GE 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

more from what I see in individual markets

and hear from customers. Commodity prices

are down significantly, primarily driven by

oversupply. Resource industries and regions

are restructuring. The dollar has strength-

ened, probably for an extended period of

time. This puts pressure on American export-

ers. At the same time, commercial air travel

is at a record high. Healthcare demographics

and access will demand an increase in global

spend. And one-third of the world’s population

still lacks sufficient access to electricity. The

global imperative for enhanced infrastructure

investment has not changed. Growth is avail-

able, but you have to work at it.

What is unique in this cycle is the difficult

relationship between business and govern-

ment, the worst I have ever seen. Technology,

productivity and globalization have been the

driving forces during my business career.

In business, if you don’t lead these chang-

es, you get fired; in politics, if you don’t fight

them, you can’t get elected. As a result, most

government policy is anti-growth. In the U.S.,

we want exports but seem to hate trade and

exporters; globally, governments love small

businesses but then regulate them to death.

And so, we perpetuate a cycle: slow growth,

poor job creation, populism, low productiv-

ity, higher regulation, poor policy and more

slow growth. We now live in a world where

the most promising growth policy is “negative

interest rates.” In the U.S., 2015 was the 10th

consecutive year when GDP growth failed to

reach 3%, a rate that used to be considered

our entitlement.

We don’t try to pick a cycle, or time a market,

or complain about elections. We will always

act to get more out of this economy than

our peers. We believe in “self-help.” We are

aggressively managing our cost structure to

capitalize on deflation. In 2016, we will fund

a record level of restructuring. We have a

very strong balance sheet with excess cash.

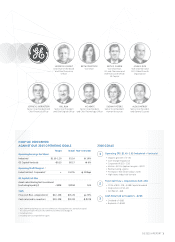

Long-Term Investment in China

GE has been in China for 100 years, and is continuing to localize, partner

and go digital with strategic investments in its talent and economy.

22,000 employees

30+ plants

60+ technology labs

34 joint ventures

Near-Term Goals: 10x10

$10B

in revenues $10B

in sourcing

Pictured left to right:

Gary Gu, Ming Tu, Diana Tang, Peter Li,

Xiangli Chen, Rachel Duan, Fengming Liu,

Weiming Xiang, Xiang Qian, Dan Yang,

Jing Cheng

4 GE 2015 ANNUAL REPORT