Honda 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

9 4

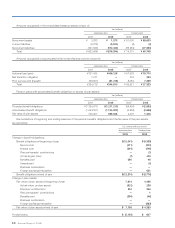

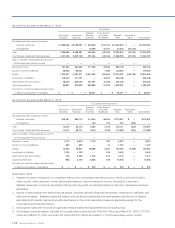

The tax effects allocated to each component of other comprehensive income (loss) and reclassification adjustments are as

follows:

Yen

(millions)

Before-tax

amount

Tax (expense)

or benefit

(note 11)

Net-of-tax

amount

2006:

Adjustments from foreign currency translation ¥ 301,737 ¥ (52,577) ¥ 249,160

Unrealized gains (losses) on marketable securities:

Unrealized holding gains (losses) arising during the year 49,675 (19,868) 29,807

Reclassification adjustments for losses (gains) realized in net income (1,395) 554 (841)

Net unrealized gains (losses) 48,280 (19,314) 28,966

Unrealized gains (losses) on derivative instruments

Unrealized holding gains (losses) arising during the year (43) 17 (26)

Reclassification adjustments for losses (gains) realized in net income (64) 26 (38)

Net unrealized gains (losses) (107) 43 (64)

Minimum pension liabilities adjustment 191,207 (82,522) 108,685

Other comprehensive income (loss) ¥ 541,117 ¥(154,370) ¥ 386,747

2007:

Adjustments from foreign currency translation ¥ 95,275 ¥ 1,500 ¥ 96,775

Unrealized gains (losses) on marketable securities:

Unrealized holding gains (losses) arising during the year 1,408 (404) 1,004

Reclassification adjustments for losses (gains) realized in net income (9,520) 3,945 (5,575)

Net unrealized gains (losses) (8,112) 3,541 (4,571)

Unrealized gains (losses) on derivative instruments

Unrealized holding gains (losses) arising during the year (562) 225 (337)

Reclassification adjustments for losses (gains) realized in net income 703 (282) 421

Net unrealized gains (losses) 141 (57) 84

Minimum pension liabilities adjustment 14,827 (5,919) 8,908

Other comprehensive income (loss) ¥ 102,131 ¥ (935) ¥ 101,196

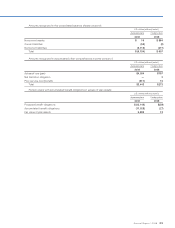

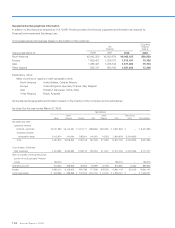

2008:

Adjustments from foreign currency translation ¥(370,075) ¥ 57,808 ¥(312,267)

Unrealized gains (losses) on marketable securities:

Unrealized holding gains (losses) arising during the year (43,138) 16,752 (26,386)

Reclassification adjustments for losses (gains) realized in net income (122) 49 (73)

Net unrealized gains (losses) (43,260) 16,801 (26,459)

Unrealized gains (losses) on derivative instruments

Unrealized holding gains (losses) arising during the year 704 (282) 422

Reclassification adjustments for losses (gains) realized in net income 30 (12) 18

Net unrealized gains (losses) 734 (294) 440

Pension and other postretirement benefits adjustment*

Unrealized gains (losses) arising during the year (45,466) 20,023 (25,443)

Reclassification adjustments for losses (gains) realized in net income 13,516 (4,819) 8,697

Net unrealized gains (losses) (31,950) 15,204 (16,746)

Other comprehensive income (loss) ¥(444,551) ¥ 89,519 ¥(355,032)