IBM 1998 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

74

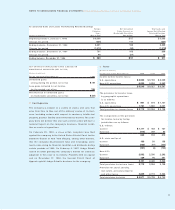

LInterest on Debt

Interest paid and accrued on borrowings of the company and its

subsidiaries amounted to $1,585 million in 1998, $1,596 million

in 1997 and $1,565 million in 1996. Of these amounts, $28 mil-

lion in 1998, $32 million in 1997 and $31 million in 1996 were

capitalized. The remainder was charged to the cost of rentals

and financing in the amounts of $844 million in 1998, $836 mil-

lion in 1997 and $818 million in 1996, or interest expense in

the amounts of $713 million in 1998, $728 million in 1997 and

$716 million in 1996. The decrease in total interest expense in

1998 versus 1997 was due primarily to lower average interest

rates, partially offset by higher levels of debt. The increase in

total interest expense in 1997 versus 1996 was primarily due

to higher levels of debt, partially offset by lower interest rates.

The average interest rate for total debt was 5.7 percent,

6.4 percent and 7.0 percent in 1998, 1997 and 1996, respec-

tively. These rates include the results of currency and interest

rate swaps applied to the debt described in note K, “Debt,” on

page 73.

MFinancial Instruments

The company maintains portfolios of financial instruments

both on- and off-balance sheet.

Financial Instruments On-Balance Sheet (excluding derivatives)

Financial assets with carrying values approximating fair value

include cash and cash equivalents, marketable securities, notes

and other accounts receivable and other investments. Financial

liabilities with carrying values approximating fair value include

accounts payable and other accrued expenses and liabilities,

and short-term and long-term debt.

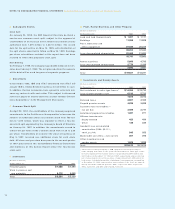

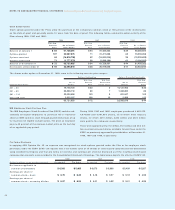

The following table summarizes the company’s marketable

securities and other investments, all of which were considered

available for sale.

MARKETABLE SECURITIES AND OTHER INVESTMENTS

(Dollars in millions) Carrying Value

At December 31: 1998 1997

Current marketable securities:

U.S. government securities $«««15 $«««93

Time deposits and other bank obligations 335 181

Non-U.S. government securities and

other fixed-term obligations 43 173

Total $«393 $«447

Marketable securities— non-current:*

U.S. government securities $«««— $«««54

Time deposits and other bank obligations 271 183

Non-U.S. government securities and

other fixed-term obligations 10 58

Total $«281 $«295

Other investments:*

Alliance investments— Other $«138 $«236

*Included within Investments and sundry assets on the Consolidated

Statement of Financial Position (See note H on page 72).

Financial Instruments Off-Balance Sheet (excluding derivatives)

IBM has guaranteed certain loans and financial commitments of

affiliates. The approximate amount of these financial guarantees

were $1,158 million and $861 million at December 31, 1998 and

1997, respectively. Additionally, the company is responsible for

fulfilling financial commitments associated with certain con-

tracts to which it is a party. These commitments, which in the

aggregate were approximately $1,600 million and $600 million

at December 31, 1998 and 1997, respectively, are not expected

to have a material adverse effect on the company’s financial

position or results of operations.

The company’s dealers had unused lines of credit available from

IBM for working capital financing of approximately $3.6 billion

and $2.1 billion at December 31, 1998 and 1997, respectively.

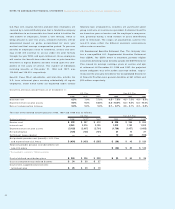

Derivative Financial Instruments

The company has used derivative instruments as an element

of its risk management strategy for many years. Although

derivatives entail a risk of nonperformance by counterparties,

the company manages this risk by establishing explicit dollar

and term limitations that correspond to the credit rating of

each carefully selected counterparty. The company has not

sustained a material loss from these instruments nor does it

anticipate any material adverse effect on its results of opera-

tions or financial position in the future.