Honda 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

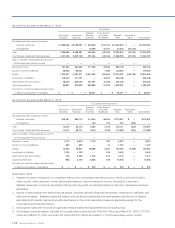

A n n u a l R e p o r t 2 0 0 8 9 5

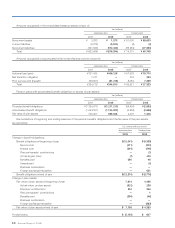

U.S. dollars

(millions) (note 2)

Before-tax

amount

Tax (expense)

or benefit

(note 11)

Net-of-tax

amount

2008:

Adjustments from foreign currency translation $(3,693) $576 $(3,117)

Unrealized gains (losses) on marketable securities:

Unrealized holding gains (losses) arising during the year (431) 168 (263)

Reclassification adjustments for losses (gains) realized in net income (1) 0 (1)

Net unrealized gains (losses) (432) 168 (264)

Unrealized gains (losses) on derivative instruments

Unrealized holding gains (losses) arising during the year 7 (3) 4

Reclassification adjustments for losses (gains) realized in net income 0 (0) 0

Net unrealized gains (losses) 7 (3) 4

Pension and other postretirement benefits adjustment*

Unrealized gains (losses) arising during the year (454) 200 (254)

Reclassification adjustments for losses (gains) realized in net income 135 (48) 87

Net unrealized gains (losses) (319) 152 (167)

Other comprehensive income (loss) $(4,437) $893 $(3,544)

* The primary component of other comprehensive income (loss) for Pension and other postretirement benefits adjustment is actuarial gains or losses.

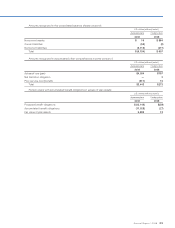

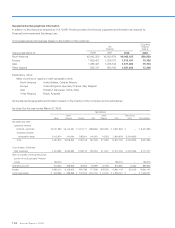

16. Fair Value of Financial Instruments

The estimated fair values of significant financial instruments at March 31, 2007 and 2008 are as follows (see note 1 (q)):

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Carrying

amount

Estimated

fair value

Carrying

amount

Estimated

fair value

Carrying

amount

Estimated

fair value

Finance subsidiaries—receivables (a) ¥ 3,434,721 ¥ 3,444,144 ¥ 3,590,110 ¥ 3,661,502 $ 35,833 $ 36,546

Marketable securities 210,598 210,598 120,085 120,085 1,199 1,199

Held-to-maturity securities 16,337 16,348 20,672 20,851 206 208

Debt (3,947,020) (3,960,743) (4,394,817) (4,428,164) (43,865) (44,198)

Foreign exchange instruments (b)

Asset position 3,735 3,735 116,169 116,169 1,160 1,160

Liability position (24,783) (24,783) 429 429 4 4

Net (21,048) (21,048) 116,598 116,598 1,164 1,164

Interest rate instruments (c)

Asset position 10,866 10,866 (19,662) (19,662) (196) (196)

Liability position (2,417) (2,417) (54,721) (54,721) (546) (546)

Net 8,449 8,449 (74,383) (74,383) (742) (742)

(a) The carrying amounts of finance subsidiaries—receivables at March 31, 2007 and 2008 in the table exclude ¥1,709,978

million and ¥1,111,187 million ($11,091 million) of direct financing leases, net, classified as finance subsidiaries—receivables

in the consolidated balance sheets, respectively. The carrying amounts of finance subsidiaries—receivables at March

31, 2007 and 2008 in the table also include ¥678,649 million and ¥652,749 million ($6,515 million) of finance receivables

classified as trade receivables and other assets in the consolidated balance sheets, respectively.