GE 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. Excluding liquidity and including assets of discontinued operations. Non-GAAP Financial Measure. See Financial Measures That Supplement U.S. Generally Accepted Accounting Principles Measures

(Non-GAAP Financial Measures) on page 95.

2. Subject to customary closing conditions.

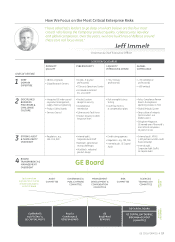

2015 Portfolio Changes: the biggest portfolio shift in GE’s history

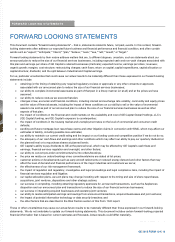

Alstom Aquisition Closed

On November 2, 2015, GE closed its aquisition of Alstom’s Thermal, Renewables & Grid businesses for approximately $10.1B.

ORIGINAL DEAL

Buyer: Electrolux

Purchase price: $3.3B

Expected gain: ~$0.05–0.07/share

GE terminated agreement & received $175M

breakup fee

NEW DEAL

Buyer: Haier

Purchase price: $5.4B

Expected gain: ~$0.20/share

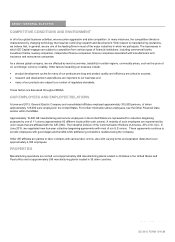

GE Capital Exit Plan Ahead of Schedule

On April 10, 2015, GE announced a plan to sell most of the assets of GE Capital (targeting ~$200B ENI in total sales), in addition

to the Synchrony split-off, retaining those financial assets that support our industrial businesses (which we call Verticals).

Synchrony Split-Off Complete

On November 17, 2015, GE completed its exchange offer for Synchrony Financial (our North American credit card business).

Appliances Sale to Haier Expected to Close in 20162

On January 15, 2016, GE entered into an agreement to sell its Appliances business to Haier following GE’s termination

of its agreement with Electrolux on December 7, 2015.

Share buyback $20.4B GE shares retired 671M ENI reduction $65B Offer oversubscribed 3.2X

Alstom’s Strategic Fit with GE

• Complementary technologies

• Global presence

• Ability to compete for “rest of the power plant”

• Installed base

Retaining GE Capital businesses that directly relate to,

and support the growth of, our core industrial businesses

(targeted)

On track to return ~$35B to

investors by 2018

GE Segments Impacted

EPS Impact

POWER SERVICES INSTALLED BASE

60%

increase

Executing Faster than Plan

Actual 2015 Progress (on a fourth-quarter 2014 basis):

Closed deals $104B

Signed deals $157B

Target for completing asset sales: 2016

(1 year ahead of plan)

Plan to apply for de-designation as a non-bank

systemically important financial institution (SIFI)

early 2016

Original 2015 Plan:

Closed deals $90B

Target for completing asset sales: 2017

COST

SYNERGIES

~$3B

GROWTH

SYNERGIES

$0.6B+

2015 $0

Targeted 2016 ~$0.05

Targeted 2018 ~$0.15–0.20

Capital

Appliances

2020 Targeted Synergy Benefits

15K units 9K units

The New GE Capital

VALUABLE INDUSTRIAL FINANCE COMPANY

Aviation Services

Energy Financial Services

Industrial Finance, including Healthcare

Equipment Finance , Industrial Finance

Solutions, Working Capital Solutions,

Trade Payables Solutions

Other (including our run-off insurance

portfolio)

SMALLER, SIMPLER, SAFER

ENI1

2014 2015 2017

≤$90B

$167B

$363B

Enhancing the competitiveness

of our industrial businesses

• GE CONTRIBUTION • ALSTOM CONTRIBUTION

GRID

SOLUTION

STEAM

TURBINE

HEAT

RECOVERY

STEAM

GENERATOR

STEAM TURBINE

GENERATOR

GAS TURBINE

GENERATOR

GAS

TURBINE

14 GE 2015 FORM 10-K