IBM 1998 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

81

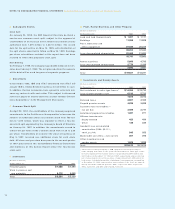

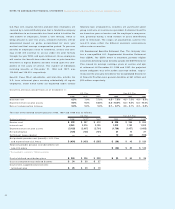

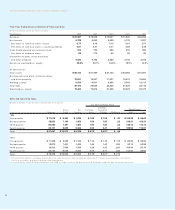

The pro forma amounts, for purposes of SFAS 123, reflect the

portion of the estimated fair value of awards earned in 1998,

1997 and 1996. The aggregate fair value of awards granted is

earned ratably over the vesting or service period and is greater

than that included in the pro forma amounts.

The company used the Black-Scholes model to value the stock

options granted in 1998, 1997 and 1996. The weighted-average

assumptions used to estimate the value of the options included

in the pro forma amounts, and the weighted-average estimated

fair value of an option granted are as follows:

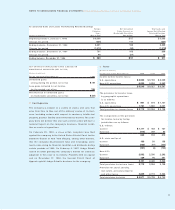

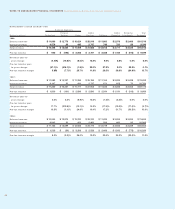

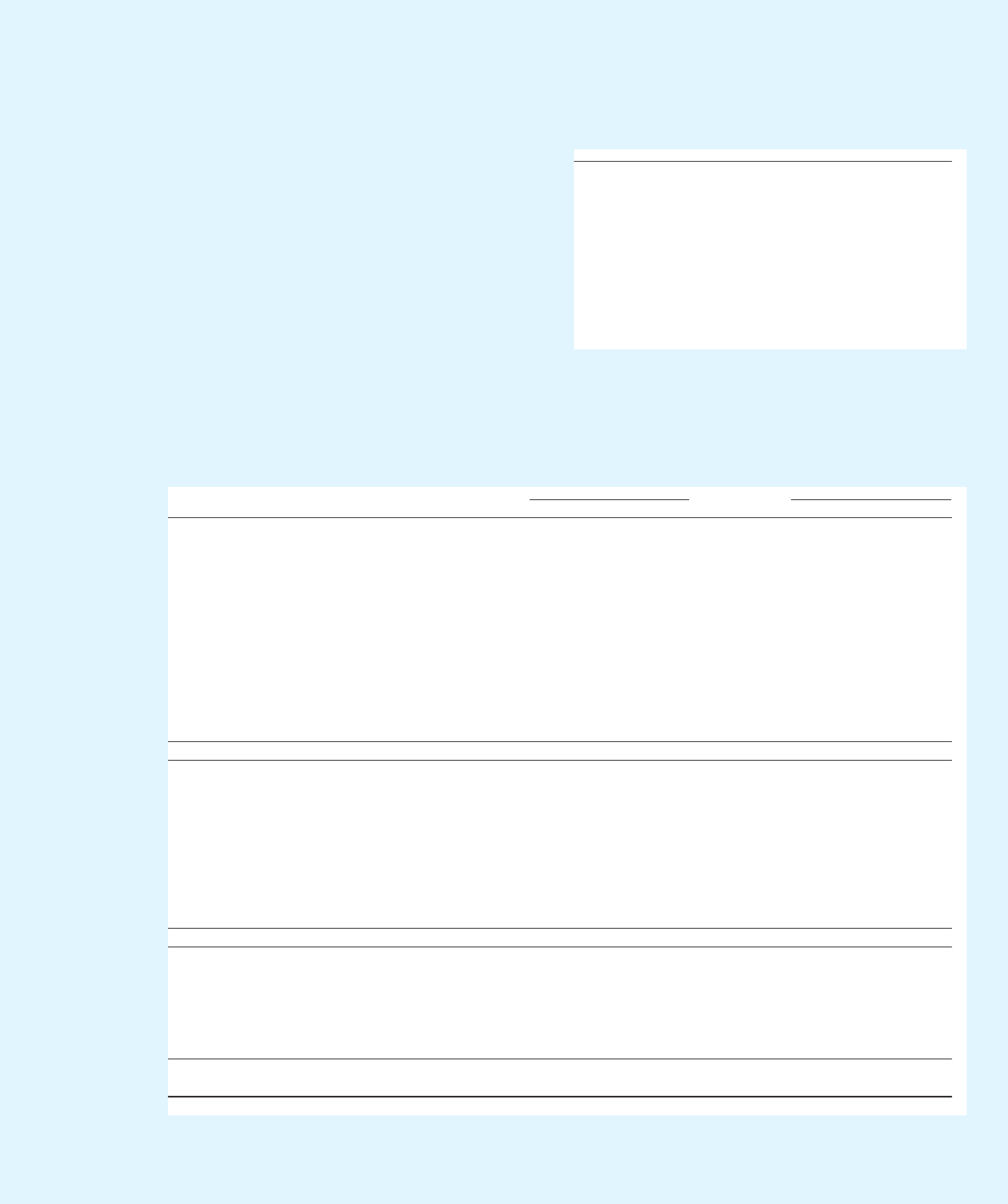

WRetirement Plans

The company and its subsidiaries have defined benefit and defined contribution retirement plans covering substantially all regular

employees, and a supplemental retirement plan that covers certain executives.

The changes in the benefit obligations and plan assets of the U.S. and material non-U.S. defined benefit plans for 1998 and 1997

were as follows:

U.S. Plan Non-U.S. Plans

(Dollars in millions) 1998 1997*1998 1997*

Change in benefit obligation:

Benefit obligation at beginning of year $«33,161 $«29,729 $«18,846 $«19,883

Service cost 532 397 399 366

Interest cost 2,261 2,215 1,213 1,182

Plan participants’ contributions ——29 33

Acquisitions/divestitures, net 22 (2) —129

Amendments —14 2—

Actuarial losses 2,729 2,805 1,331 431

