page 17

... related to 15 planned new and relocated stores, store modernizations and renewals, and technology investments. Cash Flow and Financing Outlook As of the end of 2003, the Company's long-term financing strategy remains on track. Improved operating performance, four consecutive years of positive free... -

Page 18

... related to inventory, the reversal of 2003's accounts payable and accrued expense benefits associated with the 53rd week, and dividend payments, which are subject to approval by the Company's Board of Directors. In accordance with its long-term financing strategy, the Company manages its financial... -

Page 19

..., equity and other compensation plans. Executive Management Committee - Sets the overall strategic direction and financial targets for the Company, defines the enterprise-wide risk tolerance levels consistent with overall business strategies, recommends capital and operating budgets to the Board of... -

Page 20

... are discussed below: Business • Strategic - The Company's key business risk is the successful execution of the five-year turnaround plan for Department Stores and Catalog/Internet to achieve competitive levels of profitability. The Company has strategies and processes in place to ensure that the... -

Page 21

... offerings or pricing, changing merchandise allocations among various store formats and locations based on customer demand shifts, and changing marketing programs. The Company has multiple delivery channels (i.e., Department Stores, Catalog and the Internet), and many different product lines... -

Page 22

... department store sales are expected to decline about 1%. Catalog/Internet sales are expected to increase low-single digits each quarter and for the year. Gross Margin Management expects JCPenney's gross margin ratio to increase modestly, reflecting additional benefits from the centralized business... -

Page 23

... and the independent auditors have free access to the Audit Committee without management present. Robert B. Cavanaugh Executive Vice President and Chief Financial Officer INDEPENDENT AUDITORS' REPORT To the Stockholders and Board of Directors of J. C. Penney Company, Inc.: We have audited the... -

Page 24

... e x ce pt p e r sh a re d at a ) 2003 2002 2001 Retail sales, net Cost of goods sold Gross margin Selling, general and administrative expenses Net interest expense Real estate and other (income)/expense Income from continuing operations before income taxes Income tax expense Income from continuing... -

Page 25

...-term debt Deferred taxes Total current liabilities Long-term debt Deferred taxes Other liabilities Liabilities of discontinued operations Total Liabilities Stockholders' Equity Preferred stock, no par value and stated value of $600 per share; authorized, 25 million shares; issued and outstanding... -

Page 26

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Preferred Stock Common Stock Reinvested Earnings Accumulated Other Comprehensive (Loss)/Income Total Stockholders' Equity ($ in millions) January 27, 2001 Net income Unrealized gain on investments Reclassification adjustment for gains included in ... -

Page 27

...and other unit closing costs Depreciation and amortization Net gains on sale of assets Company contributions to savings and profit sharing plans Benefit plans expense/(income) Pension contribution Stock-based compensation Deferred taxes Change in cash from: Receivables Inventory Prepaid expenses and... -

Page 28

...year presentation. None of the reclassifications impacted the Company's net earnings/(loss) in any period. Merchandise and Services Revenue Recognition Revenue, net of returns, is recorded at the point of sale when payment is made and customers take possession of the merchandise in department stores... -

Page 29

...are negotiated by the buying team after the related merchandise is sold and the markdown information is known; consequently, they are credited directly to cost of goods sold in the period received. Vendor compliance charges reimburse the Company for incremental merchandise handling expenses incurred... -

Page 30

... used in the actuarial model for pension accounting and is determined based upon the Company's long-term plans for such increases. For retiree medical plan accounting, the health care cost trend rates do not have a material impact since dollar limits have been placed on Company contributions... -

Page 31

... receivables. Merchandise Inventories Inventories are valued primarily at the lower of cost (using the last-in, first-out or "LIFO" method) or market, determined by the retail method for department stores and store support centers (SSCs) and average cost for Catalog/Internet and regional... -

Page 32

... important that could trigger an impairment review include, but are not limited to, significant underperformance relative to historical or projected future operating results and significant changes in the manner of use of the assets or the Company's overall business strategies. For long-lived assets... -

Page 33

... City. The stock sale transaction, which included the Mexico holding company and operating companies comprising JCPenney's Mexico department store operation, resulted in a loss of $14 million, net of a $27 million tax benefit. The loss was principally related to currency translation losses of $25... -

Page 34

...$ 27 258 $ 22 280 $ 267 3 23 293 182 29 153 -- 153 263 4 -- 267 Real estate investments Leveraged lease investments Capitalized software, net Deferred catalog book costs Debt issuance costs, net Other Total $ $ 169 $ 134 97 77 52 27 556 $ 106 131 94 73 46 41 491 32 J. C. Penney Company, Inc. -

