IBM 1998 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

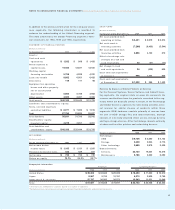

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

87

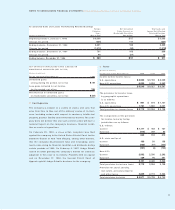

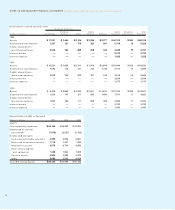

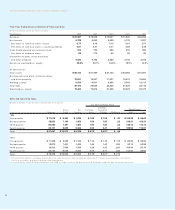

Segment Assets and Other Items

The assets of the hardware segments primarily include inven-

tory and plant, property and equipment. The software segment

assets mainly include inventory, plant, property and equipment,

and investment in deferred software development. The Global

Services segment assets primarily include maintenance inven-

tory and plant, property and equipment associated with its

strategic outsourcing business. Details regarding the Global

Financing segment assets can be found on page 89.

To accomplish the efficient use of space and equipment, it

becomes necessary, in most instances, for several segments

to share plant, property and equipment assets. Where assets

are shared, landlord ownership of the assets is assigned to

one segment and not allocated to each user segment. This is

consistent with the company’s management system and is

reflected as such in the schedule on page 88. In such cases,

there will not be a precise compatibility between segment

pre-tax income and segment assets.

Similarly, the depreciation amounts reported by segment are

deployed on a landlord ownership basis and may not be con-

sistent with the actual amounts included in the segments’ pre-

tax income. Such amounts included in pre-tax income reflect

occupancy charges from the landlord segment and are not

specifically identified by the management reporting system.

Capital expenditures reported by segment are also in line with

the landlord ownership basis of asset assignment.

The Global Financing segment amounts on page 88 for inter-

est income and interest expense reflect the interest income

and expense associated with the financing business as well as

the investment in cash and marketable securities. The remain-

ing amounts of interest income and interest expense are not

allocated discretely to the other segments, but are included as

part of an indirect expense allocation.

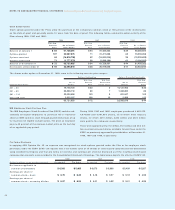

Reconciliations to IBM as Reported

(Dollars in millions) 1998 1997 1996

REVENUE:

Total reportable segments $«90,912 $«89,173 $«86,602

Other revenues 151 99 343

Elimination of internal

revenue (9,396) (10,764) (10,998)

Total IBM Consolidated $«81,667 $«78,508 $«75,947

PRE-TAX INCOME:

Total reportable segments $«««9,699 $«««9,686 $«10,269

Elimination of internal

transactions (162) (377) (251)

Unallocated corporate

expenses (497) (282) (996)

Purchased research and

development —— (435)

Total IBM Consolidated $«««9,040 $«««9,027 $«««8,587

Major Customers

No single customer represents 10% or more of the company’s

total revenue.

Immaterial Items

INVESTMENT IN EQUITY ALLIANCES AND

EQUITY ALLIANCES GAINS/LOSSES

The investments in equity alliances and the resulting gains and

losses from these investments attributable to the segments

are minimal and do not have a material impact on the financial

results of the segments.