IBM 1998 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

79

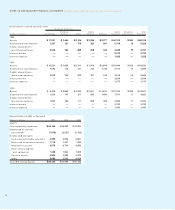

Stock options to purchase 2,062,365 shares in 1998, 165,833

shares in 1997 and 784,141 shares in 1996 were outstanding, but

were not included in the computation of diluted earnings per

share because the options’ exercise price was greater than the

average market price of the common shares, and therefore, the

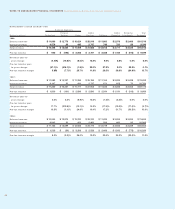

VStock-Based Compensation Plans

The company applies Accounting Principles Board (APB)

Opinion No. 25 and related Interpretations in accounting for its

stock-based compensation plans. A description of the terms

of the company’s stock-based compensation plans follows:

Long-Term Performance Plan

Incentive awards are provided to officers and other key

employees under the terms of the IBM 1997 Long-Term Per-

formance Plan, which was approved by stockholders in April

1997, and its predecessor plan, the 1994 Long-Term Perfor-

mance Plan (“the Plans”). The Plans are administered by the

Executive Compensation and Management Resources Com-

mittee of the Board of Directors. The committee determines

the type and terms of the awards to be granted, including

vesting provisions.

Awards may include stock options, stock appreciation rights,

restricted stock, cash or stock awards, or any combination

thereof. The number of shares that may be issued under the

IBM 1997 Long-Term Performance Plan for awards is 50.3 mil-

lion, which was 5 percent of the outstanding common stock on

February 10, 1997. There were 34.3 million and 46.4 million

unused shares available for granting under the IBM 1997 Long-

Term Performance Plan as of December 31, 1998 and 1997,

respectively, and approximately 2.0 and 9.0 million shares

available for granting under the 1994 Long-Term Performance

Plan at December 31, 1998 and 1997, respectively.

These awards, which are expressed in terms of shares, are

adjusted to fair value at the end of each period and the change

in value is included in net income. Awards under the Plans

resulted in compensation expense of $322.4 million, $214.1 mil-

lion and $203.9 million in 1998, 1997 and 1996, respectively.

effect would be antidilutive. In addition, 2,565,519 restricted

stock units in 1998 relating to the company’s Long-Term

Performance Plan were not included in the computation of

diluted earnings as their effect would be antidilutive.

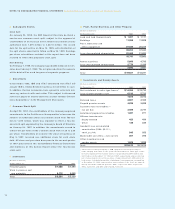

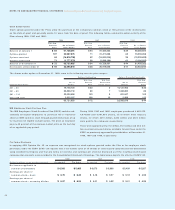

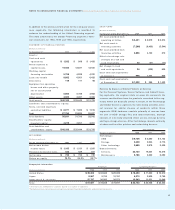

TEarnings Per Share of Common Stock

The following table sets forth the computation of basic and diluted earnings per share.

For the year ended December 31: 1998 1997 1996

Number of shares on which basic earnings per share is calculated:

Average outstanding during year 934,502,785 983,286,361 1,056,704,188

Add— Incremental shares under stock

compensation plans 25,562,450 27,648,581 23,004,716

Number of shares on which diluted earnings per share is calculated 960,065,235 1,010,934,942 1,079,708,904

Net income (millions) $«6,328 $«6,093 $«5,429

Less— Preferred stock dividends (millions) 20 20 20

Net income on which basic and diluted earnings per share

are calculated (millions) $«6,308 $«6,073 $«5,409

Basic earnings per share $«««6.75 $«««6.18 $«««5.12

Diluted earnings per share $«««6.57 $«««6.01 $«««5.01

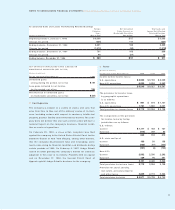

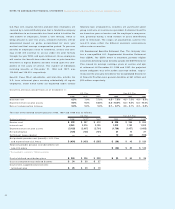

URental Expense and Lease Commitments

Rental expense, including amounts charged to inventories and fixed assets and excluding amounts previously reserved, was

$1,431 million in 1998, $1,280 million in 1997 and $1,210 million in 1996. The table below depicts gross minimum rental commitments

under noncancelable leases, amounts related to vacant space that the company has reserved and sublease income commitments.

These amounts generally reflect activities related to office space and manufacturing equipment.

Beyond

(Dollars in millions) 1999 2000 2001 2002 2003 2003

Gross rental commitments $«1,398 $«1,242 $«1,085 $«877 $«623 $«1,417

Vacant space 205 188 150 98 59 222

Sublease income commitments 165 140 122 64 35 66