Page 35

.... Pricing is tiered based on the corporate credit ratings for the Company by Moody's and Standard & Poor's. Obligations under the credit facility are guaranteed by J. C. Penney Company, Inc. and JCP Real Estate Holdings, Inc., which is a wholly owned subsidiary of the Company. 9 LONG-TERM DEBT... -

Page 36

...both, at the Company's sole discretion. Preferred Stock Purchase Rights In January 2002, in connection with the Holding Company formation, the Board of Directors issued one preferred stock purchase right on each outstanding and future share of common stock. JCP's then-existing rights plan, which was... -

Page 37

... over performance periods ranging from one to five years. The number of option shares is fixed at the grant date, and the exercise price of stock options is generally set at the market price on the date of the grant. The 2001 Plan does not permit stock options below grant date market value. Options... -

Page 38

...associate's credited service (up to 35 years), as defined in the plan document. Estimated Future Benefit Payments ($ in millions) Pension Benefits(1) 14 LEASES The Company conducts the major part of its operations from leased premises that include retail stores, Catalog/Internet fulfillment centers... -

Page 39

...End of year $ Change in fair value of plan assets Beginning of year $ Company contributions Actual return on assets Benefits (paid)(1) End of year $ Funded status of plan Excess of fair value over projected benefits $ Unrecognized losses and prior service cost Prepaid pension cost/(accrued liability... -

Page 40

... to maintain an efficient risk/return diversification profile. This strategy allows the pension plan to serve as a funding vehicle to secure benefits for Company associates, while at the same time being cost effective to the Company. The risk of loss in the plan's equity portfolio is mitigated by... -

Page 41

...the plan is monitored with updated market and liability information at least annually. Actual asset allocations are monitored monthly and rebalancing actions are executed at least quarterly, if needed. To manage the risk associated with an actively managed portfolio, the Company reviews each manager... -

Page 42

... related to third-party fulfillment operations that were discontinued in 2002. 16 REAL ESTATE AND OTHER (INCOME)/EXPENSE ($ in millions) 2003 2002 2001 Real estate activities $ Net gains from sale of real estate Asset impairments, PVOL and other unit closing costs Centralized merchandising process... -

Page 43

... included in Real Estate and Other (Income)/Expense. Reserves are reviewed for adequacy on a periodic basis and are adjusted as appropriate. The balance of the reserves relates principally to future lease obligations for department stores closed as part of restructuring programs in prior years, and... -

Page 44

... have a material impact on the Company's financial position or results of operations. As part of the 2001 DMS sale, the Company signed a guarantee agreement with a maximum exposure of $20 million. This relates to the 1994 sale of a block of long-term care business by a former subsidiary to a third... -

Page 45

... sales, net Percent increase/(decrease) Income/(loss) from continuing operations Return on beginning stockholders' equity - continuing operations Per common share Income/(loss) from continuing operations(1) Dividends Stockholders' equity Financial position Capital expenditures Total assets Long-term... -

Page 46

...-YEAR OPERATIONS SUMMARY (UNAUDITED) 2003 2002 2001 2000 1999 Department Stores and Catalog Number of department stores: JCPenney Department Stores Beginning of year Openings Closings End of year Renner Department Stores Total Department Stores Gross selling space (square feet in millions) Sales... -

Page 47

...: % Ownership Institutional Company savings plans Individual and other 74% 16% 10% Department Stores and Catalog/Internet Continuing Operations Income from continuing operations before income taxes (GAAP) $ 546 $ 415 $ Add back/(deduct): Net interest expense 261 226 Real estate and other (income... -

Page 48

... important to its customers and its employees. JCPenney's commitment focuses on three major endeavors. The Company is a contributor to JCPenney Afterschool Fund, a charitable organization committed to providing children with high quality after-school programs. The Company supports community health... -

Page 49

... Compliance Program," which may be obtained as indicated on the inside back cover of this Annual Report. Annual Meeting The Company's Annual Meeting of Stockholders will be held at 10:00 a.m. CDT, Friday, May 14, 2004, at the JCPenney Home Office located at 6501 Legacy Drive, Plano, Texas, 75024... -

Page 50

...reviewing the Company's financial policies, strategies and capital structure. Reference to Proxy Statement For additional information about Company directors, board committees, executive compensation and audit fees, see the 2004 J. C. Penney Company, Inc. Notice of Annual Meeting and Proxy Statement... -

Page 51

...Sales Period Release Date JCPenney Mailing Address J. C. Penney Company, Inc. P.O. Box 10001, Dallas, TX 75301-4314 Stock Exchange Listing Trading symbol JCP New York Stock Exchange SEC Filings JCPenney SEC filings, including the following, are available on the Company's Investor Relations web site... -

Page 52

J . C . P E N N E Y C O M PA N Y, I N C . 2003 ANNUAL REPORT