Honda 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 7 9

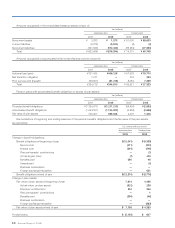

Maturities of debt securities classified as held-to-maturity at March 31, 2008 were as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

Due within one year ¥ 641 $ 6

Due after one year through five years 18,033 180

Due after five years through ten years 1,998 20

Total ¥20,672 $ 206

Realized gains and losses from available-for-sale securities

included in other expenses (income)—other for each of the

years in the three-year period ended March 31, 2008, were,

¥462 million net losses, ¥10,463 million net gains and ¥232

million ($2 million) net losses, respectively.

Gross unrealized losses on marketable securities and fair value of the related securities, aggregated by length of time that

individual securities have been in a continuous unrealized loss position at March 31, 2008 were as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

Fair value

Unrealized

losses Fair value

Unrealized

losses

Available-for-sale

Less than 12 months ¥12,242 ¥(4,910) $ 122 $(49)

12 months or longer 215 (193) 2 (2)

¥12,457 ¥(5,103) $ 124 $(51)

Held-to-maturity

Less than 12 months ¥ — ¥ — $ — $ —

12 months or longer — — — —

¥ — ¥ — $ — $ —

Honda judged this decline in fair value of investment securities to be temporary, with considering such factors as financial and

operating conditions of the issuer, the industry in which the issuer operates, degree and period of the decline in fair value and

other relevant factors.

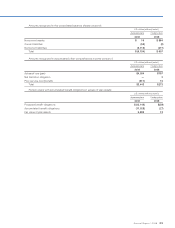

8. Property on Operating Leases

Future minimum lease rentals expected to be received from property on operating leases at March 31, 2008 are as follows:

Years ending March 31:

Yen

(millions)

2009 ¥177,679

2010 164,938

2011 73,503

2012 10,095

2013 412

Total future minimum lease rentals ¥426,627

Future minimum rentals as shown above should not necessarily be considered indicative of future cash collections.