Honda 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

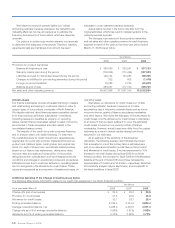

A n n u a l R e p o r t 2 0 0 8 6 5

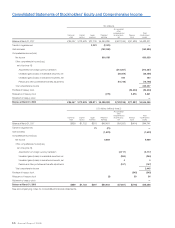

Honda Motor Co., Ltd. and Subsidiaries

Years ended March 31, 2006, 2007 and 2008 Yen (millions)

Common

stock

Capital

surplus

Legal

reserves

Retained

earnings

Accumulated

other

comprehensive

income (loss), net

Treasury

stock

Total

stockholders’

equity

Balance at March 31, 2005

¥86,067 ¥172,531 ¥34,688 ¥3,809,383 ¥(793,934) ¥(19,441) ¥3,289,294

Transfer to legal reserves

1,123 (1,123) —

Cash dividends

(71,061) (71,061)

Comprehensive income (loss):

Net income

597,033 597,033

Other comprehensive income (loss),

net of tax (note 15)

Adjustments from foreign currency translation

249,160 249,160

Unrealized gains (losses) on marketable securities, net

28,966 28,966

Unrealized gains (losses) on derivative instruments, net

(64) (64)

Minimum pension liabilities adjustment

108,685 108,685

Total comprehensive income

983,780

Purchase of treasury stock

(77,067) (77,067)

Reissuance of treasury stock

(125) 928 803

Retirement of treasury stock

(2) (66,221) 66,224 1

Balance at March 31, 2006

86,067 172,529 35,811 4,267,886 (407,187) (29,356) 4,125,750

Cumulative effect of adjustments resulting from the

adoption of SAB No. 108, net of tax (note 1 (u))

— — — (62,640) 18,149 — (44,491)

Adjusted balances as of March 31, 2006

86,067 172,529 35,811 4,205,246 (389,038) (29,356) 4,081,259

Transfer to legal reserves

1,919 (1,919) —

Cash dividends

(140,482) (140,482)

Comprehensive income (loss):

Net income

592,322 592,322

Other comprehensive income (loss),

net of tax (note 15)

Adjustments from foreign currency translation

96,775 96,775

Unrealized gains (losses) on marketable securities, net

(4,571) (4,571)

Unrealized gains (losses) on derivative instruments, net

84 84

Minimum pension liabilities adjustment

8,908 8,908

Total comprehensive income

693,518

Adjustment for initially applying SFAS No. 158,

net of tax (note 13)

(139,324) (139,324)

Purchase of treasury stock

(30,974) (30,974)

Reissuance of treasury stock

(277) 18,891 18,614

Retirement of treasury stock

—

Balance at March 31, 2007

¥86,067 ¥172,529 ¥37,730 ¥4,654,890 ¥(427,166) ¥(41,439) ¥4,482,611

Consolidated Statements of Stockholders’ Equity and Comprehensive Income