IBM 1998 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview

IBM’s financial results for 1998 demonstrated the value and

strength of the company’s portfolio of businesses. The com-

pany achieved good results despite a number of challenges

throughout the year: weakness in Asia, ongoing softness in

memory chip prices, continued pricing pressures across many

of its product lines, product transitions in the Server segment

and weakness in Latin America during the second half of the

year. Despite all of these factors, the company achieved overall

strong performance, especially from its Global Services seg-

ment, Software segment and hard disk drive (HDD) products

of the Technology segment. The AS/400 product line, when

viewed on a combined software and hardware basis, had

good year-over-year performance. On a geographic basis,

good results within North America and Europe were somewhat

offset by weakness in Asia and Latin America.

The company’s financial results showed improved revenue

growth and a more balanced performance between gross

profit and expense in the second half of the year versus the

first half of 1998. This improved performance led to a diluted

earnings per share growth of about 17 percent in the second

half of the year, versus a decline of about 1 percent in the first

half of the year when compared to the same periods of 1997.

The company reported revenue of $81.7 billion—a record for

the fourth consecutive year; while net income of $6.3 billion

yielded a record $6.57 earnings per share of common stock—

assuming dilution. The company funded investments of

approximately $20 billion in capital expenditures, research

and development, strategic acquisitions and repurchases of

common stock.

Challenges

While good progress was made in 1998, there are a number of

uncertainties facing the company in 1999: the continued weak

economies in Asia and Latin America, continued price pres-

sure in the information technology industry, particularly within

the fiercely competitive Personal Systems segment and the

microelectronics unit of the Technology segment, and how

the “Year 2000 issue” will affect customer purchases. The

company’s focus in 1999 will be to increase revenue with par-

ticular emphasis on addressing customers’ needs to build

integrated e-business solutions through the use of the com-

pany’s hardware, services, software and technology. In addi-

tion, the company plans to continue to invest judiciously,

reduce infrastructure and optimize the deployment of the

company’s employees and resources to maintain or improve

its pre-tax profits.

MANAGEMENT DISCUSSION International Business Machines Corporation and Subsidiary Companies

54

Forward-looking and Cautionary Statements

Certain statements contained in this Annual Report may con-

stitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These state-

ments involve a number of risks, uncertainties and other

factors that could cause actual results to differ materially, as

discussed more fully elsewhere in this Annual Report and in

the company’s filings with the Securities and Exchange

Commission, including the company’s 1998 Form 10-K to be

filed on or about March 26, 1999.

Results of Operations

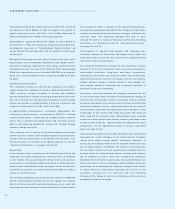

(Dollars in millions except per share amounts)

1998 1997 1996

Revenue $«81,667 $«78,508 $«75,947

Cost 50,795 47,899 45,408

Gross profit 30,872 30,609 30,539

Gross profit margin 37.8% 39.0% 40.2%

Total expense 21,832 21,582 21,952

Income before

income taxes $«««9,040 $÷«9,027 $«««8,587

Net income $«««6,328 $«÷6,093 $«««5,429

Earnings per share of

common stock—basic $«««««6.75 $÷÷«6.18 $«««««5.12

Earnings per share of

common stock—

assuming dilution $«««««6.57 $÷÷«6.01 $÷÷«5.01

Revenue in 1998 grew 4.0 percent as reported and 6.2 percent

when currency impacts are removed. This increase was pri-

marily driven by growth in the Global Services segment, HDD

storage products of the Technology segment, and middleware

software offerings including those from Tivoli Systems, Inc.

(Tivoli) of the Software segment.

