Honda 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

8 0

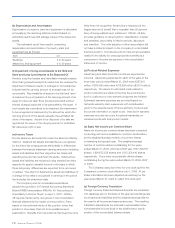

9. Short-term and Long-term Debt

Short-term debt at March 31, 2007 and 2008 is as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Short-term bank loans ¥ 311,117 ¥ 415,605 $ 4,148

Medium-term notes 182,355 436,731 4,359

Commercial paper 772,396 834,779 8,332

¥1,265,868 ¥ 1,687,115 $16,839

The weighted average interest rates on short-term debt outstanding at March 31, 2007 and 2008 were 4.00% and 4.36%,

respectively.

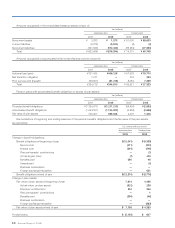

Long-term debt at March 31, 2007 and 2008 is as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Honda Motor Co., Ltd.:

Loans, maturing through 2031:

Unsecured, principally from banks ¥ 516 ¥ 435 $ 4

516 435 4

Subsidiaries:

Loans, maturing through 2030

Secured, principally from banks 18,581 13,614 136

Unsecured, principally from banks 134,949 164,887 1,647

0.47% Japanese yen unsecured bond due 2007 50,000 — —

0.79% Japanese yen unsecured bond due 2008 30,000 30,000 299

0.99% Japanese yen unsecured bond due 2009 30,000 30,000 299

1.14% Japanese yen unsecured bond due 2009 30,000 30,000 299

0.31% Japanese yen unsecured bond due 2010 150 100 1

0.66% Japanese yen unsecured bond due 2010 30,000 30,000 299

0.94% Japanese yen unsecured bond due 2010 30,000 30,000 299

1.30% Japanese yen unsecured bond due 2011 —40,000 399

1.51% Japanese yen unsecured bond due 2011 30,000 30,000 299

1.48% Japanese yen unsecured bond due 2012 —30,000 299

3.65% Thai baht unsecured bond due 2007 7,340 — —

5.32% Thai baht unsecured bond due 2008 3,670 3,180 32

3.82% Thai baht unsecured bond due 2009 —3,180 32

5.46% Thai baht unsecured bond due 2009 5,505 4,770 48

4.20% Thai baht unsecured bond due 2010 —9,540 96

Medium-term notes, maturing through 2023 2,282,138 2,259,434 22,552

Less unamortized discount, net 1,697 1,438 14

2,680,636 2,707,267 27,022

Total long-term debt 2,681,152 2,707,702 27,026

Less current portion 775,409 871,050 8,694

¥1,905,743 ¥ 1,836,652 $18,332