Honda 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 9 3

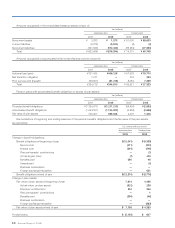

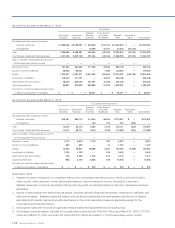

15. Accumulated Other Comprehensive Income (Loss)

The components and related changes in accumulated other comprehensive income (loss) for each of the years in the three-

year period ended March 31, 2008 are as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2006 2007 2008 2008

Adjustments from foreign currency translation:

Balance at beginning of year ¥(624,937) ¥(375,777) ¥(279,002) $(2,785)

Adjustments for the year 249,160 96,775 (312,267) (3,117)

Balance at end of year (375,777) (279,002) (591,269) (5,902)

Net unrealized gains on marketable securities:

Balance at beginning of year 33,744 62,710 58,139 580

Reclassification adjustments for realized (gain) loss

on marketable securities (841) (5,575) (73) (1)

Increase (decrease) in net unrealized gains on marketable securities 29,807 1,004 (26,386) (263)

Balance at end of year 62,710 58,139 31,680 316

Net unrealized gains (losses) on derivative instruments:

Balance at beginning of year — (64) 20 1

Reclassification adjustments for realized (gain) loss

on derivative instruments (38) 421 18 0

Increase (decrease) in net unrealized gains on derivative instruments (26) (337) 422 4

Balance at end of year (64) 20 460 5

Minimum pension liabilities adjustment:

Balance at beginning of year (202,741) (94,056) — —

Cumulative effect of adjustments resulting from the adoption

of SAB No. 108, net of tax (note 1 (u)) — 18,149 — —

Adjusted balances at beginning of year (202,741) (75,907) — —

Adjustments for the year 108,685 8,908 — —

Adjustment for initially applying SFAS No. 158, net of tax (note 13) — 66,999 — —

Balance at end of year (94,056) — — —

Pension and other postretirement benefits adjustment*

Balance at beginning of year — — (206,323) (2,059)

Adjustment for initially applying SFAS No. 158, net of tax (note 13) — (206,323) — —

Reclassification adjustments for realized (gain) loss on pension and

other postretirement benefits adjustment — — 8,697 87

Increase (decrease) in net unrealized gains on pension and other

postretirement benefits adjustment — — (25,443) (254)

Balance at end of year — (206,323) (223,069) (2,226)

Total accumulated other comprehensive income (loss):

Balance at beginning of year (793,934) (407,187) (427,166) (4,263)

Cumulative effect of adjustments resulting from the adoption

of SAB No. 108, net of tax (note 1 (u)) — 18,149 — —

Adjusted balances at beginning of year (793,934) (389,038) (427,166) (4,263)

Adjustments for the year 386,747 101,196 (355,032) (3,544)

Adjustment for initially applying SFAS No. 158, net of tax (note 13) — (139,324) — —

Balance at end of year ¥(407,187) ¥(427,166) ¥(782,198) $(7,807)