Honda 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

102

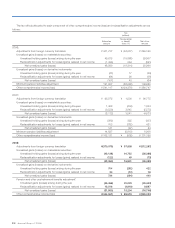

As of and for the year ended March 31, 2008

Yen (millions)

Motorcycle

Business

Automobile

Business

Financial

Services

Business

Power Product

and Other

Businesses

Segment

Total

Reconciling

Items Consolidated

Net sales and other operating revenue:

External customers ¥ 1,558,696 ¥ 9,489,391 ¥ 533,553 ¥ 421,194 ¥12,002,834 ¥ — ¥12,002,834

Intersegment — — 15,499 21,571 37,070 (37,070) —

Total 1,558,696 9,489,391 549,052 442,765 12,039,904 (37,070) 12,002,834

Cost of sales, SG&A and R&D expenses 1,407,409 8,827,726 431,254 420,406 11,086,795 (37,070) 11,049,725

Gain on transfer of the substitutional portion

of the Employee’s Pension Funds — — — — — — —

Segment income 151,287 661,665 117,798 22,359 953,109 — 953,109

Equity in income of affiliates 28,035 89,521 — 1,386 118,942 — 118,942

Assets 1,240,527 5,591,311 5,907,839 330,604 13,070,281 (454,738) 12,615,543

Investments in affiliates 118,219 411,001 — 16,976 546,196 — 546,196

Depreciation and amortization 48,000 356,003 101,987 12,435 518,425 — 518,425

Capital expenditures 86,687 544,922 839,888 21,794 1,493,291 — 1,493,291

Provision for credit and lease residual losses

on finance subsidiaries—receivables ¥ — ¥ — ¥ 58,011 ¥ — ¥ 58,011 ¥ — ¥ 58,011

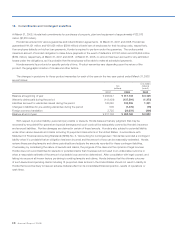

As of and for the year ended March 31, 2008

U.S. dollars (millions) (note 2)

Motorcycle

Business

Automobile

Business

Financial

Services

Business

Power Product

and Other

Businesses

Segment

Total

Reconciling

Items Consolidated

Net sales and other operating revenue:

External customers $15,557 $94,715 $ 5,325 $4,204 $119,801 $ — $119,801

Intersegment — — 155 215 370 (370) —

Total 15,557 94,715 5,480 4,419 120,171 (370) 119,801

Cost of sales, SG&A and R&D expenses 14,047 88,111 4,304 4,196 110,658 (370) 110,288

Gain on transfer of the substitutional portion

of the Employee’s Pension Funds — — — — — — —

Segment income 1,510 6,604 1,176 223 9,513 — 9,513

Equity in income of affiliates 280 893 — 14 1,187 — 1,187

Assets 12,382 55,807 58,966 3,300 130,455 (4,539) 125,916

Investments in affiliates 1,180 4,103 — 169 5,452 — 5,452

Depreciation and amortization 479 3,553 1,018 124 5,174 — 5,174

Capital expenditures 865 5,439 8,383 218 14,905 — 14,905

Provision for credit and lease residual losses

on finance subsidiaries—receivables $ — $ — $ 579 $ — $ 579 $ — $ 579

Explanatory notes:

1. Segment income is measured in a consistent manner with consolidated operating income, which is net income before

other income, other expenses, income tax (benefit) expense, minority interest in income, and equity in income of

affiliates. Expenses not directly associated with specific segments are allocated based on the most reasonable measures

applicable.

2. Assets of each segment are defined as total assets, including derivative financial instruments, investments in affiliates, and

deferred tax assets. Segment assets are based on those directly associated with each segment and those not directly

associated with specific segments are allocated based on the most reasonable measures applicable except for the

corporate assets described below.

3. Intersegment sales and revenues are generally made at values that approximate arm’s-length prices.

4. Unallocated corporate assets, included in reconciling items, amounted to ¥354,903 million as of March 31, 2006, ¥377,873

million as of March 31, 2007, and ¥385,442 million ($3,847 million) as of March 31, 2008 respectively, which consist