IBM 1998 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 1998 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS International Business Machines Corporation and Subsidiary Companies

80

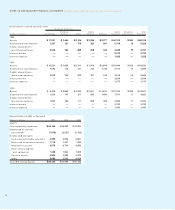

IBM Employees Stock Purchase Plan

The IBM Employees Stock Purchase Plan (ESPP) enables sub-

stantially all regular employees to purchase full or fractional

shares of IBM common stock through payroll deductions of up

to 10 percent of eligible compensation. The price an employee

pays is 85 percent of the average market price on the last day

of an applicable pay period.

During 1998, 1997 and 1996, employees purchased 3,993,372,

4,676,980 and 6,461,856 shares, all of which were treasury

shares, for which $415 million, $354 million and $324 million

were paid to the company, respectively.

There were approximately 31.5 million, 35.5 million and 40.2 mil-

lion reserved unissued shares available for purchase under the

ESPP, as previously approved by stockholders, at December 31,

1998, 1997 and 1996, respectively.

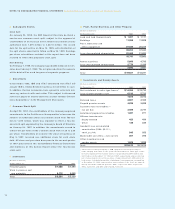

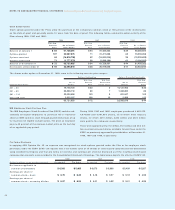

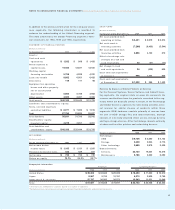

Stock Option Grants

Stock options granted under the Plans allow the purchase of the company’s common stock at 100 percent of the market price

on the date of grant and generally expire 10 years from the date of grant. The following tables summarize option activity of the

Plans during 1998, 1997 and 1996:

1998 1997 1996

Wtd. Avg. Wtd. Avg. Wtd. Avg.

Exercise No. of Shares Exercise No. of Shares Exercise No. of Shares

Price under Option Price under Option Price under Option

Balance at January 1 $««54 61,728,361 $«44 61,435,322 $«39 68,565,806

Options granted 107 20,587,675 71 21,471,228 63 15,359,058

Options exercised 44 (14,816,738) 42 (19,630,005) 36 (19,302,622)

Options terminated 71 (1,777,373) 56 (1,548,184) 61 (3,186,920)

Balance at December 31 $««72 65,721,925 $«54 61,728,361 $«44 61,435,322

Exercisable at December 31 $««44 23,095,818 $«38 26,619,548 $«41 30,603,845

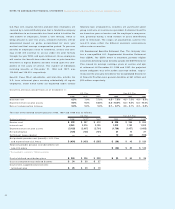

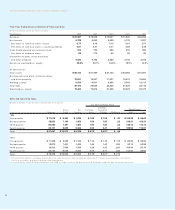

The shares under option at December 31, 1998, were in the following exercise price ranges:

Options Outstanding Options Currently Exercisable

Wtd. Avg. Wtd. Avg. Wtd. Avg.

