IBM 1998 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

85

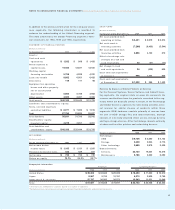

The Global Services segment is the world’s largest and most

versatile information technology services provider, supporting

computer hardware and software products, and providing pro-

fessional services to help customers of all sizes realize the full

value of information technology (IT). The segment provides its

customers with services that include business and IT consult-

ing, business transformational services like an ERP solution,

e-business services and full scope services like strategic out-

sourcing or Total Systems Management services. The Global

Services segment is uniquely suited to integrate the full range

of the company’s capabilities, including hardware, software

and research.

The Software segment delivers operating systems for the

company’s servers and middleware for IBM and non-IBM plat-

forms. Middleware includes application development, data

management, networking, systems management, transaction

processing, and messaging and collaboration. In addition to its

own development, product and marketing effort, the segment

supports more than 29,000 independent software vendors to

ensure that the company’s software and hardware offerings are

included in those partners’ solutions.

The Global Financing segment provides and facilitates a broad

array of financing services for the company, its customers and

its business partners. The primary focus is to leverage its

financial structuring, portfolio management and partnering

skills to expand the company’s customer and partner base.

Enterprise Investments segment provides a spectrum of initia-

tives in information technology solutions, supporting the hard-

ware, software and services segments of the company. The

segment develops unique products designed to meet specific

marketplace requirements and to complement the company’s

overall portfolio of products.

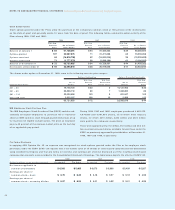

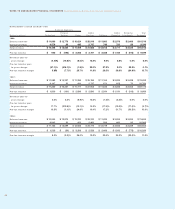

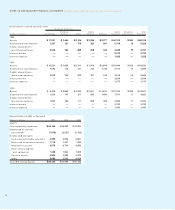

Segment revenue and pre-tax income include transactions

between the segments which are intended to reflect an arm’s-

length transfer at the best price available for comparable

external customers. Specifically, semiconductors and disk

drives are sourced internally from the Technology segment for

use in the manufacture of the Server segment and Personal

Systems segment products. Technology, hardware and soft-

ware used by the Global Services segment in outsourcing

engagements are sourced internally from the Technology,

Server, Personal Systems and Software segments. For the

internal use of information technology services, the Global

Services segment recovers cost as well as a reasonable fee

reflecting the arm’s-length value of providing the services. The

Global Services segment enters into arm’s-length leases at

prices equivalent to market rates with the Global Financing

segment to facilitate the acquisition of equipment used in

outsourcing engagements. All internal transaction prices are

reviewed and reset annually if appropriate.

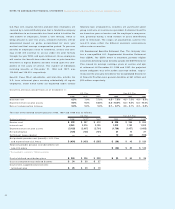

The company extensively utilizes shared-staff concepts in

order to realize economies of scale and efficient use of

resources. As such, a significant amount of expense is shared

by all of the company’s segments. This expense represents

sales coverage, marketing and support functions such as

Accounting, Treasury, Procurement, Legal, Human Resources

and Billing and Collections. Where practical, shared expenses

are allocated based on measurable drivers of expense, e.g.,

Human Resources costs are allocated on headcount while

account coverage expenses are allocated on a revenue mix

that reflects the company’s sales commission plan. When a

clear and measurable driver cannot be identified, shared

expenses are allocated based on a financial basis consistent

with the company’s management system, e.g., image advertis-

ing is allocated based on the gross profit of the segments. The

unallocated corporate expenses primarily relate to expense

arising from certain acquisitions, indirect infrastructure reduc-

tions and currency exchange gains and losses recorded in net

income which are not allocated to the segments.

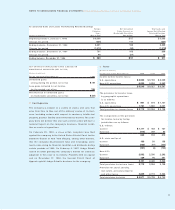

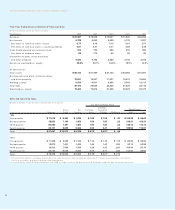

The following tables reflect the results of the segments con-

sistent with the company’s management system. These

results are not necessarily a depiction that is in conformity

with generally accepted accounting principles, e.g., employee

retirement plan costs are developed using actuarial assump-

tions on a country-by-country basis and allocated to the seg-

ments on headcount. A different result could be arrived at for

any segment if actuarial assumptions unique to each segment

were used. Performance measurement is based on income

before income taxes (pre-tax income). These results are used,

in part, by management, both in evaluating the performance

of, and in allocating resources to, each of the segments.