Honda 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 8 5

At March 31, 2008, certain of the Company’s subsidiaries have operating loss carryforwards for income tax purposes of

¥112,182 million ($1,120 million), which are available to offset future taxable income, if any. Periods available to offset future

taxable income vary in each tax jurisdiction and range from one year to an indefinite period as follows:

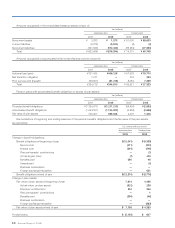

Yen

(millions)

U.S. dollars

(millions)

(note 2)

Within 1 year ¥ 3,180 $ 32

1 to 5 years 14,846 148

5 to 15 years 21,993 220

Indefinite periods 72,163 720

¥112,182 $ 1,120

At March 31, 2007 and 2008, Honda did not recognize

deferred tax liabilities of ¥78,252 million and ¥105,848 million

($1,056 million), respectively, for certain portions of the

undistributed earnings of the Company’s foreign subsidiaries

because such portions were considered indefinitely

reinvested. At March 31, 2007 and 2008, the undistributed

earnings not subject to deferred tax liabilities were ¥2,995,170

million and ¥3,327,339 million ($33,210 million), respectively.

Honda adopted the provision of FIN No. 48 on April

1, 2007. As of the date of adoption of FIN No. 48, Honda

identified unrecognized tax benefits of ¥36,330 million ($363

million). As of March 31, 2008, Honda’s gross unrecognized

tax benefits totaled ¥99,527 million ($993 million). Of this

amount, the amount that would impact Honda’s effective tax

rate, if recognized, is ¥85,403 million ($852 million).

Honda recognized interest and penalty of ¥3,011 million

($30 million) for the year ended March 31, 2008. As of

March 31, 2008, Honda had recorded approximately ¥5,960

million ($59 million) for accrued interest and accrued penalty.

A reconciliation of the beginning and ending amount of

unrecognized tax benefits is as follows:

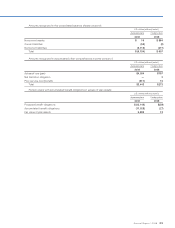

Yen

(millions)

U.S. dollars

(millions)

(note 2)

Balance at beginning of year ¥ 36,330 $ 363

Additions for tax positions related to the current year 9,213 92

Additions for tax positions of prior years 74,674 745

Reductions for tax positions of prior years (14,769) (147)

Settlements (51) (1)

Reductions for statute of limitations (555) (6)

Effect of exchange rate changes (5,315) (53)

Balance at end of year ¥ 99,527 $ 993

Tax liabilities associated with uncertain tax positions are

primarily classified as other (noncurrent) liabilities, as we do

not expect to pay cash or settle on these positions within the

next twelve months.

Honda is subject to income tax examinations in many

tax jurisdictions, mainly related to transfer pricing issues.

Tax examinations can involve complex issues and the

resolution of issues may span multiple years, particularly if

subject to negotiation or litigation. Although Honda believes

its estimates of the total unrecognized tax benefits are

reasonable, uncertainties regarding the final determination of

income tax audit settlements and any related litigation could

affect the amount of total unrecognized tax benefits in the

future periods.

The Company has been examined by the Tokyo Regional

Taxation Bureau regarding transfer pricing matters for the

period from the year ended March 31, 2002 to the year

ended March 31, 2007. Honda has recognized the liability

for unrecognized tax benefits, including those related to this

examination.

In addition, Honda has open tax years from primarily 2001

to 2008 with various significant taxing jurisdictions including

the United States (fiscal years 2001-2008), Japan (fiscal years

2002-2008), Canada, the United Kingdom, Germany, France,

Belgium, Thailand, India, Brazil, and Australia.

If our estimates of unrecognized tax benefits and potential

tax benefits are not representative of actual outcomes, our

consolidated financial statements could be materially affected

in the period of settlement or when the statutes of limitations

expire, as we treat these events as discrete items in the period

of resolution. It is difficult to estimate the timing and range

of possible change related to our uncertain tax positions,

as finalizing audits with the relevant income tax authorities

may involve formal administrative and legal proceedings.

Accordingly, it is not possible to reasonably estimate the

expected changes to the total unrecognized tax benefits

over next twelve months, although any settlements or statute

expirations may result in a significant increase or decrease in

our total unrecognized tax benefits, including those positions

related to tax examinations being currently conducted.