Honda 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 4 9

of ¥13.4 billion. The other factors had a net positive impact

of ¥15.1 billion. Among such other factors, the effects of

transaction gains and losses had a positive impact, but this

was offset by the negative impact of various factors, including

the net loss associated with the revaluation of assets and

liabilities denominated in foreign currencies, and the absence

of gains on sale of investment securities which were recorded

in the fiscal year ended March 31, 2007.

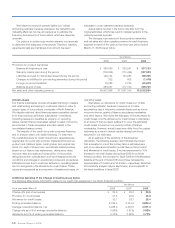

Income Tax Expense

Income tax expense increased ¥103.5 billion, or 36.5%, to

¥387.4 billion. The effective tax rate was 43.2%, an increase

by 7.4 percentage points from the previous fiscal year. This

increase in the effective tax rate was mainly due to the

recognition of liabilities for unrecognized tax benefits as a

result of an ongoing examination of the Company’s tax filings

by the Tokyo Regional Taxation Bureau with regard to transfer

pricing matters.

Additional detailed information is described in Note 11 to

the accompanying consolidated financial statements.

Minority Interest in Income of Consolidated Subsidiaries

The amount deducted for minority interest in income of

consolidated subsidiaries grew ¥7.1 billion, or 35.7% from the

previous year, to ¥27.3 billion.

Equity in Income of Affiliates

Equity in income of affiliates grew ¥15.5 billion, or 15.0%, to

¥118.9 billion, due mainly to an increase of income at equity

method affiliates in Asia accompanying an increase in their

sales along with market expansion.

Net Income

Net income rose ¥7.7 billion, or 1.3% from the previous year,

to ¥600.0 billion.

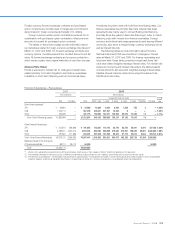

Business Segments

Motorcycle Business

Unit sales of Honda motorcycles, all-terrain vehicles (ATVs)

and personal watercraft (PWC) in fiscal 2008 totaled

9,320,000 units, a decrease of 10.1%, from the previous fiscal

year. Unit sales in Japan were 311,000 units, a decrease of

7.7%. Overseas unit sales in the motorcycle totaled 9,009,000

units, a decrease of 10.2%, due mainly to a decrease in unit

sales of parts for local production at affiliates accounted

for under equity method in Asia, which offset the increase

in unit sales in Other Regions, especially in South America.

Revenue from external customers increased ¥188.0 billion, or

13.7%, to ¥1,558.6 billion, from the previous fiscal year, due

mainly to increased unit sales in Asia and Other Regions, and

the positive impact of foreign currency translation effects.

Honda estimates that if the exchange rate of the Japanese

yen had remained unchanged from the previous fiscal year,

consolidated net sales for the period would have increased

by approximately ¥94.8 billion, or 6.9%, compared to the

increase as reported of ¥188.0 billion, which includes a

positive foreign currency effect.

Operating income increased ¥50.6 billion, or 50.4%, to

¥151.2 billion, from the previous fiscal year, due mainly to a

positive foreign currency effects caused by an appreciation of

Brazilian real and a positive impact of changes in the model

mix, which offset the increased R&D expenses and higher

SG&A expenses.

Automobile Business

Honda’s unit sales of automobiles amounted to 3,925,000

units, up 7.5% from the previous fiscal year. In Japan, unit

sales decreased 8.5%, to 615,000 units. Overseas unit sales

increased 11.1%, to 3,310,000 units, due mainly to increased

unit sales in North America, Europe, Asia and Other Regions.

Revenue from external customers increased ¥600.3

billion, or 6.8%, to ¥9,489.3 billion, from the previous fiscal

year, due to increased unit sales and the positive impact of

the foreign currency translation effects. Honda estimates

that if the exchange rate of the Japanese yen had remained

unchanged from the previous fiscal year, consolidated net

sales for the period would have increased by approximately

¥514.4 billion, or 5.8%, compared to the increase as reported

of ¥600.3 billion, which includes a positive foreign currency

effect.

Operating income increased ¥62.1 billion, or 10.4%, to

¥661.6 billion, from the previous fiscal year, due mainly to

the positive impacts of higher revenue attributable to the

increased unit sales, continuing cost reduction effects,

increased prices, and the positive foreign currency effects,

while offsetting the negative impacts of increased sales

incentives in North America, substantially increased raw

material costs, increased SG&A expenses, changes in the

model mix, higher R&D expenses, and increased depreciation

expenses.

Power Product and Other Businesses

Honda’s unit sales of power products totaled 6,057,000

units, down 5.7% from the previous fiscal year. In Japan, unit

sales totaled 550,000 units, an increase of 4.4%. Overseas

unit sales came to 5,507,000 units, a decrease of 6.6%, due

0

200

400

600

800

08_07_06_05_04_

0

100

200

300

400

08_07_06_05_04_

Net Income and Net Income

per Common Share

Years ended March 31

)neY()snoillib(neY

Net Income (left)

Net Income per Common Share

(right)

0807060504