Honda 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 9 7

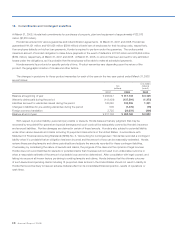

17. Risk Management Activities and Derivative Financial Instruments

Honda is a party to derivative financial instruments in the normal course of business to reduce their exposure to fluctuations

in foreign exchange rates and interest rates. Currency swap agreements are used to convert long-term debt denominated

in a certain currency to long-term debt denominated in other currencies. Foreign currency forward exchange contracts and

purchased option contracts are normally used to hedge sale commitments denominated in foreign currencies (principally U.S.

dollars). Foreign currency written option contracts are entered into in combination with purchased option contracts to offset

premium amounts to be paid for purchased option contracts. Interest rate swap agreements are mainly used to convert

floating rate financing, such as commercial paper, to (normally three-five years) fixed rate financing in order to match financing

costs with income from finance receivables. These instruments involve, to varying degrees, elements of credit, exchange rate

and interest rate risks in excess of the amount recognized in the consolidated balance sheets.

The aforementioned instruments contain an element of risk in the event the counterparties are unable to meet the terms of

the agreements. However, Honda minimizes the risk exposure by limiting the counterparties to major international banks and

financial institutions meeting established credit guidelines. Management of Honda does not expect any counterparty to default

on its obligations and, therefore, does not expect to incur any losses due to counterparty default. Honda generally does not

require or place collateral for these financial instruments.

Foreign currency forward contracts and currency swap agreements are agreements to exchange different currencies at a

specified rate on a specific future date. Foreign currency option contracts are contracts that allow the holder of the option the

right but not the obligation to exchange different currencies at a specified rate on a specific future date.

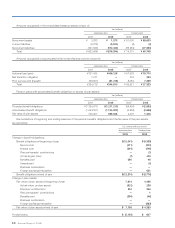

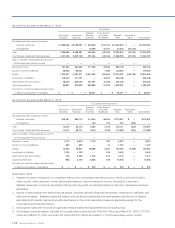

Contract amounts outstanding for foreign currency forward exchange contracts, foreign currency option contracts and

currency swap agreements at March 31, 2007 and 2008 are as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Foreign currency forward exchange contracts ¥ 978,994 ¥ 615,845 $ 6,147

Foreign currency option contracts 5,793 272,204 2,717

Currency swap agreements 608,534 663,013 6,617

¥ 1,593,321 ¥ 1,551,062 $15,481

Cash flow hedge

The Company applies hedge accounting for certain foreign

currency forward exchange contracts related to forecasted

foreign currency transactions between the Company and

its subsidiaries. Changes in the fair value of derivative

financial instruments designated as cash flow hedges are

recognized in other comprehensive income (loss). The

amounts are reclassified into earnings in the same period

when forecasted hedged transactions affect earnings. The

amount recognized in accumulated other comprehensive

income (loss) was ¥20 million gain in the fiscal year ended

March 31, 2007 and ¥460 million ($5 million) gain in the

fiscal year ended March 31, 2008, respectively. All amounts

recorded in accumulated other comprehensive income

(loss) as year-end are expected to be recognized in earnings

within the next twelve months. The period that hedges the

changes in cash flows related to the risk of foreign currency

rate is at most around two months.

There are no derivative financial instruments where

hedge accounting has been discontinued due to the

forecasted transaction no longer being probable. The

Company excludes financial instruments’ time value

component from the assessment of hedge effectiveness,

of which amount was ¥1,187 million loss for the year ended

March 31, 2007, and ¥256 million ($3 million) loss for the year

ended March 31, 2008, respectively. There is no portion

of hedging instruments that has been assessed as hedge

ineffectiveness.

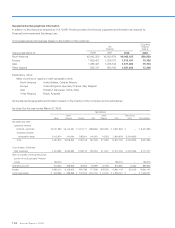

Derivative financial instruments not designated as

accounting hedges

Changes in the fair value of derivative financial instruments

not designated as accounting hedges are recognized in

earnings in the period of the change.

Interest rate swap agreements generally involve the

exchange of fixed and floating rate interest payment

obligations without the exchange of the underlying principal

amount.

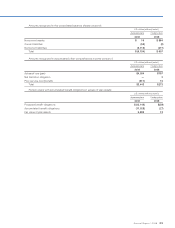

At March 31, 2007 and 2008, the notional principal

amounts of interest rate swap agreements were ¥4,198,463

million and ¥4,294,956 million ($42,868 million), respectively.