No. of Exercise Contractual No. of Exercise

Exercise Price Range Options Price Life (in years) Options Price

$21 – 50 16,708,124 $«32 5 15,137,952 $«32

$51 – 80 26,369,118 68 7 7,463,820 66

$81 – 110 20,024,496 103 9 491,047 103

$111 and over 2,620,187 138 10 2,999 112

65,721,925 $«72 23,095,818 $«44

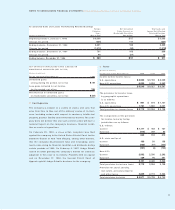

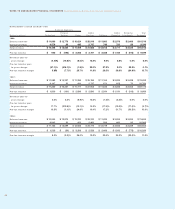

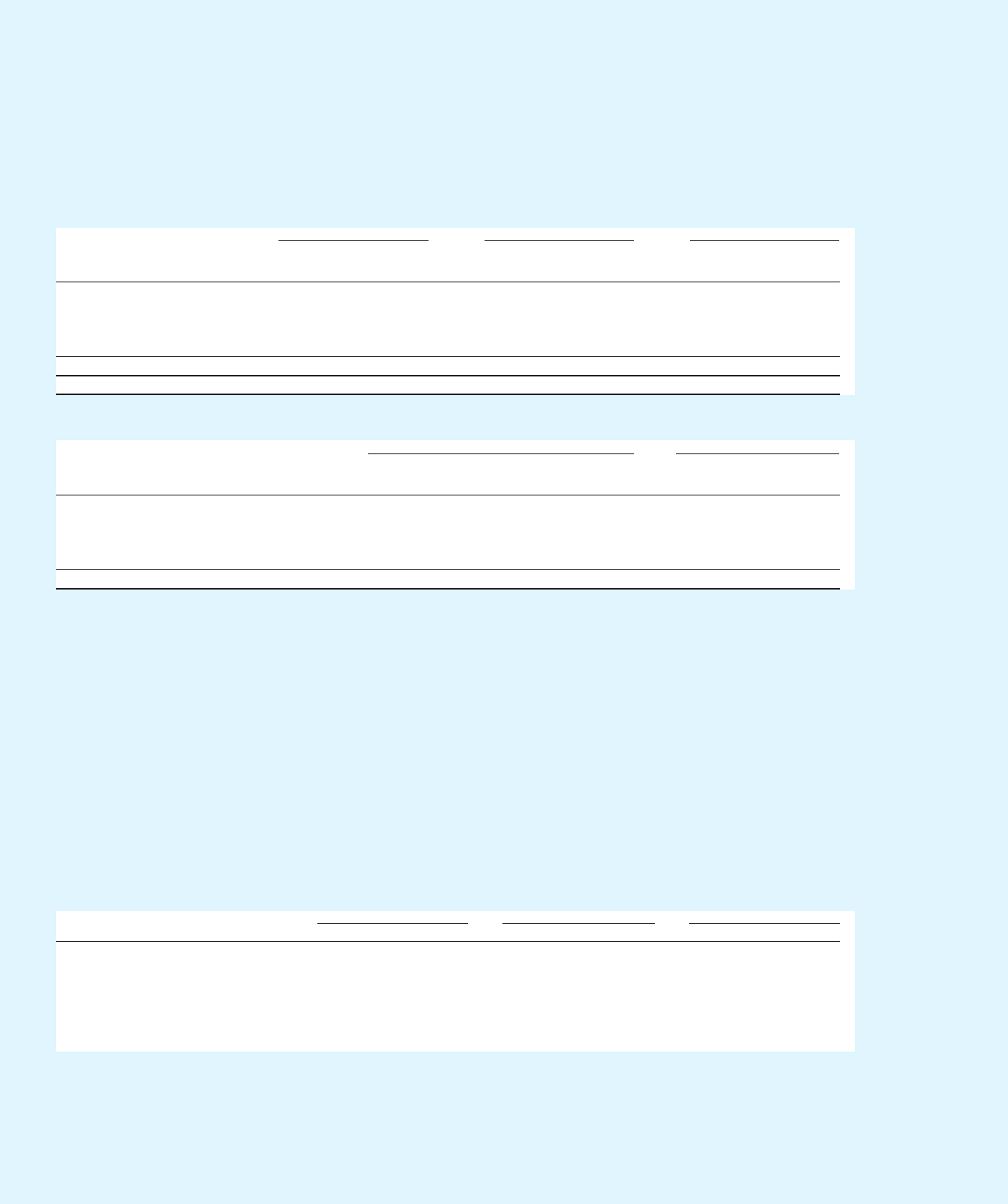

Pro Forma Disclosure

In applying APB Opinion No. 25, no expense was recognized for stock options granted under the Plan or for employee stock

purchases under the ESPP. SFAS 123 requires that a fair market value of all awards of stock-based compensation be determined

using standard techniques and that pro forma net income and earnings per share be disclosed as if the resulting stock-based

compensation amounts were recorded in the Consolidated Statement of Earnings. The table below depicts the effects of SFAS 123.

1998 1997 1996

(Dollars in millions except per share amounts) As reported Pro forma As reported Pro forma As reported Pro forma

Net income applicable to

common shareholders $«6,308 $«5,985 $«6,073 $«5,866 $«5,409 $«5,267

Earnings per share of

common stock—basic $«««6.75 $«««6.40 $«««6.18 $«««5.97 $«««5.12 $«««4.98

Earnings per share of

common stock—assuming dilution $÷«6.57 $«««6.24 $«««6.01 $«««5.82 $«««5.01 $«««4.89