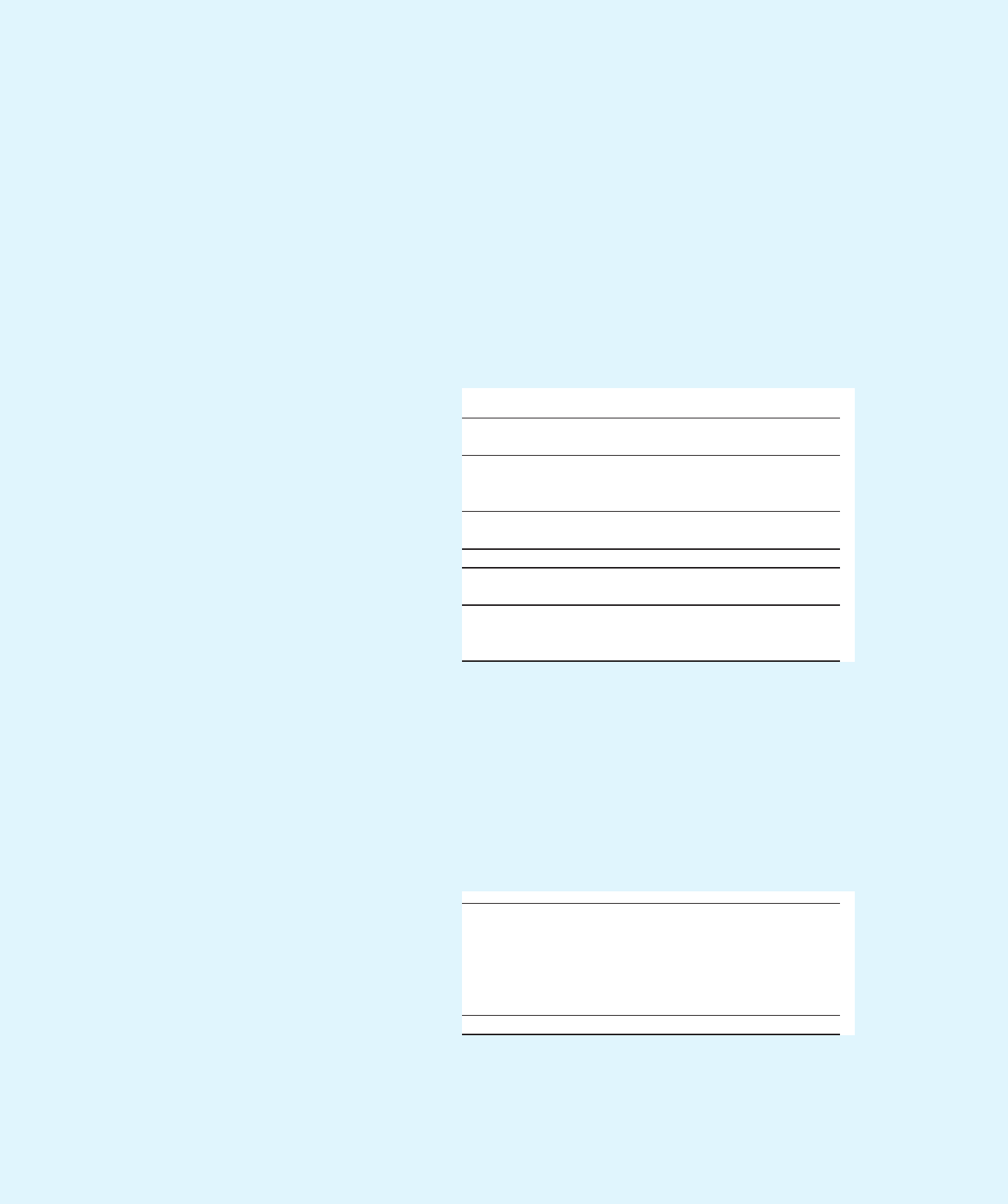

The following table provides the company’s percentage of

revenue by segment and illustrates the continuing shift toward

a greater percentage of the company’s revenue being derived

from the Global Services and Software segments.

1998 1997 1996

Hardware segments 43.4% 46.7% 48.2%

Global Services segment 35.4 32.1 29.4

Software segment 14.5 14.2 15.0

Global Financing segment 3.5 3.6 4.0

Enterprise Investments

segment/Other 3.2 3.4 3.4

Total 100.0% 100.0% 100.0%