Honda 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

8 6

The Company Law of Japan provides that earnings in an

amount equal to 10% of dividends of retained earnings shall

be appropriated as a capital surplus or a legal reserve on the

date of distribution of retained earnings until an aggregated

amount of capital surplus and a legal reserve equals 25% of

stated capital. Certain foreign subsidiaries are also required

to appropriate their earnings to legal reserves under the laws

of the respective countries.

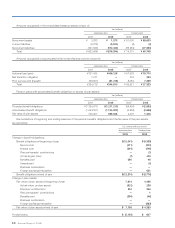

Dividends and appropriations to the legal reserves

charged to retained earnings during the years in the three-

year period ended March 31, 2008 represent dividends

paid out during those years and the related appropriations

to the legal reserves. Dividends per share for each of the

years in the three-year period ended March 31, 2008 were

¥38.5, ¥77 and ¥84 ($0.84), respectively. The accompanying

consolidated financial statements do not include any provision

for the dividend of ¥22 ($0.22) per share aggregating ¥39,921

million ($398 million) proposed and resolved in the general

stockholders’ meeting held in June 2008.

The Company executed a two-for-one stock split for the

Company’s common stock effective July 1, 2006. Information

pertaining to dividends per share has been adjusted

retroactively for the year ended March 31, 2006 to reflect this

stock split.

12. Dividends and Legal Reserves

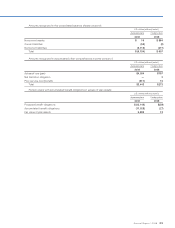

13. Pension and Other Postretirement Benefits

The Company and its subsidiaries have various pension

plans covering substantially all of their employees in Japan

and certain employees in foreign countries. Benefits under

the plans are primarily based on the combination of years of

service and compensation. The funding policy is to make

periodic contributions as required by applicable regulations.

Plan assets consist primarily of listed equity securities and

bonds.

Retirement benefits for directors, excluding certain

benefits, are provided in accordance with management

policy. There are occasions where officers other than

directors receive special lump-sum payments at retirement.

Such payments are charged to income as paid since

amounts vary with circumstances and it is impractical to

compute a liability for future payments.

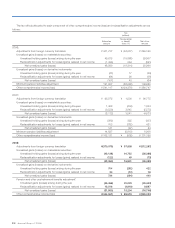

In January 2003, the Emerging Issues Task Force (EITF)

reached a final consensus on Issue No. 03-2 “Accounting

for the Transfer to the Japanese Government of the

Substitutional Portion of Employee Pension Fund Liabilities”

(“EITF 03-2”). EITF 03-2 addresses accounting for a transfer

to the Japanese government of a substitutional portion of an

Employees’ Pension Fund (“EPF”) plan, which is a defined

benefit pension plan established under the Welfare Pension

Insurance Law. EITF 03-2 requires employers to account

for the separation process of the substitutional portion

from the entire EPF plan (which includes a corporation

portion) upon completion of the transfer to the government

of the substitutional portion of the benefit obligation and

related plan assets. The separation process is considered

the culmination of a series of steps in a single settlement

transaction. Under this approach, the difference between

the fair value of the obligation and the assets required to be

transferred to the government should be accounted for and

separately disclosed as a subsidy.

As stipulated in the Japanese Welfare Pension

Insurance Law, the “Honda Employees’ Pension Fund (a

confederated welfare pension fund, the “Fund”)”, of which

the Company and a part of its domestic subsidiaries and

affiliates accounted for under the equity method were

members, has obtained approval from the Japanese Minister

of Health, Labor and Welfare for exemption from benefits

obligations related to past employee service with respect to

the substitutional portion of the Fund on July 1, 2005 and

completed its transfer on March 9, 2006. Previously on

April 1, 2004, the Company received approval of exemption

from the obligation for benefits related to future employee

services with respect to the fund. As a result, the Company

recognized a gain of ¥228,681 million, which is the difference

between the settled accumulated benefit obligation and the

assets transferred to the government; a gain of ¥56,448

million for the derecognizing of previous accrued salary

progression; and settlement loss of ¥147,113 million for

the related unrecognized loss. Collectively, the Company

recognized a net gain of ¥138,016 million for the fiscal year

ended March 31, 2006.

The Company and its consolidated subsidiaries adopted

SFAS No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans – an amendment of

FASB Statements No. 87, 88, 106, and 132(R)” on March 31,

2007, recognized its overfunded or underfunded status as

an asset or liability in its consolidated balance sheets.