IBM 1998 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

72

CSubsequent Events

Stock Split

On January 26, 1999, the IBM Board of Directors declared a

two-for-one common stock split, subject to the approval of

stockholders of an increase in the number of common shares

authorized from 1,875 million to 4,687.5 million. The record

date for the split will be on May 10, 1999, with distribution of

the split shares expected to follow on May 26, 1999. Earnings

per share calculations included in this report have not been

restated to reflect this proposed stock split.

Debt Offering

On February 1, 1999, the company issued $600 million of 5 3/8%

notes due February 1, 2009. The net proceeds from the issuance

of this debt will be used for general corporate purposes.

DDivestitures

In December 1998, IBM and AT&T announced that AT&T will

acquire IBM’s Global Network business for $5 billion in cash.

In addition, the two companies have agreed to enter into out-

sourcing contracts with each other. This subject is discussed

further on pages 61 and 62 under the section entitled “Divesti-

tures/Acquisitions” in the Management Discussion.

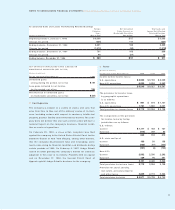

ECommon Stock Split

On April 29, 1997, the stockholders of the company approved

amendments to the Certificate of Incorporation to increase the

number of authorized shares of common stock from 750 mil-

lion to 1,875 million, which was required to effect a two-for-

one stock split approved by the company’s Board of Directors

on January 28, 1997. In addition, the amendments served to

reduce the par value of the common stock from $1.25 to $.50

per share. Stockholders of record at the close of business on

May 9, 1997, received one additional share for each share

held. All share and per share data prior to the second quarter

of 1997 presented in the Consolidated Financial Statements

and footnotes of this Annual Report reflect the two-for-one

stock split.

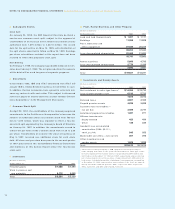

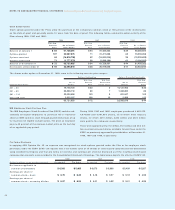

FInventories

(Dollars in millions)

At December 31: 1998 1997

Finished goods $«1,088 $«1,090

Work in process and

raw materials 4,112 4,049

Total $«5,200 $«5,139

GPlant, Rental Machines and Other Property

(Dollars in millions)

At December 31: 1998 1997

Land and land improvements $«««1,091 $«««1,117

Buildings 11,088 11,208

Plant, laboratory and

office equipment 27,025 25,015

39,204 37,340

Less: Accumulated depreciation 22,463 21,680

16,741 15,660

Rental machines 5,666 4,793

Less: Accumulated depreciation 2,776 2,106

2,890 2,687

Total $«19,631 $«18,347

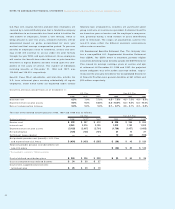

HInvestments and Sundry Assets

(Dollars in millions)

At December 31: 1998 1997

Net investment in sales-type leases*$«14,384 $«13,733

Less: Current portion— net 6,510 5,720

7,874 8,013

Deferred taxes 2,921 3,163

Prepaid pension assets 4,836 3,828

Customer loan receivables—

not yet due 3,499 2,741

Installment payment receivables 1,087 977

Alliance investments:

Equity method 420 484

Other 138 236

Goodwill, less accumulated

amortization (1998, $2,111;

1997, $1,717) 945 950

Marketable securities— non-current 281 295

Other investments and

sundry assets 1,509 1,228

Total $«23,510 $«21,915

*These leases relate principally to IBM equipment and are generally for

terms ranging from three to five years. Net investment in sales-type leases

includes unguaranteed residual values of approximately $685 million and

$563 million at December 31, 1998 and 1997, respectively, and is reflected

net of unearned income at those dates of approximately $1,600 million for

both years. Scheduled maturities of minimum lease payments outstanding

at December 31, 1998, expressed as a percentage of the total, are approxi-

mately as follows: 1999, 48 percent; 2000, 31 percent; 2001, 15 percent;

2002, 5 percent; and 2003 and beyond, 1 percent.