IBM 1998 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

70

value with changes in fair value recognized immediately in net

income. Refer to note M, “Financial Instruments,” on pages 74

and 75 for descriptions of the major classes of derivative

financial instruments used by the company, including the

specific methods used to account for them.

In assessing the fair value of its financial instruments, both

derivative and non-derivative, the company uses a variety of

methods and assumptions that are based on market condi-

tions and risks existing at each balance sheet date. Quoted

market prices or dealer quotes for the same or similar instru-

ments are used for the majority of marketable securities,

long-term investments and long-term debt. Other techniques,

such as option pricing models, estimated discounted value of

future cash flows, replacement cost and termination cost, are

used to determine fair value for the remaining financial instru-

ments. These values represent a general approximation of

possible value and may never actually be realized.

Cash Equivalents

All highly liquid investments with a maturity of three months or

less at date of purchase are carried at fair value and considered

to be cash equivalents.

Marketable Securities

Marketable securities included within current assets represent

highly liquid securities with a maturity less than one year. The

company’s marketable securities are considered available for

sale and are reported at fair value with changes in unrealized

gains and losses, net of applicable taxes, recorded in Accu-

mulated gains and losses not affecting retained earnings

within stockholders’ equity. Realized gains and losses are cal-

culated based on the specific identification method.

Inventories

Raw materials, work in process and finished goods are stated

at the lower of average cost or net realizable value.

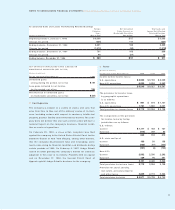

Depreciation

Plant, rental machines (computer equipment used internally or

as part of managed operations contracts) and other property

are carried at cost and depreciated over their estimated

useful lives using the straight-line method.

The estimated useful lives of depreciable properties are gener-

ally as follows: buildings, 50 years; building equipment, 20 years;

land improvements, 20 years; plant, laboratory and office equip-

ment, 2 to 15 years; and computer equipment, 1.5 to 5 years.

Software

Costs related to the conceptual formulation and design of

licensed programs are expensed as research and develop-

ment. Costs incurred subsequent to establishment of tech-

nological feasibility to produce the finished product are

capitalized. The annual amortization of the capitalized amounts

is the greater of the amount computed based on the estimated

revenue distribution over the products’ revenue-producing

lives, or the straight-line method, and is applied over periods

ranging up to four years. Periodic reviews are performed

to ensure that unamortized program costs remain recoverable

from future revenue. Costs to support or service licensed pro-

grams are charged against income as incurred, or when

related revenue is recognized, whichever occurs first.

Retirement Plans and Nonpension Postretirement Benefits

Current service costs of retirement plans and postretirement

healthcare and life insurance benefits are accrued in the

period. Prior service costs resulting from amendments to the

plans are amortized over the average remaining service period

of employees expected to receive benefits. Assuming thresh-

olds established in SFAS 87, “Employers’ Accounting for

Pensions,” are met, unrecognized net gains and losses are

amortized to service cost over the average remaining service

life of employees expected to receive benefits. See note W,

“Retirement Plans,” on page 81 through 83 and note X,

“Nonpension Postretirement Benefits,” on pages 83 and 84 for

further discussion.

Goodwill

Goodwill is charged to net income on a straight-line basis over

the periods estimated to be benefited, generally not exceeding

five years. Reviews to evaluate recoverability of this goodwill

are conducted periodically.

Common Stock

Common stock refers to the $.50 par value capital stock as

designated in the company’s Certificate of Incorporation.

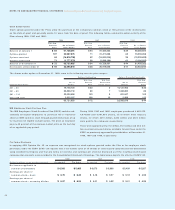

Earnings Per Share of Common Stock

Earnings per share of common stock is computed by dividing

net income after deduction of preferred stock dividends by the

weighted-average number of common shares outstanding for

the period. Earnings per common share of stock—assuming

dilution reflects the potential dilution that could occur if securi-

ties or other contracts to issue common stock were exercised

or converted into common stock which would then share in the

net income of the company. See note T, “Earnings Per Share of

Common Stock,” on page 79 for further discussion.