GE 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A OTHER CONSOLIDATED INFORMATION

GE 2015 FORM 10-K 73

2014 ± 2013 COMMENTARY

x The decrease in the consolidated provision for income taxes was attributable to increased benefits from lower taxed global

operations, excluding the benefit of audit resolutions.

x This decrease was partially offset by an increase in income taxed at rates above the average rate.

On January 2, 2013, the American Taxpayer Relief Act of 2012 was enacted and the law extended several provisions, including a two-

year extension of the U.S. tax provision deferring tax on active Financial Services income and certain U.S. business credits, retroactive

to January 1, 2012. Under accounting rules, a tax law change is taken into account in calculating the income tax provision in the period

enacted. Because the extension was enacted into law in 2013, tax expense in 2013 reflected retroactive extension of the previously

expired provisions.

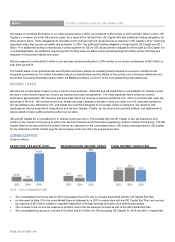

BENEFITS FROM GLOBAL OPERATIONS

Absent the effects of the GE Capital Exit Plan, our consolidated income tax rate is lower than the U.S. statutory rate primarily because

of benefits from lower-taxed global operations, including the use of global funding structures. There is a benefit from global operations

as non-U.S. income is subject to local country tax rates that are significantly below the 35% U.S. statutory rate. These non-U.S.

earnings have been indefinitely reinvested outside the U.S. and are not subject to current U.S. income tax. Most of these earnings have

been reinvested in active non-U.S. business operations and we do not intend to repatriate these earnings to fund U.S. operations. The

rate of tax on our indefinitely reinvested non-U.S. earnings is below the 35% U.S. statutory rate because we have significant business

operations subject to tax in countries where the tax on that income is lower than the U.S. statutory rate and because GE funds certain

non-U.S. operations through foreign companies that are subject to low foreign taxes.

A substantial portion of the benefit related to business operations subject to tax in countries where the tax on that income is lower than

the U.S. statutory rate is derived from our GECAS aircraft leasing operations located in Ireland and from our Power Services

manufacturing operations located in Hungary. No other operation in any one country accounts for a material portion of the remaining

balance of the benefit.

We expect our ability to benefit from non-U.S. income taxed at less than the U.S. rate to continue, subject to changes in U.S. or foreign

ODZ,QDGGLWLRQVLQFHWKLVEHQHILWGHSHQGVRQPDQDJHPHQW¶VLQWHQWLRQWRLQGHILQLWHO\UHLQYHVWDPRXQWVRXWVLGHWKH86RXU tax

provision will increase to the extent we no longer indefinitely reinvest foreign earnings.

