IBM 1998 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

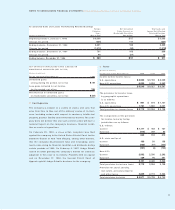

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

69

ASignificant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of

International Business Machines Corporation and its controlled

subsidiary companies, which are majority owned. Investments

in business entities in which IBM does not have control, but

has the ability to exercise significant influence over operating

and financial policies (generally 20–50 percent ownership), are

accounted for by the equity method. Other investments are

accounted for by the cost method.

Use of Estimates

The preparation of financial statements in conformity with

generally accepted accounting principles requires manage-

ment to make estimates and assumptions that affect the

amounts reported in the consolidated financial statements and

accompanying disclosures. Although these estimates are

based on management’s best knowledge of current events and

actions the company may undertake in the future, actual

results ultimately may differ from the estimates.

Revenue

HARDWARE

Revenue from hardware sales or sales-type leases is recog-

nized when the product is shipped. Revenue from rentals and

operating leases is recognized monthly as the fees accrue.

SERVICES

Revenue from time and material service contracts is recog-

nized as the services are provided. Revenue from fixed price

long-term service contracts is recognized over the contract

term based on the percentage of services provided during the

period compared to the total estimated services provided over

the entire contract. Losses on fixed price contracts are recog-

nized during the period in which the loss first becomes appar-

ent. Revenue from maintenance is recognized over the

contractual period or as the services are performed. Revenue

in excess of billings on service contracts are recorded as

unbilled receivables and included in trade accounts receivable.

Billings in excess of revenue recognized on service contracts

are recorded as deferred income until the above revenue

recognition criteria are met.

SOFTWARE

Revenue from one-time charge licensed software is recognized

when the program is shipped, provided the company has ven-

dor-specific objective evidence of the fair value of each ele-

ment of the software offering. A deferral is recorded for

post-contract customer support and any other future deliver-

ables included within the contract arrangement. This deferral is

earned over the support period or as contract elements are

delivered. Revenue from monthly software licenses is recog-

nized as license fees accrue.

FINANCING

Revenue from financing is recognized at level rates of return

over the term of the lease or receivable.

Revenue for all categories is reduced for estimated customer

returns, allowances and anticipated price actions.

Income Taxes

Income tax expense is based on reported income before

income taxes. Deferred income taxes reflect the impact of

temporary differences between assets and liabilities recog-

nized for financial reporting purposes and such amounts rec-

ognized for income tax purposes. In accordance with

Statement of Financial Accounting Standards (SFAS) 109,

“Accounting for Income Taxes,” these deferred taxes are mea-

sured by applying currently enacted tax laws.

Translation of Non-U.S. Currency Amounts

Assets and liabilities of non-U.S. subsidiaries that operate in a

local currency environment are translated to U.S. dollars at year-

end exchange rates. Income and expense items are translated

at average rates of exchange prevailing during the year. Transla-

tion adjustments are recorded in Accumulated gains and losses

not affecting retained earnings within stockholders’ equity.

Inventories and plant, rental machines and other non-mone-

tary assets and liabilities of non-U.S. subsidiaries and

branches that operate in U.S. dollars, or whose economic

environment is highly inflationary, are translated at approxi-

mate exchange rates prevailing when acquired. All other

assets and liabilities are translated at year-end exchange

rates. Inventories charged to cost of sales and depreciation

are translated at historical exchange rates. All other income

and expense items are translated at average rates of

exchange prevailing during the year. Gains and losses that

result from translation are included in net income.

Financial Instruments

In the normal course of business, the company uses a variety

of derivative financial instruments for the purpose of currency

exchange rate and interest rate risk management. In order to

qualify for hedge accounting, the company requires that the

derivative instruments used for risk management purposes

effectively reduce the risk exposure that they are designed to

hedge. For instruments associated with the hedge of antici-

pated transactions, hedge effectiveness criteria also require

that the occurrence of the underlying transactions be proba-

ble. Instruments meeting these hedging criteria are formally

designated as hedges at the inception of the contract. Those

risk management instruments not meeting these criteria and

considered ineffective as hedges are accounted for at fair