IBM 1998 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

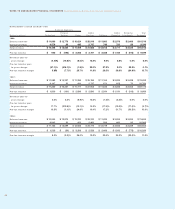

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

78

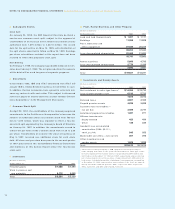

The effect of tax law changes on deferred tax assets and lia-

bilities did not have a significant impact on the company’s

effective tax rate.

The significant components of activities that gave rise to

deferred tax assets and liabilities included on the balance

sheet were as follows:

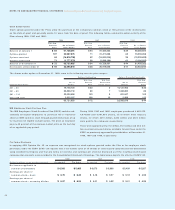

DEFERRED TAX ASSETS

(Dollars in millions)

At December 31: 1998 1997

Employee benefits $«««3,909 $«««3,707

Bad debt, inventory and

warranty reserves 1,249 1,027

Alternative minimum tax credits 1,169 1,092

Capitalized research and development 913 1,196

Restructuring charges 863 1,163

Deferred income 686 893

General business credits 555 492

Equity alliances 387 378

Foreign tax loss carryforwards 304 202

State and local tax loss carryforwards 212 203

Depreciation 201 132

Intracompany sales and services 182 235

Other 2,614 2,507

Gross deferred tax assets 13,244 13,227

Less: Valuation allowance 488 2,163

Net deferred tax assets $«12,756 $«11,064

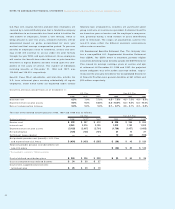

DEFERRED TAX LIABILITIES

(Dollars in millions)

At December 31: 1998 1997

Sales-type leases $«««3,433 $«««3,147

Retirement benefits 2,775 2,147

Depreciation 1,505 1,556

Software costs deferred 287 420

Other 1,841 1,413

Gross deferred tax liabilities $«««9,841 $«««8,683

As part of implementing its global strategies involving the relo-

cation of certain of its manufacturing operations, the company

transferred certain intellectual property rights to several non-

U.S. subsidiaries in December 1998. Since these strategies,

including this transfer, result in the anticipated utilization of

U.S. federal tax credit carryforwards, the company reduced

the valuation allowance from that previously required. The val-

uation allowance at December 31, 1998, principally applies to

certain state and local and foreign tax loss carryforwards that,

in the opinion of management, are more likely than not to

expire before the company can utilize them.

A reconciliation of the company’s effective tax rate to the

statutory U.S. federal tax rate is as follows:

For the year ended December 31: 1998 1997 1996

Statutory rate 35% 35% 35%

Foreign tax differential (6) (3) 2

State and local 111

U.S. valuation allowance

related items (1) — (6)

Other 1—5

Effective rate 30% 33% 37%

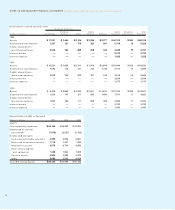

For tax return purposes, the company has available tax credit

carryforwards of approximately $2,067 million, of which $1,169

million have an indefinite carryforward period, $184 million

expire in 1999 and the remainder thereafter. The company also

has state and local and foreign tax loss carryforwards, the tax

effect of which is $516 million. Most of these carryforwards are

available for 10 years or have an indefinite carryforward period.

Undistributed earnings of non-U.S. subsidiaries included in

consolidated retained earnings amounted to $13,165 million at

December 31, 1998, $12,511 million at December 31, 1997,

and $12,111 million at December 31, 1996. These earnings,

which reflect full provision for non-U.S. income taxes, are

indefinitely reinvested in non-U.S. operations or will be remit-

ted substantially free of additional tax.

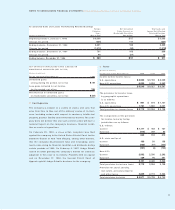

RSelling and Advertising

Selling and advertising expense is charged against income as

incurred. Advertising expense, which includes media, agency

and promotional expenses, amounted to $1,681 million, $1,708

million and $1,569 million in 1998, 1997 and 1996, respectively.

SResearch, Development and Engineering

Research, development and engineering expense amounted

to $5,046 million in 1998, $4,877 million in 1997 and $5,089 mil-

lion in 1996. Expenditures for product-related engineering

included in these amounts were $580 million, $570 million and

$720 million in 1998, 1997 and 1996, respectively.

Expenditures of $4,466 million in 1998, $4,307 million in 1997

and $4,369 million in 1996 were made for research and

development activities covering basic scientific research and

the application of scientific advances to the development of

new and improved products and their uses. Of these amounts,

software-related activities were $2,086 million, $2,016 million

and $2,161 million in 1998, 1997 and 1996, respectively.

Included in the 1996 expenditures is $435 million of purchased

in-process research and development expense relating to the

Tivoli and Object Technology International, Inc. acquisitions.