IBM 1998 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

83

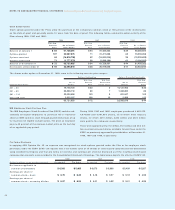

Net periodic pension cost is determined using the Projected

Unit Credit actuarial method.

The effects on the company’s results of operations and finan-

cial position from changes in the estimates and assumptions

used in computing pension and prepaid pension assets or

pension liability is mitigated by the delayed recognition provi-

sions of SFAS 87, with the exception of the effects of settle-

ment gains, curtailment losses and early terminations, which

are recognized immediately. The 0.5% decrease in the dis-

count rate in 1998 resulted in an actuarial loss of $2,144 mil-

lion for the U.S. plan. The 0.75% decrease in the discount rate

in 1997 resulted in an actuarial loss of $2,723 million for the

U.S. plan.

It is the company’s practice to fund amounts for pensions suf-

ficient to meet the minimum requirements set forth in applica-

ble employee benefits laws and with regard to local tax laws.

Additional amounts are contributed from time to time when

deemed appropriate by the company. Liabilities for amounts in

excess of these funding levels are accrued and reported in the

company’s Consolidated Statement of Financial Position. The

assets of the various plans include corporate equities, gov-

ernment securities, corporate debt securities and real estate.

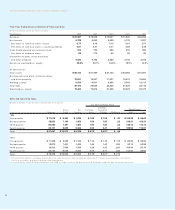

At December 31, 1998, the material non-U.S. defined benefit

plans in which the plan assets exceeded the benefit obligation

had obligations of $18,217 million and assets of $21,736 mil-

lion. The material non-U.S. defined benefit plans in which the

benefit obligation exceeded the fair value of plan assets had

obligations of $3,831 million and assets of $3,558 million.

At December 31, 1997, the material non-U.S. defined benefit

plans in which the plan assets exceeded the benefit obligation

had obligations of $18,322 million and assets of $21,391 mil-

lion. The material non-U.S. defined benefit plans in which the

benefit obligation exceeded the fair value of plan assets had

obligations of $524 million and assets of $450 million.

XNonpension Postretirement Benefits

The company and its U.S. subsidiaries have defined benefit

postretirement plans that provide medical, dental and life

insurance for retirees and eligible dependents. Plan cost

maximums for those who retired prior to January 1, 1992, will

take effect beginning with the year 2001. Plan cost maximums

for all other employees take effect upon retirement.

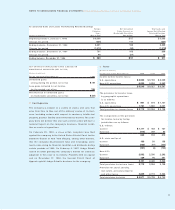

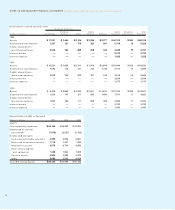

The changes in the benefit obligation and plan assets of the

U.S. plans for 1998 and 1997 are as follows:

(Dollars in millions) 1998 1997*

Change in benefit obligation:

Benefit obligation at beginning

of year $««6,384 $««6,453

Service cost 42 32

Interest cost 427 455

Amendments (26) (290)

Actuarial gains (146) (234)

Actuarial losses 272 435

Benefits paid from trust (486) (455)

Direct benefit payments (10) (12)

Benefit obligation at end of year 6,457 6,384

Change in plan assets:

Fair value of plan assets at

beginning of year 120 559

Actual return on plan assets 10 16

Employer contributions 479 —

Benefits paid, net

of employee contributions (486) (455)

Fair value of plan assets at

end of year 123 120

Benefit obligation in excess

of plan assets (6,334) (6,264)

Unrecognized net actuarial losses 700 578

Unrecognized prior service cost (965) (1,073)

Accrued postretirement

benefit liability recognized in the

Consolidated Statement

of Financial Position $«(6,599) $«(6,759)

*Reclassified to conform to 1998 presentation.

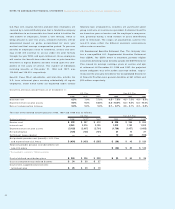

The benefit obligation was determined by application of the

terms of medical, dental and life insurance plans, including

the effects of established maximums on covered costs,

together with relevant actuarial assumptions. These actuarial

assumptions included a projected healthcare cost trend rate

of 6 percent.