GE 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AVIATIONENERGY MANAGEMENT

MISSION: Developing transformational

medical technologies & services that are

shaping a new age of patient care

Major products: diagnostic imaging systems

(MRI, CT, nuclear & molecular imaging, digital

mammography), surgical imaging products,

ultrasound, pharmaceutical research &

production tools

Digital solutions: Centricity™, Dose

Management, Workforce Optimization,

Asset Optimization, Health Cloud

MISSION: Being a global technology

leader for the transmission, distribution &

conversion of electrical power

Major products: electrical distribution &

control products & services, lighting &

power panels, grid management products

& grid modernization services, industrial

automation & software solutions, advanced

motor, drive & control technologies

Digital solutions: Grid IQ™, Proficy

Monitoring & Analysis™, SmallWorld™

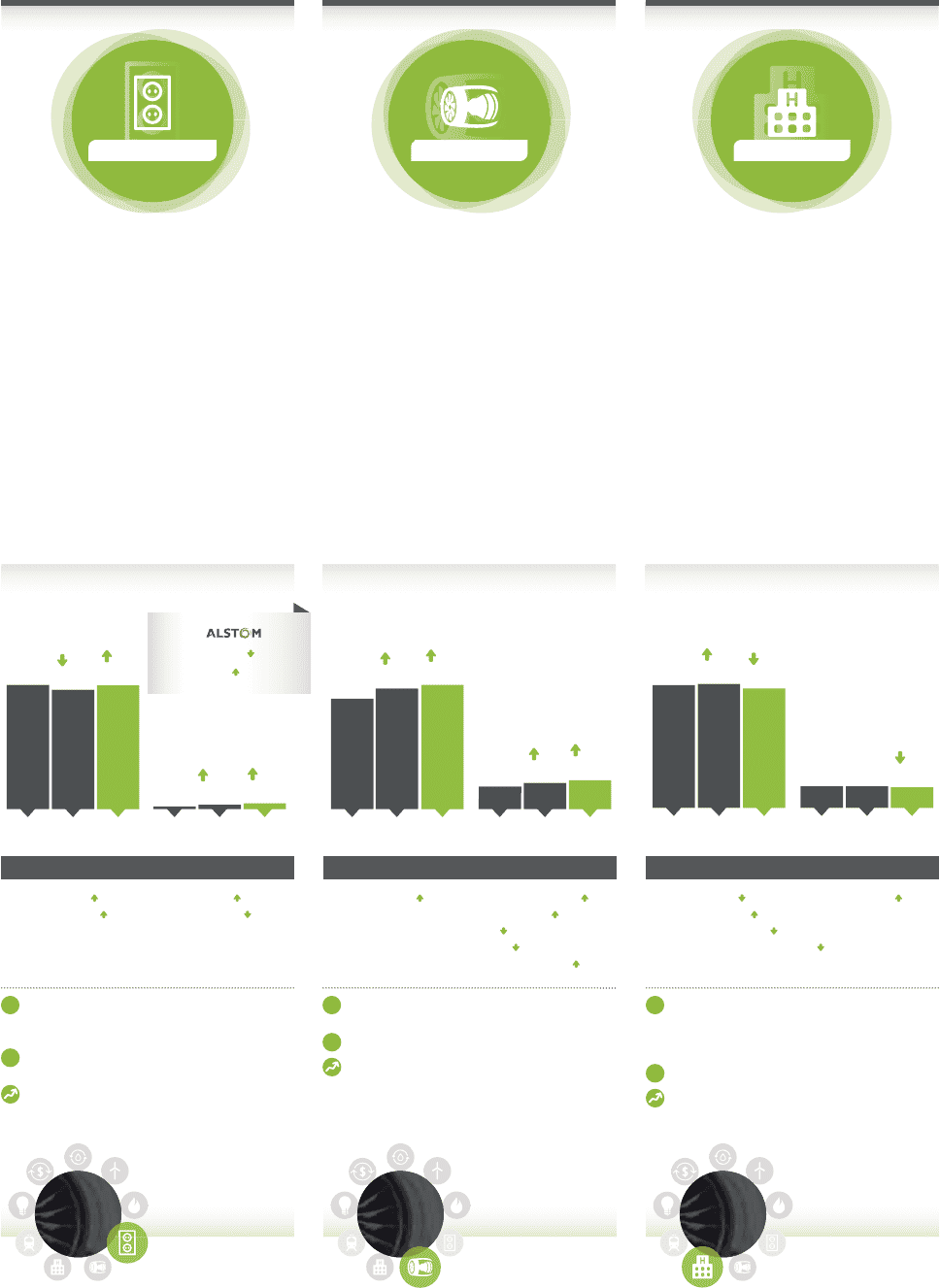

Revenues Profits Revenues Profits Revenues Profits

MISSION: Providing our aviation

customers with the most technologically

advanced & productive engines,

systems & services for their success

Major products: jet & turboprop engines,

components & integrated systems for

commercial, military, business & general

aviation aircraft & ship propulsion

applications, global service network

Digital solutions: Flight Efficiency Services,

Fuel Management, Fleet Management

Margins: 16.3% 40bps Backlog: $17.2B 4%

U.S. orders: $8.7B 1%

Europe orders: $3.5B 8%

Growth region orders: $5.3B 6%

Margins: 3.6% 20bps Ex. Alstom 4.1% 70bps

Backlog: $11.7B 134% Ex. Alstom $3.4B 33%

(flat organically)

Margins: 22.3% 160bps Backlog: $151.2B 13%

# commercial engines shipped: 2,588 17

# GEnx engines shipped: 260 27

# military engines shipped: 766 302

Commercial spares rate: $37.1 million/day $6.9M

Other 2015 resultsOther 2015 results Other 2015 results

HEALTHCARE

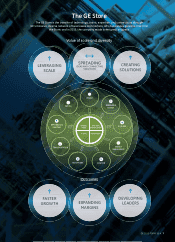

Advanced materials/

manufacturing &

engineering

productivity

Diagnostics

technology &

first-mover in

growth markets

Electrification,

controls &

power conversion

technology

+ Positive: Grid Solutions growth through

Alstom, strength in electrification & more

renewables on the grid

– Negative: Continued pressure from oil prices

& excess capacity

Outlook: Positioning the business for long-term

growth & margin expansion with Alstom

+ Positive: Continued growth in developed

markets, demand for IT/analytics-

based solutions, biopharmaceutical

market expansion

– Negative: Pressure in emerging markets

Outlook: Positioning the business for long-

term growth

+ Positive: Lower fuel costs & continued

strength in air passenger traffic

– Negative: Military spending uncertain

Outlook: Delivering through commercial

product transition

term

growth

2015 Ex.

Revenues = $6.6B 9%

Profits = $0.3B 12%

CONTRIBUTION

TO GE STORE

CONTRIBUTION

TO GE STORE

CONTRIBUTION

TO GE STORE

$18.2B 4%

$17.6B

$3.0B

0%

$3.0B

1%

$18.3B

2013 2014 2015 2013 2014 2015

5%

$2.9B

$21.9B

9%

$24.0B

3%

$24.7B

$4.3B

14%

$5.0B

2013 2014 2015 2013 2014 2015

11%

$5.5B

3%

$7.3B

$7.6B

$0.1B

10%

$0.3B

124%

$0.2B

2014 2015 2013 2014 2015

2013

4%

$7.6B

12 GE 2015 FORM 10-K