Honda 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

4 8

Financial Review

Operating and Financial Review

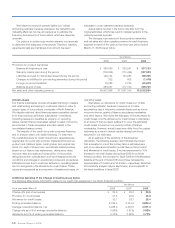

Net Sales and Other Operating Revenue

Honda’s consolidated net sales and other operating revenues

(hereafter, “net sales”) for the fiscal year ended March 31,

2008 grew ¥915.6 billion, or 8.3%, compared with fiscal 2007,

to ¥12,002.8 billion. Factors behind this increase were higher

unit sales in the motorcycle business in Other Regions, higher

unit sales in the automobile business in all overseas regions,

and higher unit sales of power products in Asia, as well as

the positive impact of foreign currency translation effects.

Honda estimates that if the exchange rate of the Japanese

yen had remained unchanged against other currencies from

the previous fiscal year, consolidated net sales for the period

would have increased by approximately ¥743.0 billion, or

6.7%, compared to the increase as reported of ¥915.6 billion,

which includes a positive foreign currency effect.

Domestic net sales decreased by ¥95.4 billion, or 5.7%,

to ¥1,585.7 billion, but overseas net sales were up ¥1,011.1

billion, or 10.7%, to ¥10,417.0 billion.

Operating Income

Operating income increased ¥101.2 billion, or 11.9% to

¥953.1 billion when compared with the preceding year. After

considering the net effect of the positive impact of foreign

currency effects of ¥37.6 billion, Honda estimates operating

income increased ¥63.5 billion, or 7.5%.

Factors contributing to the remaining increase of ¥63.5

billion in operating income, after consideration of foreign

currency effects can be summarized as follows (i) changes

in net sales and the model mix, (ii) cost reductions and the

effect of raw material cost fluctuations, (iii) changes in selling,

general and administrative (SG&A) expenses and (iv) R&D

expenses. Details regarding these factors are as follows.

Changes in net sales and the model mix was a positive

impact of ¥170.0 billion due mainly to an increase of income

because of higher sales and an effect of price increase. On

the other hand, higher incentives payment in North America

and change in model mix caused by shift of customers’

demands towards more fuel efficient (compact) models

for automobiles segment because of the higher fuel prices

negatively affected operating income.

Because of the positive impact of continuing cost

reduction effects which offset the negative impacts of surging

raw materials prices, such as steel and precious grade metals

used as catalyst, as well as an increase in depreciation, cost

of sales had a positive impact of ¥11.5 billion.

Selling, general and administrative expenses had a

negative impact of ¥81.8 billion due to higher transportation

and storage costs accompanying the increase in unit sales,

an increase of provisions for credit losses mainly in financial

services business in North America, and higher advertising

and sales promotion costs.

R&D expenses also had a negative impact of ¥36.1 billion,

as we spent more on safety and environmental technologies

and worked to enhance the attractiveness of our products.

With respect to the discussion above of the change in

operating income, management has identified the factors

set forth below and used what it believes to be a reasonable

method to analyze the respective changes in such factors.

Each of these factors is explained below. Management

has analyzed changes in these factors at the levels of the

Company and its material consolidated subsidiaries.

(1) “Foreign currency effects” consist of translation

adjustments, which come from the translation of the

currency of foreign subsidiaries’ financial statements into

Japanese yen, and foreign currency adjustments, which

result from foreign-currency-denominated sales. At the

levels of the Company and those consolidated subsidiaries

which have been analyzed, such foreign currency

adjustments primarily relate to the following currencies:

U.S. dollar, Canadian dollar, Euro, British pound, Brazilian

real and Japanese yen.

(2) With respect to “cost reduction and effects of raw material

cost fluctuations”, management has analyzed cost

reduction and effects of raw material cost fluctuations

at the levels of the Company and its material foreign

manufacturing subsidiaries in North America, Europe and

Other Regions.

(3) With respect to “changes in net sales and model mix”,

management has analyzed changes in sales volume and

in the mix of product models sold in major markets which

have resulted in increases/decreases in profit, as well as

certain other reasons for increases/decreases in net sales

and cost of sales.

(4) With respect to “selling, general and administrative

expenses”, management has analyzed reasons for an

increase/decrease in selling, general and administrative

expenses from the previous fiscal year excluding currency

translation effects.

Income before Income Taxes, Minority Interest and

Equity in Income of Affiliates

Income before income taxes, minority interest and equity

in income of affiliates increased ¥102.9 billion, or 13.0%, to

¥895.8 billion. Main factors of this increase except factors

relating operating income are as follows;

Losses on the valuation of interest rate swaps and other

derivatives of our finance subsidiaries had a negative impact

0

2,000

4,000

6,000

8,000

10,000

12,000

08_07_06_05_04_

Net Sales and Other Operating

Revenue

Years ended March 31

)snoillib(neY

0807060504