Honda 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

5 8

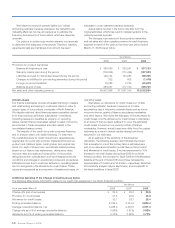

Japanese Plans Yen (billions)

Assumptions Percentage point change (%) Funded status Equity Pension expense

Discount rate +0.5/–0.5 –89.5/+100.8 +45.2/–57.6 –4.7/+5.9

Expected long-term rate of return +0.5/–0.5 — — –3.6/+3.6

Foreign Plans Yen (billions)

Assumptions Percentage point change (%) Funded status Equity Pension expense

Discount rate +0.5/–0.5 –36.2/+41.0 +27.7/–31.7 –5.6/+7.5

Expected long-term rate of return +0.5/–0.5 — — –2.2/+2.2

*1 Note that this sensitivity analysis may be asymmetric, and are specific to the base conditions at March 31, 2008.

*2 Funded status for fiscal 2008 is affected by March 31, 2008 assumptions. Pension expense for fiscal 2008 is affected by March 31, 2007

assumptions.

(Income Taxes)

Honda adopted the provision of FASB Interpretation No. 48

“Accounting for Uncertainty in Income Taxes” (FIN No. 48) on

April 1, 2007. Honda is subject to income tax examinations

in many tax jurisdictions. We recognize the tax benefit from

an uncertain tax position based on the technical merits of

the position when the position is more likely than not to be

sustained upon examination. Benefits from tax positions

that meet the more likely than not recognition threshold are

measured at the largest amount of benefit that is greater than

50% likelihood of being realized upon ultimate resolution.

We performed a comprehensive review of any uncertain tax

positions in accordance with FIN No. 48.

We believe our accounting for tax uncertainties is a “critical

accounting estimate” because it requires us to evaluate and

assess the probability of the outcome that could be realized

upon ultimate resolution. Our estimates may change in the

future due to new developments.

We believe that our estimates and assumptions of

unrecognized tax benefits are reasonable, however, if our

estimates of unrecognized tax benefits and potential tax benefits

are not representative of actual outcomes, our consolidated

financial statements could be materially affected in the period of

settlement or when the statutes of limitations expire, as we treat

these events as discrete items in the period of resolution.

Quantitative and Qualitative Disclosure About Market

Risk

Honda is exposed to market risks, which are changes in

foreign currency exchanges rates, in interest rates and in prices

of marketable equity securities. Honda is a party to derivative

financial instruments in the normal course of business in order

to manage risks associated with changes in foreign currency

exchange rates and in interest rates. Honda does not hold any

derivative financial instruments for trading purposes.

(Foreign Currency Exchange Rate Risk)

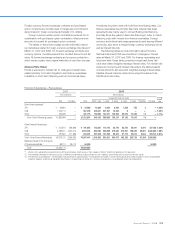

Foreign Exchange Risk

2007 2008

Yen (millions) Average

contractual

rate (Yen)

Yen (millions) Average

contractual

rate (Yen)

Contract

amounts Fair value

Contract

amounts Fair value

Forward Exchange Contract

To sell US$ ¥336,005 1,299 117.84 ¥214,797 9,199 104.25

To sell EUR 60,305 (963) 154.35 40,963 64 157.99

To sell CA$ 16,548 (67 ) 100.88 14,146 560 101.72

To sell GBP 173,894 (1,352 ) 228.48 70,227 2,739 207.07

To sell other foreign currencies 36,344 (670 ) — 12,147 362 —

To buy US$ 9,864 (122 ) 114.93 7,104 (196) 102.92

To buy other foreign currencies 11,358 (85 ) — 2,272 (29) —

Cross-currencies 334,676 (1,533 ) —254,189 (517) —

Total ¥978,994 (3,493 ) ¥615,845 12,182

Currency Option Contracts

Option purchased to sell US$ ¥ — — — ¥ 96,720 877 —

Option written to sell US$ — — — 136,005 (502) —

Option purchased to sell other currencies 2,317 24 — 17,378 409 —

Option written to sell other currencies 3,476 (42 ) —22,101 (457) —

Total ¥5,793 (18 ) ¥272,204 327