Benefits paid from trust (2,144) (1,997) (683) (623)

Direct benefit payments ——(254) (281)

Foreign exchange impact ——1,155 (2,186)

Plan curtailments/settlements/termination benefits ——10 (88)

Benefit obligation at end of year 36,561 33,161 22,048 18,846

Change in plan assets:

Fair value of plan assets at beginning of year 38,475 34,281 21,841 21,039

Actual return on plan assets 5,240 6,193 2,400 3,454

Employer contribution ——452 192

Acquisitions/divestitures, net 22 (2) —129

Plan participants’ contributions ——29 33

Benefits paid from trust (2,144) (1,997) (683) (623)

Foreign exchange impact ——1,283 (2,263)

Settlements ——(28) (120)

Fair value of plan assets at end of year 41,593 38,475 25,294 21,841

Fair value of plan assets in excess

of benefit obligation 5,032 5,314 3,246 2,995

Unrecognized net actuarial gains (1,289) (1,901) (2,342) (2,897)

Unrecognized prior service costs 174 190 181 194

Unrecognized net transition asset (771) (911) (78) (83)

Adjustment to recognize minimum liability ——(87) (3)

Prepaid pension asset recognized

in the Consolidated Statement of Financial Position $«««3,146 $«««2,692 $««««««920 $««««««206

*Reclassified to conform to 1998 presentation.

1998 1997 1996

Term (years)*5/6 5/6 5/6

Volatility** 26.4% 23.0% 22.0%

Risk-free interest rate (zero

coupon U.S. treasury note) 5.1% 6.2% 6.0%

Dividend yield 0.8% 1.0% 1.2%

Weighted-average fair

value of options $«36 $«25 $«20

*Option term is based on tax incentive options (5 years) and non-tax

incentive options (6 years).

**To determine volatility, the company measured the daily price changes

of the stock over the most recent 5 and 6 year periods.