Honda 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

7 6

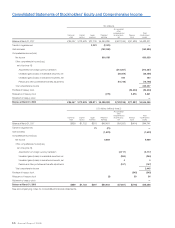

The following illustration presents quantitative information about balances of outstanding securitized portfolios as of

March 31, 2007 and 2008.

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Securitized receivables

Retail ¥1,208,409 ¥ 664,879 $6,636

Direct financing leases 67,758 33,470 334

Total securitized receivables ¥1,276,167 ¥ 698,349 $6,970

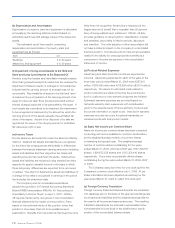

5. Inventories

Inventories at March 31, 2007 and 2008 are summarized as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Finished goods ¥ 772,917 ¥ 755,122 $ 7,537

Work in process 34,970 38,756 387

Raw materials 375,229 405,382 4,046

¥1,183,116 ¥1,199,260 $11,970

6. Investments and Advances—Affiliates

Significant investments in affiliates accounted for under

the equity method at March 31, 2007 and 2008 are Showa

Corporation (33.5%), Keihin Corporation (42.2%), Guangzhou

Honda Automobile Co., Ltd. (50.0%), Dongfeng Honda

Engine Co., Ltd. (50.0%), and P.T. Astra Honda Motor

(50.0%).

Certain adjustments were recorded to investments and

advances to affiliates as of April 1, 2006, please refer to note

1(u) for further information.

The difference between the carrying amount of

investment in affiliates and the amount of underlying equity in

net assets is not material as of March 31, 2007 and 2008.

Investments in affiliates include equity securities which have quoted market values at March 31, 2007 and 2008 compared

with related carrying amounts as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007* 2008 2008

Carrying amount ¥185,914 ¥ 210,532 $2,101

Market value 412,892 263,946 2,634

* See note 3.