Honda 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

5 0

mainly to decreased unit sales in North America. Revenue

from external customers increased ¥3.4 billion, or 0.8%, to

¥421.1 billion, from the previous fiscal year, due mainly to

the positive impact of foreign currency translation effects.

Honda estimates that if the exchange rate of the Japanese

yen had remained unchanged from the previous fiscal year,

consolidated net sales for the period would have decreased

by approximately ¥3.3 billion, or 0.8%, compared to the

increase as reported of ¥3.4 billion, which includes a positive

foreign currency effect.

Operating income was ¥22.3 billion, a decrease of ¥13.8

billion, or 38.2% from the previous fiscal year, due mainly to

the negative impact of the increased SG&A expenses and an

increase of R&D expenses in other businesses, which offset

the positive impact of the foreign currency effects caused by

the appreciation of the European currencies.

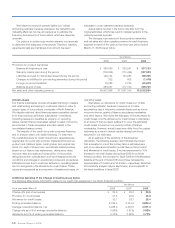

Financial Services Business

To support the sale of its products, Honda provides

wholesale financing to dealers and retail lending and leasing

to customers through our finance subsidiaries in Japan, the

United States, Canada, the United Kingdom, Germany, Brazil

and Thailand.

As a result of increased sales of automobiles mainly

in North America, credit assets and property on operating

leases of financial subsidiaries rose 3.4% from the previous

fiscal year, to ¥4,967.5 billion.

In fiscal year 2008, revenue from external customers in a

financial services business increased ¥123.8 billion, or 30.2%,

to ¥533.5 billion from the previous fiscal year due mainly to

an increase in operating lease revenue. Honda estimates

that if the exchange rate of the Japanese yen had remained

unchanged from the previous fiscal year, consolidated net

sales for the period would have increased by approximately

¥137.0 billion, or 33.4%, compared to the increase as reported

of ¥123.8 billion, which includes a negative foreign currency

effect.

Operating income also expanded ¥2.2 billion, or 2.0%,

to ¥117.7 billion from the previous fiscal year, due mainly to

the increased profit attributable to higher revenue benefiting

from a higher loan balance in North America, which offset the

negative impact of the increased SG&A expenses caused by

an increase of provisions for credit losses.

Our finance subsidiaries in North America have historically

accounted for all leases as direct financing leases. However,

starting in the year ended March 31, 2007, some of the leases

which do not qualify for direct financing leases accounting

treatment are accounted for as operating leases. Generally,

direct financing lease revenues and interest income consist

of the recognition of finance lease revenue at inception of

the lease arrangement and subsequent recognition of the

interest income component of total lease payments using

the effective interest method. In comparison, operating lease

revenues include the recognition of the gross lease payment

amounts on a straight line basis over the term of the lease

arrangement, and operating lease vehicles are depreciated

to their estimated residual value on a straight line basis over

the term of the lease. It is not anticipated that the differences

in accounting for operating leases and direct financing leases

will have a material net impact on the Company’s results of

operations overall, however, operating lease revenues and

associated depreciation of leased assets do result in differing

presentation and timing compared to those of direct financing

leases.

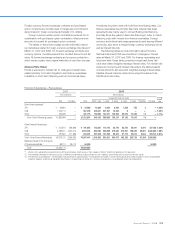

Geographical Information

Japan

In Japan, revenue from domestic and export sales was

¥4,889.0 billion, up ¥114.9 billion, or 2.4% compared to

the previous fiscal year, due primarily to the increased

revenue from exports in automobile business which offset

the negative impact of the decreased revenue in domestic

automobile business. Operating income was ¥192.5 billion,

down ¥35.5 billion, or 15.6%, compared to the previous

fiscal year, due primarily to the increased R&D expenses,

increased depreciation expenses, and substantially increased

raw material costs, which offset the positive impact of the

continuing cost reduction effects, increased profit attributable

to higher revenue, and the decreased SG&A expenses.

North America

In North America, which mainly consists of the United

States, revenue increased ¥92.6 billion, or 1.5%, to ¥6,265.2

billion, due mainly to increased revenue in the automobile

business, which offset the negative impact of foreign currency

translation effects.

Operating income decreased ¥24.1 billion, or 5.3%, to

¥432.6 billion, from the previous fiscal year, due primarily

to the negative impacts of increased sales incentives in the

automobile business, substantially increased raw material

costs, the change in the model mix in the automobile

business, increased SG&A expenses caused by an increase

of provisions for credit losses in the financial services

business, increased depreciation expenses, and the negative

impact of foreign currency effect because of the depreciation

of U.S. dollars, which offset the positive impacts of increased

profit attributable to higher revenue, continuing cost reduction

effects, and increased prices.

Europe

In Europe, revenue increased ¥246.4 billion, or 18.3%, to

¥1,594.2 billion, compared to the previous fiscal year, due

primarily to increased revenue in the automobile business and

the positive impact of foreign currency translation effects.

Operating income increased ¥19.5 billion, or 61.1%, to

¥51.5 billion, from the previous fiscal year, due mainly to the

positive impacts of increased profit attributable to higher

revenue, continuing cost reduction effects and the foreign

currency effects, which offset the negative impacts of the

increased SG&A expenses.

Asia

In Asia, revenue increased ¥366.8 billion, or 28.9%, to

¥1,638.2 billion from the previous fiscal year, due primarily

to increased revenue in the motorcycle and automobile

businesses and the positive impact of foreign currency

translation effects.

Operating income increased ¥53.5 billion, or 69.4%, to

¥130.7 billion, from the previous fiscal year, due mainly to

the positive impacts of increased profit attributable to higher