Honda 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8

9 6

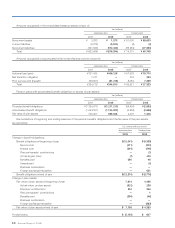

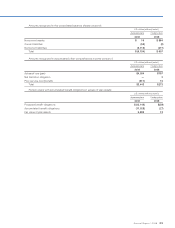

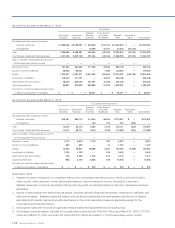

(b) The fair values of foreign currency forward exchange contracts, foreign currency option contracts and foreign currency

swap agreements are included in other assets and other current assets and/or liabilities in the consolidated balance sheets

as follows (see note 9):

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Other current assets ¥ 3,735 ¥ 36,488 $ 364

Other assets — 79,681 796

Other current liabilities (24,783) 429 4

¥(21,048) ¥116,598 $1,164

(c) The fair values of interest rate swap agreements are included in other assets and other current assets and/or liabilities in

the consolidated balance sheets as follows (see note 9):

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Other current assets ¥ 3,890 ¥ 753 $ 8

Other assets 6,976 (20,415) (204)

Other current liabilities (2,417) (54,721) (546)

¥ 8,449 ¥(74,383) $ (742)

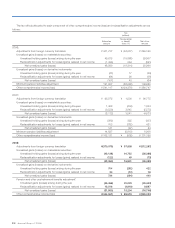

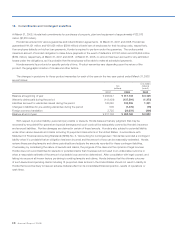

The estimated fair values have been determined using

relevant market information and appropriate valuation

methodologies. However, these estimates are subjective in

nature and involve uncertainties and matters of significant

judgment and, therefore, cannot be determined with

precision. The effect of using different assumptions

and/or estimation methodologies may be significant to the

estimated fair values.

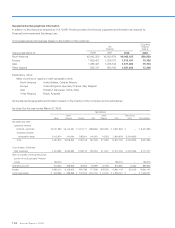

The methodologies and assumptions used to estimate

the fair values of financial instruments are as follows:

Cash and cash equivalents, trade receivables and trade

payables

The carrying amounts approximate fair values because of

the short maturity of these instruments.

Finance subsidiaries—receivables

The fair values of retail receivables and term loans to dealers

were estimated by discounting future cash flows using the

current rates for these instruments of similar remaining

maturities. Given the short maturities of wholesale

receivables, the carrying amount of those receivables

approximates fair value. The fair value of the retained

interest in the sold pools of finance receivables were

estimated by calculating the present value of the future cash

flows using a discount rate commensurate with the risks

involved.

Marketable securities

The fair value of marketable securities was estimated using

quoted market prices.

Held-to-maturity securities

The fair value of held-to-maturity securities was estimated

using quoted market prices.

Debt

The fair values of bonds and notes were estimated based on

the quoted market prices for the same or similar issues. The

fair value of long-term loans was estimated by discounting

future cash flows using rates currently available for loans

of similar terms and remaining maturities. The carrying

amounts of short-term bank loans and commercial paper

approximate fair values because of the short maturity of

these instruments.

Foreign exchange and interest rate instruments

The fair values of foreign currency forward exchange

contracts and foreign currency option contracts were

estimated by obtaining quotes from banks. The fair values

of currency swap agreements and interest rate swap

agreements were estimated by discounting future cash flows

using rates currently available for these instruments of similar

terms and remaining maturities.