IBM 1998 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

76

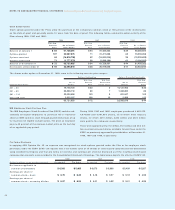

NOther Liabilities and Environmental

Other liabilities consists principally of accruals for nonpension

postretirement benefits for U.S. employees ($6.6 billion) and

nonpension postretirement benefits, indemnity and retirement

plan reserves for non-U.S. employees ($1.4 billion). More

detailed discussion of these liabilities appears in note X,

“Nonpension Postretirement Benefits,” on pages 83 and 84,

and note W, “Retirement Plans,” on pages 81 through 83.

Also included are non-current liabilities associated with infra-

structure reduction and restructuring actions taken in 1993

and prior. As a result, amounts representing postemployment

preretirement accruals in the amount of $793 million and $681

million (net of sublease receipts) for accruals for leased space

that the company has vacated are included.

The company employs extensive internal environmental pro-

tection programs that are primarily preventative in nature. The

cost of these ongoing programs is recorded as incurred.

The company continues to participate in environmental

assessments and cleanups at a number of locations, including

operating facilities, previously owned facilities and Superfund

sites. The company accrues for all known environmental liabil-

ities for remediation costs when a cleanup program becomes

probable and costs can be reasonably estimated. In addition,

estimated environmental costs associated with post-closure

activities, such as the removal and restoration of chemical stor-

age facilities and monitoring, are accrued when the decision is

made to close a facility. The total amounts accrued, which do

not reflect any insurance recoveries, were $238 million and

$243 million at December 31, 1998 and 1997, respectively.

The amounts accrued do not cover sites that are in the pre-

liminary stages of investigation where neither the company’s

percentage of responsibility nor the extent of cleanup required

has been identified. Estimated environmental costs are not

expected to materially impact the financial position or results

of the company’s operations in future periods. However, envi-

ronmental cleanup periods are protracted in length, and envi-

ronmental costs in future periods are subject to changes in

environmental remediation regulations.

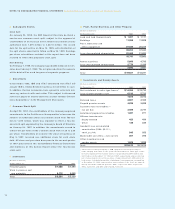

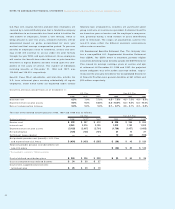

OStockholders’ Equity Activity

Stock Repurchases

The Board of Directors from time to time has authorized the

company to repurchase IBM common stock. The company

repurchased 57,384,100 common shares at a cost of $6.9 bil-

lion and 81,505,200 common shares at a cost of $7.1 billion in

1998 and 1997, respectively. The repurchases resulted in a

reduction of $28,498,409 and $34,388,668 in the stated capital

(par value) associated with common stock in 1998 and 1997,

respectively. In 1997, 10 million repurchased shares were used

to establish the Employee Benefits Trust (see below). In 1998

and 1997, 387,282 and 2,727,864 shares, respectively, were

issued as a result of acquisitions. The rest of the repurchased

shares were retired and restored to the status of authorized

but unissued shares. At December 31, 1998, approximately

$2.8 billion of Board authorization for repurchases remained.

The company plans to purchase shares on the open market

from time to time, depending on market conditions.

In 1995, the IBM Board of Directors authorized the company to

purchase all of its outstanding Series A 7 1 ⁄2 percent preferred

stock. During 1998 and 1997, the company repurchased 51,250

shares at a cost of $5.5 million and 13,450 shares at a cost

of $1.4 million, respectively. This resulted in a $512.50 and

$134.50 ($.01 par value per share) reduction in the stated cap-

ital associated with preferred stock as of December 31, 1998

and 1997, respectively. The repurchased shares were retired

and restored to the status of authorized but unissued shares.

The company plans to purchase remaining shares on the open

market and in private transactions from time to time, depend-

ing on market conditions.

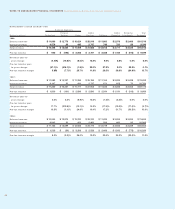

Employee Benefits Trust

Effective November 1, 1997, the company created an employee

benefits trust to which the company contributed 10 million

shares of treasury stock. The company is authorized to

instruct the trustee to sell shares from time to time and to use

proceeds from such sales, and any dividends paid on such

contributed stock, toward the partial satisfaction of the com-

pany’s future obligations under certain of its compensation

and benefits plans, including its retiree medical plans. The

shares held in trust are not considered outstanding for earn-

ings per share purposes until they are committed to be

released. The shares will be voted by the trustee in accor-

dance with its fiduciary duties. As of December 31, 1998 and

1997, no shares have been committed to be released.

At December 31, 1998, the company adjusted its valuation of

the employee benefits trust to fair value. This adjustment

solely impacted line items within stockholders’ equity and did

not affect total stockholders’ equity or net income.