Honda 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

5 6

We believe our accrued warranty liability is a “critical

accounting estimate” because changes in the calculation can

materially affect net income, and require us to estimate the

frequency and amounts of future claims, which are inherently

uncertain.

Our policy is to continuously monitor warranty cost accruals

to determine their adequacy of the accrual. Therefore, warranty

expense accruals are maintained at an amount we deem

adequate to cover estimated warranty expenses.

Actual claims incurred in the future may differ from the

original estimates, which may result in material revisions to the

warranty expense accruals.

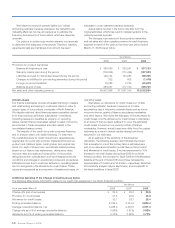

The changes in provisions for those product warranties

and net sales and other operating revenue for each business

segment for each of the years in the three-year period ended

March 31, 2008 are as follow:

Yen (millions)

2006 2007 2008

Provisions for product warranties

Balance at beginning of year ¥ 268,429 ¥ 283,947 ¥ 317,103

Warranty claims paid during the period (126,834) (113,454) (137,591)

Liabilities accrued for warranties issued during the period 125,732 143,280 136,355

Changes in liabilities for pre-existing warranties during the period 332 605 (1,476)

Foreign currency translation 16,288 2,725 (20,631)

Balance at end of year 283,947 317,103 293,760

Net sales and other operating revenue ¥9,907,996 ¥11,087,140 ¥12,002,834

(Credit Losses)

Our finance subsidiaries provide wholesale financing to dealers

and retail lending and leasing to customers mainly in order to

support sales of our products, principally in North America.

We classify retail and direct financing lease receivables derived

from those services as finance subsidiaries—receivables.

Operating leases are classified as property on operating

leases. Certain finance receivables related to sales of inventory

are included in trade receivables and other assets in the

consolidated balance sheets.

The majority of the credit risk is with consumer financing

and to a lesser extent with dealer financing. To determine

the overall allowance for credit loss amount, receivables are

segmented into pools with common characteristics such as

product and collateral types, credit grades, and original loan

terms. For each of these pools, we estimate losses primarily

based on our historic loss experiences, delinquency rates,

recovery rates and scale and composition of the portfolio,

taking factors into consideration such as changing economic

conditions and changes in operational policies and procedures.

Estimated losses due to customer defaults on operating leases

are not recognized in the allowance for credit losses. These

losses are recognized as a component of impairment losses on

operating leases.

We believe our allowance for credit losses is a “critical

accounting estimate” because it requires us to make

assumptions about inherently uncertain items such as future

economic trends, quality of finance subsidiaries receivables

and other factors. We review the adequacy of the allowance for

credit losses, and the allowance for credit losses is maintained

at an amount that we deem sufficient to cover the estimated

credit losses incurred on our owned portfolio of finance

receivables. However, actual losses may differ from the original

estimates as a result of actual results varying from those

assumed in our estimates.

As an example of the sensitivity of the allowance

calculation, the following scenario demonstrates the impact

that a deviation in one of the primary factors estimated as a

part of our allowance calculation would have on the provision

and allowance for credit losses. If we had experienced a 10%

increase in net credit losses during fiscal 2008 in our North

America portfolio, the provision for fiscal 2008 and the allowance

balance at the end of fiscal 2008 would have increased by

approximately ¥7.2 billion and ¥2.8 billion, respectively. Note that

this sensitivity analysis may be asymmetric, and are specific to

the base conditions in fiscal 2008.

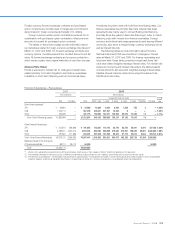

Additional Narrative of the Change in Credit Loss as Below

The following table shows information related to our credit loss experience in our North American portfolio:

Yen (billions)

Fiscal years ended March 31 2006 2007 2008

Charge-offs (net of recoveries) ¥ 22.8 ¥ 26.2 ¥ 39.9

Provision for credit losses 27.4 25.5 44.8

Allowance for credit losses 30.1 28.7 28.4

Ending receivable balance 4,166.5 4,351.8 3,890.4

Average receivable balance, net 3,938.2 4,330.8 4,317.0

Charge-offs as a % of average receivable balance 0.58% 0.61% 0.93%

Allowance as a % of ending receivable balance 0.72% 0.66% 0.73%