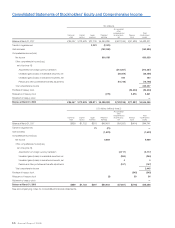

Honda 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A n n u a l R e p o r t 2 0 0 8 7 5

Net sales and other operating revenue and cost of sales include finance income and related cost of finance subsidiaries for

each of the years in the three-year period ended March 31, 2008 as follows:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2006 2007 2008 2008

Finance income ¥310,937 ¥413,334 ¥549,052 $5,480

Finance cost 115,636 188,844 303,890 3,033

Finance subsidiaries of the Company periodically sell

finance receivables. Finance subsidiaries sold retail finance

receivables subject to limited recourse provisions totaling

approximately ¥930,629 million, ¥562,488 million and

¥232,474 million ($2,320 million) to investors in fiscal years

2006, 2007 and 2008, respectively. Pre-tax net gains or

losses on such sales resulted in loss of ¥11,849 million, a

gain of ¥1,175 million, and a gain of ¥9 million ($0.1 million)

in fiscal years 2006, 2007 and 2008, respectively, which are

included in gain or loss on sale of receivables.

Finance subsidiaries sold direct financing lease

receivables subject to limited recourse provisions totaling

approximately ¥100,374 million in fiscal year 2006. Pre-tax

net gain on such sales resulted in a net gain of ¥483 million

is included in a gain on sale of receivables for fiscal year

2006. The leases sold during fiscal year 2006 had 100%

insurance coverage of the residual value of the vehicles

collateralizing those leases. Finance subsidiaries did not sell

any direct financing lease receivable in fiscal year 2007 and

2008.

Retained interests in securitizations were comprised of the following at March 31, 2007 and 2008:

Yen

(millions)

U.S. dollars

(millions)

(note 2)

2007 2008 2008

Subordinated certificates ¥44,198 ¥28,846 $288

Residual interests 43,912 25,790 257

Total ¥88,110 ¥54,636 $545

Key economic assumptions used in initially estimating the fair values at the date of the securitizations during each of the

years in the three-year period ended March 31, 2008 are as follows:

2006 2007 2008

Weighted average life (years) 1.60 to 1.75 1.66 to 1.77 1.66 to 1.73

Prepayment speed 1.00% to 1.30% 1.25% to 1.30% 1.25%

Expected credit losses 0.35% to 0.55% 0.23% to 0.27% 0.21% to 0.30%

Residual cash flows discount rate 6.53% to 12.00% 5.43% to 12.00% 5.82% to 12.00%

At March 31, 2008, the significant assumptions used in estimating the retained interest in the sold pools of finance

receivables are as follows:

Weighted average

assumption

Prepayment speed 1.27%

Expected credit losses 0.19%

Residual cash flows discount rate 11.44%

The sensitivity of the current fair value to immediate 10% and 20% adverse changes from expected levels for each

significant assumption above mentioned were immaterial.