Honda 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

7 4

Finance subsidiaries—receivables represent finance

receivables generated by finance subsidiaries. Certain

finance receivables related to sales of inventory are included

in trade receivables and other assets in the consolidated

balance sheets. Finance receivables include wholesale

financing to dealers and retail financing and direct financing

leases to consumers.

The allowance for credit losses is maintained at an

amount management deems adequate to cover estimated

losses on finance receivables. The allowance is based on

management’s evaluation of many factors, including current

economic trends, industry experience, inherent risks in the

portfolio and the borrower’s ability to pay.

Finance subsidiaries of the Company purchase

insurance to cover a substantial amount of the estimated

residual value of vehicles leased as direct financing leases

to customers. The allowance for losses on lease residual

values is maintained at an amount management deems

adequate to cover estimated losses on the uninsured portion

of the vehicles’ lease residual values. The allowance is

also based on management’s evaluation of many factors,

including current economic conditions, industry experience

and the finance subsidiaries’ historical experience with

residual value losses.

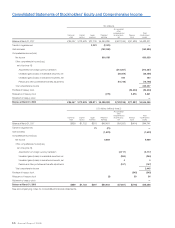

4. Finance Subsidiaries—Receivables and Securitizations

Finance subsidiaries—receivables, net, consisted of the following at March 31, 2007 and 2008:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Direct financing leases ¥1,892,566 ¥1,212,634 $12,103

Retail 2,923,944 3,143,376 31,374

Wholesale 437,242 404,433 4,037

Term loans to dealers 14,916 19,605 196

Total finance receivables 5,268,668 4,780,048 47,710

Retained interests in the sold pools of finance receivables 88,110 54,636 545

5,356,778 4,834,684 48,255

Less:

Allowance for credit losses 35,020 34,805 347

Allowance for losses on lease residual values 33,928 24,887 248

Unearned interest income and fees 143,131 73,695 736

5,144,699 4,701,297 46,924

Less:

Finance receivables included in trade receivables, net 509,697 476,305 4,754

Finance receivables included in other assets, net 168,952 176,444 1,761

Finance subsidiaries—receivables, net 4,466,050 4,048,548 40,409

Less current portion 1,426,224 1,340,728 13,382

Noncurrent finance subsidiaries—receivables, net ¥3,039,826 ¥2,707,820 $27,027

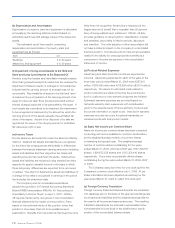

The following schedule shows the contractual maturities of finance receivables for each of the five years following March

31, 2008 and thereafter:

Years ending March 31

Yen

(millions)

2009 ¥1,854,779

2010 1,192,229

2011 820,283

2012 576,389

2013 274,965

After five years 61,403

2,925,269

Total ¥4,780,048