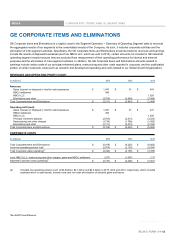

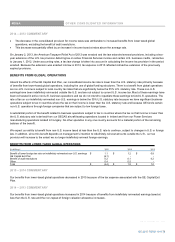

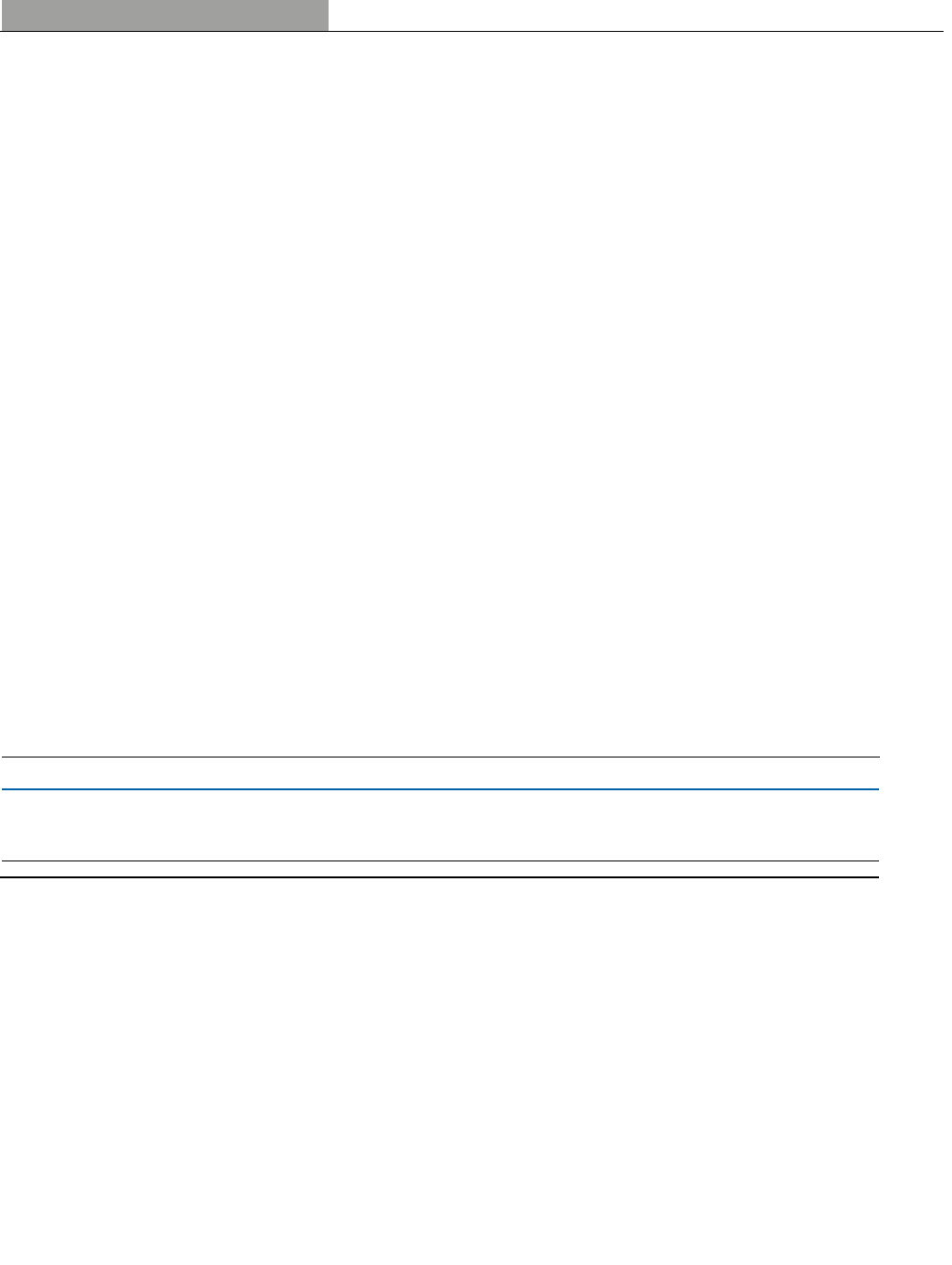

BENEFITS FROM LOWER-TAXED GLOBAL OPERATIONS

(In billions) 2015 201

4

2013

Benefit of lower forei

g

n tax rate on indefinitel

y

reinvested non-U.S. earnin

g

s $ 1.1 $ 1.2 $ 0.8

GE Capital Exit Plan (6.1) - -

Benefit of audit resolutions 0.2 0.1 0.2

Other 0.4 0.5 -

Total $

(

4.4

)

$ 1.8 $ 1.0

2015 ± 2014 COMMENTARY

Our benefits from lower-taxed global operations decreased in 2015 because of the tax expense associated with the GE Capital Exit

Plan.

2014 ± 2013 COMMENTARY

Our benefits from lower-taxed global operations increased in 2014 because of benefits from indefinitely reinvested earnings taxed at

less than the U.S. rate and the non-repeat of foreign valuation allowance increases.

GE 2015 FORM 10-K 73