Honda 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 8 7

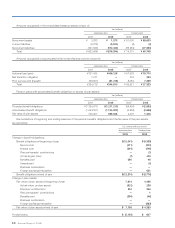

The incremental effect of applying SFAS No. 158 at March 31, 2007, on balance sheet items is as follows:

Yen (millions)

Before

Application of

SFAS 158 Adjustments

After

Application of

SFAS 158

Other assets*1¥ 625,834 ¥ 11,347 ¥ 637,181

Total assets 12,025,153 11,347 12,036,500

Accrued expenses 847,008 (39,667) 807,341

Total current liabilities 4,327,194 (39,667) 4,287,527

Other liabilities 1,047,374 190,338 1,237,712

Total liabilities 7,280,311 150,671 7,430,982

Accumulated other comprehensive loss, net*2(287,842) (139,324) (427,166)

Total stockholder’s equity 4,621,935 (139,324) 4,482,611

*1 See note 3.

*2 The incremental effect of applying SFAS No. 158 on Accumulated other comprehensive loss, net, includes tax effect of ¥72,881 million.

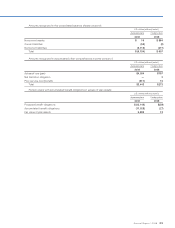

Reconciliations of beginning and ending balances of the pension benefit obligations and the fair value of the plan assets

are as follows:

Yen (millions)

Japanese plans Foreign plans

2007 2008 2007 2008

Change in benefit obligations:

Benefit obligations at beginning of year ¥(1,133,325) ¥(1,206,419) ¥(395,416) ¥(434,757)

Service cost (42,115) (41,133) (30,492) (30,259)

Interest cost (23,809) (24,128) (22,373) (24,661)

Plan participants’ contributions ——(129) (146)

Actuarial gain (loss) (4,165) (785) 21,746 44,695

Benefits paid 31,638 39,106 3,731 4,596

Amendment ——(10) (42)

Business combination (34,643) —(906) —

Foreign exchange translation ——(10,908) 62,220

Benefit obligations at end of year ¥(1,206,419) ¥(1,233,359) ¥(434,757) ¥(378,354)

Change in plan assets:

Fair value of plan assets at beginning of year 712,331 782,835 358,075 449,467

Actual return on plan assets 36,223 (62,277) 46,161 23,780

Employer contributions 33,649 35,513 40,163 36,715

Plan participants’ contributions ——129 146

Benefits paid (31,638) (39,106) (3,731) (4,596)

Business combination 32,270 —875 —

Foreign exchange translation ——7,795 (66,410)

Fair value of plan assets at end of year ¥ 782,835 ¥ 716,965 ¥ 449,467 ¥ 439,102

Funded status ¥ (423,584) ¥ (516,394) ¥ 14,710 ¥ 60,748